Gary Miller / Trusted Financial 2022 Review

NOTE: This report is highlighted with screen shots from the live presentation given to clients who were at our annual Client Holiday Luncheon back in early December. Graphs and stats have been updated where appropriate.

Greetings to All and Happy New Year!

As the photo below suggests, Santa delivered a not-too-pleasant year for investors, with December failing to provide the hoped-for “Santa Claus” rally.

For the year, clients saw their portfolios surrender about 16% to 20% of year-end 2021 value. This was the worst year since 2008. For retirees taking distributions from their portfolio, the asset value reduction can be jarring. It is vital to hold on to a longer term perspective at such a time. Even factoring in 2022, most clients have enjoyed high single digit annual returns over longer stretches of time and this is reflected in your quarterly statement. Following the Great Recession market collapse from October 2007 to March 2009, many clients regained all of their portfolio value within 18 months. I cannot promise a repeat, but am quite sure patient clients can bounce back.

The headline below reflects the fact that the pain suffered by clients and by nearly all American investors is shared throughout the world.

All major sectors gave ground, and there was considerable diversity between equity styles, as reflected in their respective indices, shown in the graph below.

Growth stocks, which were the most powerful wealth builder over the past decade, were hardest hit. This was especially true for technology firms, as well as younger companies, that are represented in the NASDAQ index. That was off about 33%.

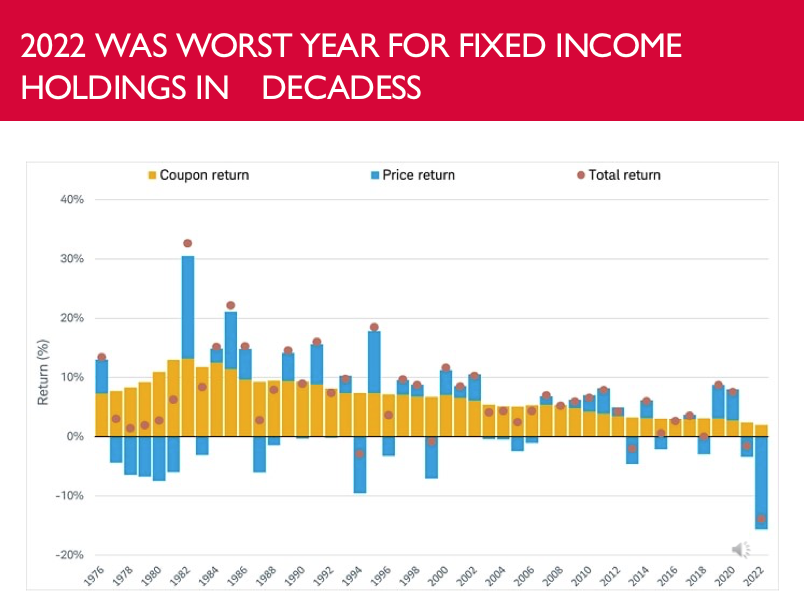

The pain was not limited to common stocks. Bonds, a key component of “balanced” portfolios also sagged.

The reason for this poor performance is the fact that the US Federal Reserve Board and central banks in Europe, Asia, [1] Australia and around the world have taken firm measures to drive interest rates higher. Their goal is to cause an economic slowdown, seeing this as the primary way to dampen inflation, the highest inflation in two generations.

Another way to describe inflation is “destruction of buying power.” It is a hidden and vicious form of theft that affects the elderly and those on fixed income or who are unable to improve their salaries. It is an insidious force that destroys a life’s savings.

However, the immediate concern for policy makers is that with high inflation, a great uncertainty falls over investors, especially business managers who may be considering new projects. If inflation is high, then it becomes difficult to predict future costs and future profitability. Thus, new projects are delayed or abandoned, new products not generated and potential jobs are lost. The economy stagnates. This situation first seen in the 1970’s is known as “Stagflation”- prices rising, but real wages and corporate earnings flat.

High inflation drives certain people to avoid saving money responsibly for the long term, thinking their dollars may be worth less in the future. Some may be driven to make poor choices, often speculating to make “the big score” and stay ahead of inflation. As an example, there are still people holding gold and silver purchased back in the late 1970’s or early 1980’s. These holdings do not pay interest, do not create jobs, do not spur invention and industriousness. But in the late 1970’s gold and silver made sense to many, who feared that inflation would destroy the buying power of their paper dollars.

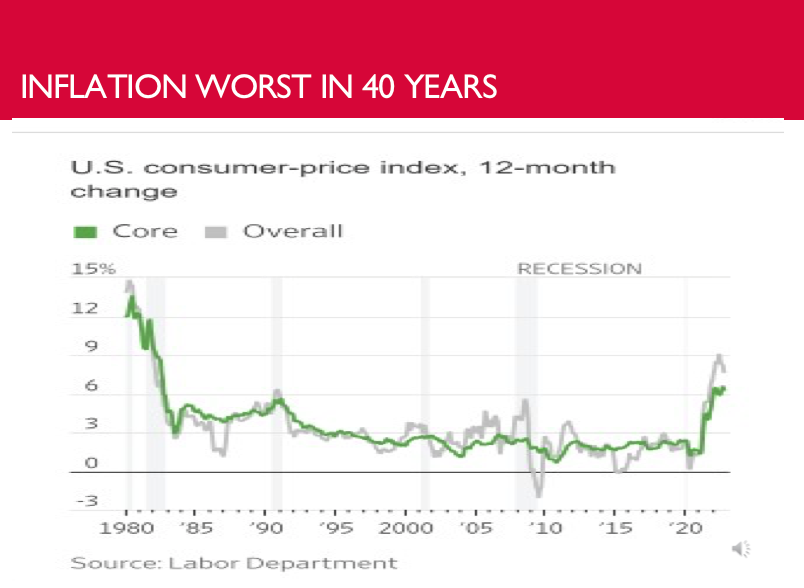

Why this resurgence of inflation?

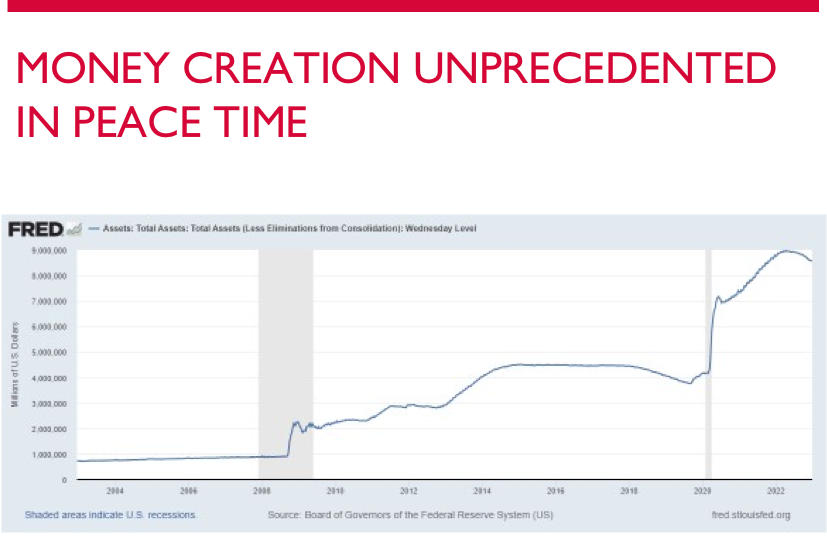

Observe what has occurred to the balance sheet of the Federal Reserve system. At the height of the Great Financial Crisis, in late 2008. In order to save the economy from a seizing up and certain bankruptcy of major banks, insurance companies and mortgage lenders, Congress passed new authorizations for the Federal Reserve to act. The Fed then loaned money to endangered companies by buying their bonds, preferred stocks and similar I.O.U.’s. As the chart shows, this doubled the assets on the Fed’s balance sheet in only a year. Historically unprecedented, this was called “Quantitative Easing.” After the immediate panic was avoided, the Fed continued to extend easy credit, believing the economy remained fragile, giving banks time to strengthen their balance sheets. So, the Fed’s holdings of bonds grew and grew. Each time the Fed suggested it wanted to end Quantitative Easing, financial markets took a tumble and the Fed backed down. Interest rates stayed artificially low. Remarkably, so did inflation during this period. Usually, when credit is easy and monetary stimulation underway, inflation spikes. Economists do not agree on why inflation remained subdued, at about 2% for so many years. In fact, three years ago, some worried about uncontrollable deflation.

When the Covid 19 pandemic hit, bringing an unprecedented shut down in financial activity, Congress and the President approved still more extraordinary spending in order to offset the negative implications of the Pandemic. Businesses that risked failure, especially in the service sector (restaurants, travel and leisure) were given forgivable loans or grants. [2] Same for many of their employees and businesses that could claim hardship. Some feel this was an overreaction. Whether one agrees with the actions taken or not, the result was a further ballooning of the Fed’s balance sheet as shown the graph above.

With the development of an effective Covid vaccine, the U.S. economy began to open up in 2021. Americans had used their time at home to pay down credit cards and/or to save money. Household balance sheets became healthier than anyone can remember. Pent-up demand, choked supply chains and shortages of key commodities combined with soaring food and gasoline prices (thanks, Russia) led to this report in July, 2022:

Realizing that inflation was not “transient”, as earlier believed, the Federal Reserve Board decided it had to brake hard to stop inflation from getting further out of control.

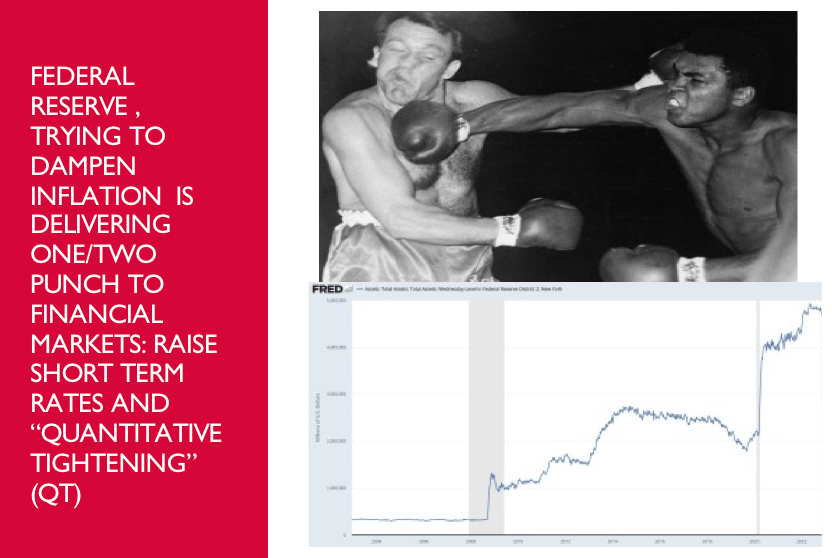

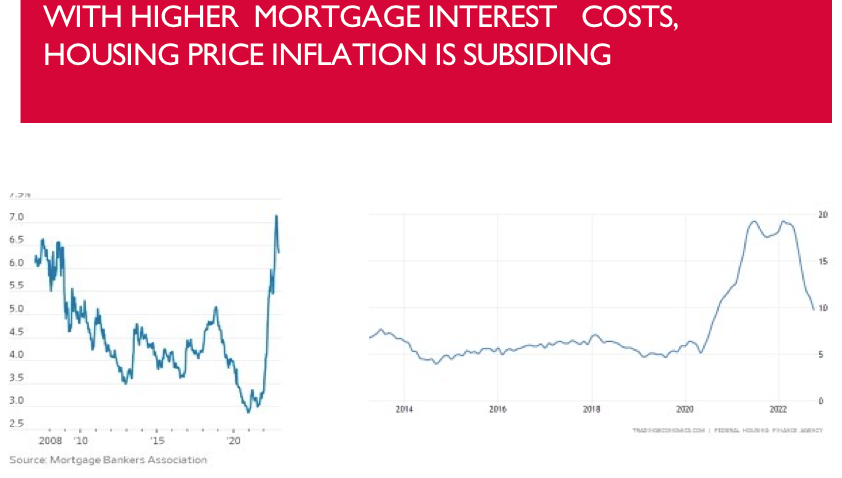

The Fed has raised the overnight lending rate for banks multiple times in 2022 from .25% in March 2022 to 4.50% at present. This ripples across the economy driving up borrowing costs. But wait, there’s more:

At the same time, the Fed is selling off securities it holds to move toward a more normalized balance sheet. This known as “Quantitative Tightening.” When this first was attempted in 2014, financial markets reacted badly. However, selling off assets held by the Fed is considered vital, as the Fed cannot forever lend money and add securities to its balance sheet. Some observers worry our central bank has already been forced to accept far too much debt and that their credibility as an independent agency is threatened. Consider that they already own 30% of mortgage backed bonds outstanding. Too much government interference in the private sector leads to expensive distortions that in the long run have failed in other nations, from the Communist bloc in Europe (1947 to 1989) to post-war U.K. , to banana republics in Latin America. A future financial crisis could require the Fed to again buy bonds to rescue the economy in the event of a MAJOR recession. So most economists at the Fed considered it imperative to reduce current holdings, while our economy is running hot, even if this sends long term interest rates soaring. [3]

There are signs that higher interest rates are beginning to have the desired effect, especially on interest sensitive sectors:

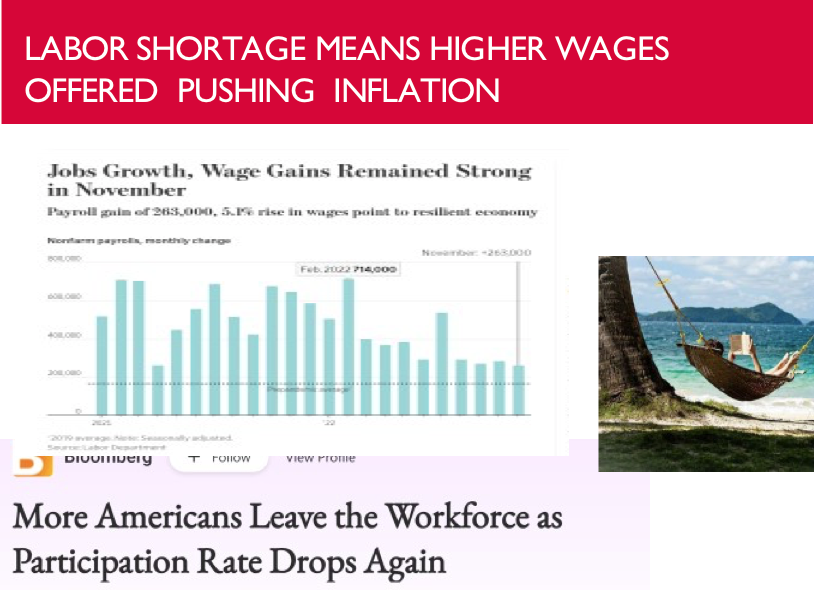

While some sectors of the economy are slowing, such as housing and autos, other pro-inflationary forces, especially wage growth, are more difficult to control. The problem faced by financial policy makers? The U.S. economy remains resilient. To reverse the labor shortage, a lot of jobs have to be lost. This means a deep recession could be in the offing.

With the radical shift for interest rates last year, equities took a beating, as did bonds. Technology and younger company stocks were hit the hardest, but even some well-established names gave back much of their enormous gains from recent years.

There was a brief stock market rally in the Summer months, based on the fleeting belief that the Fed was about to take its foot off the interest rate pedal. Subsequent statements from the Fed, especially notes from their December meeting, released this week of January 2, have dashed that hope. The Board voted unanimously to stay the course until clear signs of abating inflation are seen.

As the Fed is trying to dampen inflation, Congress just passed one of its biggest spending bills ever. There may be good things to come out of the infrastructure bill, but lower government borrowing is not one of them. This will make it still more difficult to tame inflation.

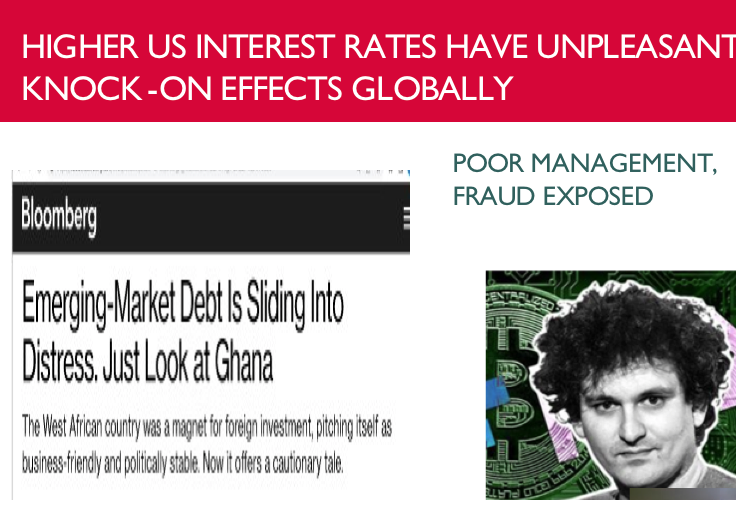

The deleterious effects of tightening credit markets and falling asset prices are beginning to appear, not just in the price for stocks and bonds but in the fate of businesses and even of nations. As Warren Buffet famously quipped:

“When the tide goes out, you get to see who’s swimming naked.”

A Review of Actions taken in 2022

At the end of 2021, clients were enjoying the fruits of a strong bull market for stocks and bonds. This was about to change, and as with many others, I did not fully appreciate the degree to which markets would correct. Still, many years’ experience has taught me to not stubbornly cling to yesterday’s winners.

I began reducing clients’ bond and stock market exposure in late 2021. However, selling off some of our most profitable holdings began in earnest in the first quarter of 2022.

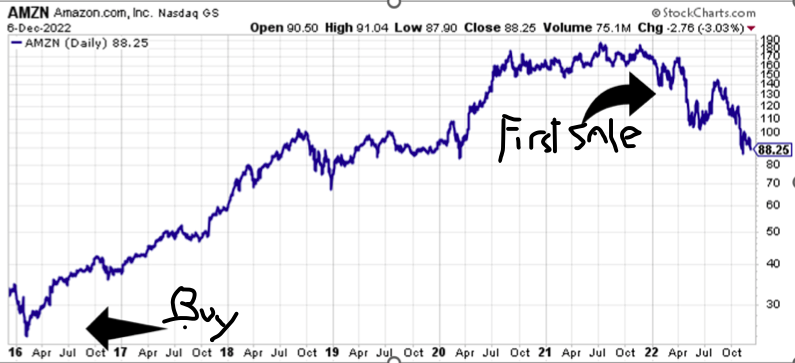

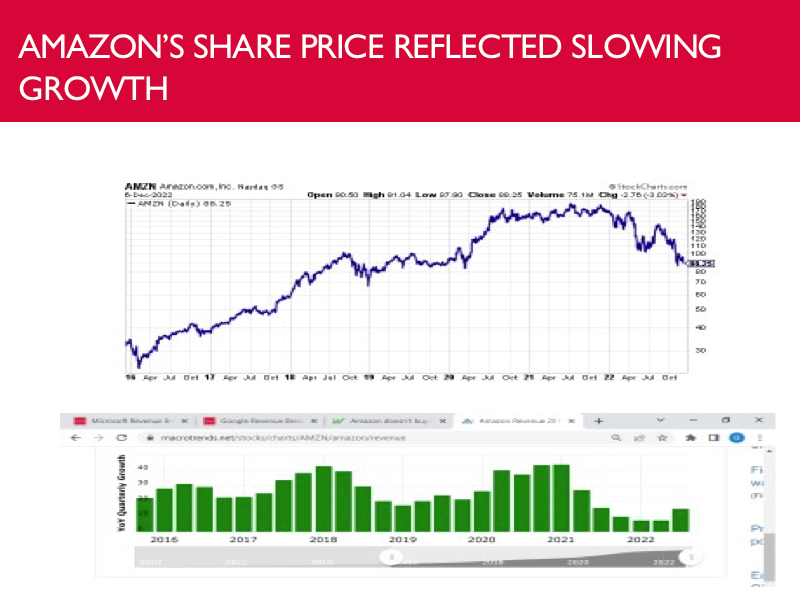

Amazon (AMZN) common stock is a good example. This company was added to client portfolios in early 2016. Share price growth was head spinning, and doubled in 2020 as a new crop of stay-at-home online shoppers were born. We all loved Amazon. The arrows in the graph below show when clients first began seeing the stock in their portfolios and then, nearly six years later when it seemed appropriate to reduce exposure:

After its share price traded in a range from mid-2020 to year end 2021, Amazon’s expected breakout to still higher levels never materialized and became a breakdown to lower price levels. Seeing this technical warning signal, I felt it wise to reduce exposure and take some profits beginning the first week of January 2022. A note of apology was sent to Amazon holders who saw their allocation reduced. There was no need to apologize. The selloff continued. As the arrows indicate, further reductions ensued until clients were entirely out of the stock by May.

The Arrows indicate the points where holdings were reduced and finally closed out entirely,

Amazon has profit margins that are very slim. The company was an amazing grower, from its earliest days. The torrid growth spurt, was accelerated by the Covid “Stay at home” environment. But in 2022 this growth began to taper off, and with it, the price of shares. While the slowdown was not clear early in the year, the price chart gave an early warning.

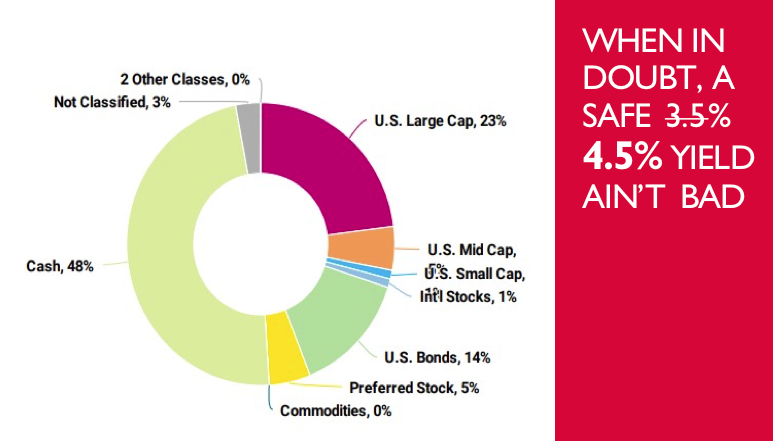

Other growth companies saw their share prices weaken as well, so reductions were made in other growth stock holdings like Adobe, American Tower, Intuit, Zoetis, Broadcom, Google, Apple and Microsoft. I found this painful, as most of the companies just listed have quite positive characteristics, market share and high margins. But decades of experience have taught me to not fight a clear bearish trend, even if it seemed a bit irrational to me. By mid- year, my approach moved to fully defensive, and by year end a typical client’s portfolio had a large holding of short term notes and “cash” (money market funds.) Why? While even the best company stocks were sagging, dividend yields available on these stable instruments rose rapidly from about .25% at the beginning of the year to near or even over 4% in December.

December 2022 Client allocations Trusted Financial Advisors

As with money market funds, all Trusted Financial client investments are purchased with consideration as to the liquidity of the holding. Does it trade on a public exchange? Can we turn the investment into spendable cash in a matter of days? My direct experience with illiquid investments, some decades ago, turned me into a money manager that insists on being able to get out of a holding quickly. Contrast this to alternate investments like real estate, private equity, limited partnerships, annuities and last year’s fad, “SPAC’s” [4] None are easy to exit and in a financial crisis, your investment can be locked in, no cash available. Not for us!

What I’m Looking at for new investment commitment

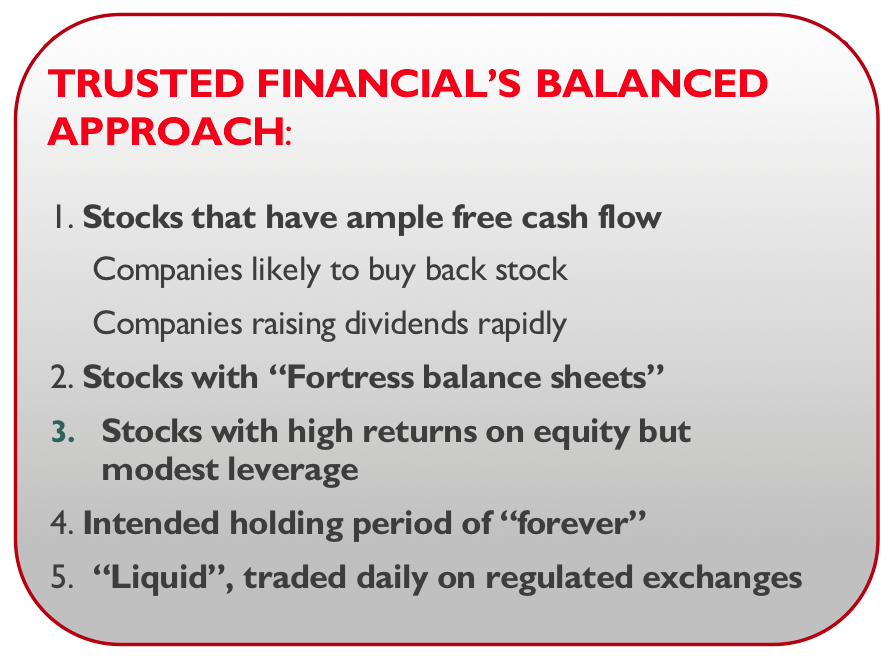

Common stocks are a fabulous way to build wealth over time. There are multiple academic studies backing up that statement. But there are a wide variety of equites, some highly speculative, others solid long term holdings. Here are the characteristics that I find attractive:

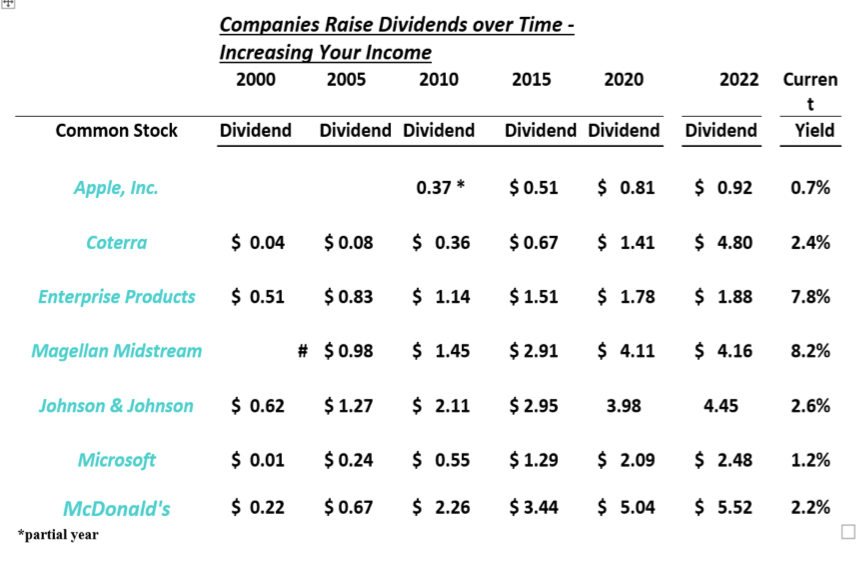

Consider, below, how regularly some companies raise dividends:

“Dividend Aristocrats” have been rewarding investors over the long run. Their rising dividends are able to offset the rising cost of living. But most of those on the sample list above have seen their shares marked down. In a bear market, all boats in the harbor go down with the tide. Still, this list represents the type of stock I like to own for the long haul. Sure, from one year to the next investors may love or hate a stock, but those that can continue to crank out real money in the form of dividends pay you to be patient in the down times.

As I find bargain stocks to buy, they will tend to mirror the characteristics shown above.

A smart balanced portfolio is a mix of equities and fixed income securities. Quality fixed income instruments have recently been offering the best yields in many years. As clients know, some of these are showing up in their portfolios. Expect more.

2022 was a year that we all knew was coming, sooner or later. No tree grows forever to the sky. Likewise, bull markets always end. This last bull was one for the record books, the longest in history. It is only natural that some retrenchment take place. My job is to see that the “give back” you experience is relatively manageable and that we are in position to quickly recoup that give back when things turn northward.

No one can know the exact right time to begin committing more funds to stocks. I am conservative in this regard and wait for multiple signals and metrics to lead me to commit your funds. [5] The gift of a bear market, for patient investors, is that we can find bargains. The analogy I like best is the admonition to begin thinking about Christmas shopping in August, when the Summer doldrums leads to bargains. It’s beginning to feel like Summer for the financial markets. That said, I’m neither one to try to catch a falling knife or bottom fish. As the market Sage Jesse Livermore quipped:

To current clients who are patiently investing their confidence in me, a big THANK YOU. For others who have perhaps been disappointed by the current financial advice they are receiving, you have my contact information.

Gary Miller, CFP

[1] Japan has been a curious exception, seemingly willing to keep interest rates low as a strategy to help exports and spark its sluggish economy.

[2] For a summary of laws passed by Congress and signed by the President, see this link: https://en.wikipedia.org/wiki/CARES_Act

[3] High T-bond rates are the result if too many bonds are seeking a home and there is insufficient interest from buyers. To entice buying interest rates offered on bonds must be high. This especially hurts the housing and real estate industry, heavily dependent on loans.

[4] SPAC’s or “Special Purpose Acquisition Companies” proliferated in 2021 and 2022. I’ve written critically of this latest manifestation of Wall Street greed. The Special Purpose company raises money by promoting itself as being sponsored or managed by some prominent personality. Serena Williams and Colin Kaepernick are among the financial geniuses that loaned their name to SPAC’s, no doubt earning handsome consulting fees. SPAC’s accept share investment from dumb money investors, and promise to use the funds to buy attractive , legitimate businesses. Conceptually like a mutual fund, investors are given no specifics as to want their money will be invested in! This is the perfect example of buying a “pig in a poke”. SPAC ‘s raised $billions during the speculative froth that characterized the top of the recent bull market. I’m proud to report that I saw this near-fraud for what it was and avoided the approach with our client funds. SPAC’s have mostly failed to meet expectations and much of the investor money that was tied up has, thankfully, been returned. For a good overview the Securities and Exchange Commission offers a useful web site: https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-alerts/celebrity

[5] In many past articles I’ve talked about how I respect technical signals to aid me in choosing when to buy, hold or unload. These can be found at our website www.trustedfinancial.com.