The past three months saw a continuation of a tech stock driven market rally, and as non-tech stocks also began to rally, confirmed that a sustainable bull market is in motion.

The Standard & Poor’s 500 Index is up 10.16% so far this year and up 29.71% over the past 12 months.

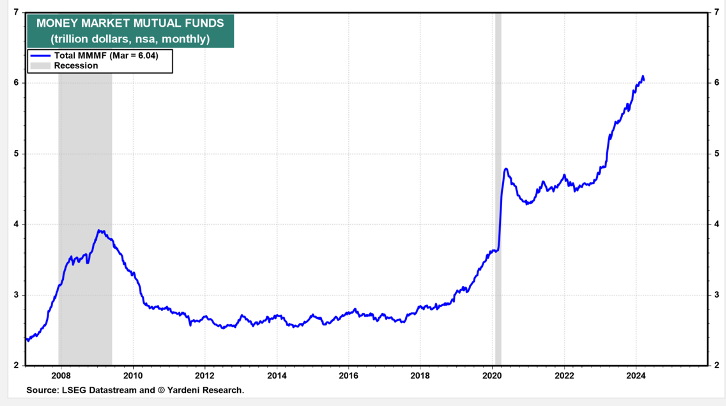

U.S. interest rates, based on the 10 Year Treasury bond, actually rose during the quarter from below 4% to about 4.25%. It is remarkable that stocks did so well in the face of rising yields. This is attributed to the widely held conviction that the Federal Reserve is finished raising short term rates to control inflation. There is debate as to when or even as to whether their next move will be to lower the overnight Fed Funds rate paid to banks.[1] Notably, we continue to have an inverted yield situation whereby overnight money and short term interest rates are higher than longer term interest rates. Thus Fed policy remains restrictive.

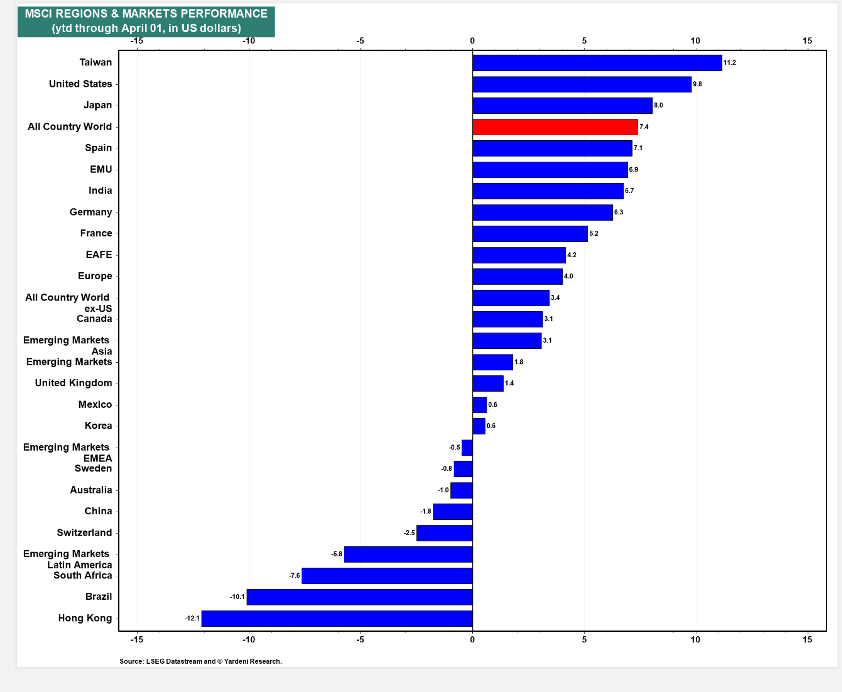

International markets came to life during the quarter. Japan and India were stars, but even Europe, while suffering an energy shortage, and nervous about a widening war against Russia, managed an impressive gain, up over 7%.

A nice summary of global stock market performance can be seen in this graphic:

Source: Yardeni Research Yardeni.com

The Big Picture is Supportive of a Bull Market in the United States

To understand the behavior of financial markets, use this generalized formula:

Inflation moderating = interest rates falling = stock and bond valuations rising[2]

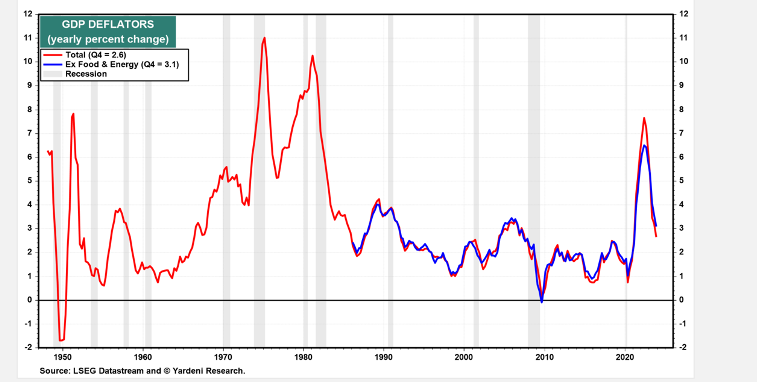

For months, there has been evidence that inflation has fallen precipitously from its highs in late 2021 of about 8%. It is now widely believed that the inflation spike that came with Covid 19 was due to supply chain disruptions, inability to obtain parts, car shortages and the like. The Federal Reserve has tried to bring inflation back down by rapidly raising interest rates in 2022. There is some question as to

Source: Yardeni.com

whether the Fed has been successful or whether normalization of supply chains is the hero in bringing inflation back down.

Productivity key to controlling Inflation

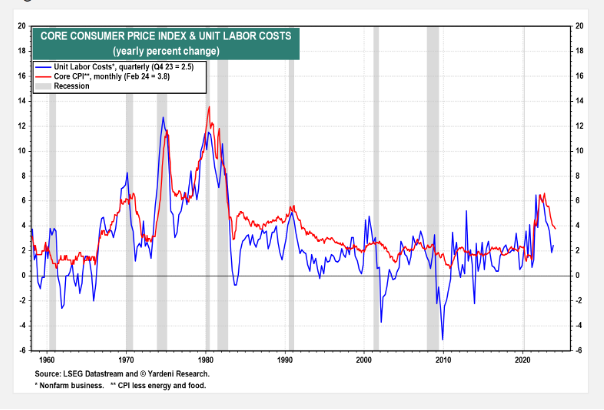

“Productivity” is measured by dividing all the goods and services produced in the economy by total hours people worked. That rate jumped 2.7% in the fourth quarter from a year earlier, according to Labor Department data, which was above the average increase over the past two decades. After nearly two decades of stagnation, productivity of the American worker is accelerating. This is an important dampener of inflation impulses in the economy. If a given worker can pound out 15 parts a day by hand, he may be able to pound out 150 parts if provided with a machine for that function. If the cost of the machine is such that the cost per part falls by 25%, then the sales price of that part may go down or is unlikely to be raised. Then if a robot is used, perhaps 750 parts per day can be produced. Assume just one human being controls this prolific robot: unit labor cost plummets and productivity soars. This means zero inflation or even disinflation.

As the graphic below suggests, inflation is closely correlated to unit labor costs.

One way to reduce unit labor costs is to provide the worker with a tool to allow them to get the job done faster, and more safely. This is what artificial intelligence can do for a knowledge worker: as most of the US economy is driven by services, information management is key. AI is particularly valuable for speeding up calculations, useful in research, for sorting and analyzing data such as demographics, seasonal buying patterns, safest shipping routes, hourly traffic activity etc. Similarly, improving the transmission of complex information via the internet when there is a need to allocate bandwidth is a good example of how AI can improve efficiency.

AI can be deployed to automate many tasks that had formerly consumed hours of human input. Researchers argue that GenAI could be transformative in the world of finance and economics, project management, healthcare and perhaps in society more broadly, akin to the widespread adoption of the internet around the turn of the century.[3] Theories like this are cited to justify soaring stock market valuations. “AI” seems to get credit for every good impulse in the economy, at least from economists and Wall Street analysts. Sociologists are less sanguine and there is dark talk of misinformation, doctored images or believable disinformation generated and promoted by “bots” that threaten civil dialogue or risk driving us into an accidental nuclear war. Hopefully the good prevails. Perhaps if AI brings us to a world where solutions for hunger and poverty are found, there will be less of an impulse to grab territory or shipping routes. Naïve? Perhaps, but personally I prefer to focus upon (and profit from) the good things that artificial intelligence may produce.

AI is, for me, a proven productivity booster as it has helped accelerate my research. Using AI is almost like having hired a Research Assistant. AI is helpful in sorting through competing companies or industries and especially useful when developing an understanding of arcane terminology unique to a given industry. Armed with basic research provided by certain artificial intelligence applications, I then apply my own criteria, developed over decades, to decision making.

Soft Landing?

Last year there was endless discussion in the financial media as to whether the U.S. economy could “land” or return to normal while avoiding a crash or recession, AKA “hard landing.” Currently, in the USA, we enjoy full employment and falling inflation – it seems reasonable to believe the economy has already landed softly.

Although the set up appears supportive for equities and bonds, caution is merited. When too many people love a single stock or sector, those late to the game are easily shaken out and a significant, if temporary correction to a secular uptrend can be painful. Although we’ve enjoyed a nice run with our integrated circuit companies, I would not be at all surprised by a correction of 10% for some, as profits are taken, and investors await and hope for earnings surprises. While aware of day to day fluctuations, I attempt to value a position for its long term potential. I subscribe to Warren Buffet’s approach to owning a business when he says, “my favorite holding period is forever.” The publicly traded shares of great businesses will oscillate with headlines and the passions of short term investors. At one point or another we have witnessed the price of some big winners like Apple, Microsoft or Energy Product Partners sag for a while. In managing your money, I try to think long term.

Preferred Stocks We Own Gradually Disappearing.

The yield on preferred stock is often considerably higher than the dividends paid on common stock and on bonds. They’ve been great at generating superior cash flow for clients. Alas, during the recent quarter we saw redemption of preferred stock issued by Energy Transfer partners. Clients have been in a one of three outstanding issues, all paying well over 7% dividend yield. I hate to see them go!

Recently, the energy transport companies Sunoco and Nustar agreed to a merger. One of the rationales for this union was synergies and cost savings. Specifically mentioned by management was a plan to retire high cost debt. NuStar’s 7.625% fixed-to-floating rate preferred which is held in many client accounts since 2021, is going to be retired. Under the terms of this particular issue, its interest rate recently began to float and is based now on SOFR[4] so its effective yield has soared to over 11%, too good to last! We will soon receive a notice that the notes are going “bye-bye”, but it’s been a great run!

Energy Industry Also Driving Performance

You may have noticed that the preferred stocks we are losing to redemption were issued by energy related companies. After over-expanding in the heady days following the development of hydraulic fracturing, the industry has, of late, demonstrated discipline in capital spending and borrowing to support such spending. This is evidenced by their prompt retirement of costly borrowing in the form of preferred stock. Long term clients have been placed into energy related investments for decades. I have long felt that holding an interest in this vital resource makes good investment policy. Producing petroleum-based products is expensive, and can be a dirty and polluting business. It would be nice to have an economy based entirely on renewable energy, but renewables tend to be sporadic, producing only when the wind blows, when the sun shines and when reservoirs are not depleted by drought. For a fully reliable portfolio of energy sources, a nation must depend not just on renewables but also hydrocarbons (and perhaps nuclear) energy sources that can be fired up during peak load times to run factories, automobiles and to heat and light homes 24/7. I’m pleased to know that our investment in expanded pipelines, storage and transportation as well as primary production efforts over the past 20 years has contributed to making the USA energy independent and the number one producer in the world. This is not just good economically but also strategically: our ability to supply allies and to squeeze hostile producers like Russia and Iran has given our nation a power to (I hope) do good in the world.

Nvidia: leading portfolio performance

Chris Miller, in his book “Chip War” compares semi-conductors to the oil market, noting that dollar volume of global sales is larger than that of oil and gas (!) and arguing that chip design and manufacturing capacity is as important, arguably more important that a nation’s ability to produce oil and gas. I’ve always looked favorably upon industries that produce a vital product for which there is universal demand, like oil and now, like computer chips.

Last summer I cautiously positioned many clients into a portfolio of semi-conductor companies. It was pretty clear that a broad swath of companies engaged in design, testing, manufacture and packaging of semi-conductors are benefiting from demand for Cloud computing capacity. The trend of migrating data and functions from in-office computers to data centers continues apace. But wait…with predicted wide spread adoption of artificial intelligence, the demand for high end chips appears boundless. As my education in this sector has expanded, I resumed[5] focusing on specific companies. At end of December, shares of Nvidia (NVDA) popped above a trading range and so it was time to make a modest acquisition of this specific company for many clients. As mentioned, this has been a spectacular success, so far. The Van Eck Semi-Conductor exchange traded fund (SMH) also holds Nvidia as its largest position. As mentioned earlier, Nvidia stock soared 82.5% in the first quarter. For context, the S&P 500 gained 10.2%.

Nvidia pioneered the application of chips made for gaming and graphics, ‘Graphic Processing Units’ (GPUs). A GPU is a processor that is made up of many smaller and more specialized computing ‘cores’. By working together, the cores deliver massive performance when a processing task can be divided up across many cores at the same time (or in parallel.) In comparison, a “Central Processing Unit” (CPU) can also have multiple processing cores (but not as many as a GPU) and is commonly referred to as the ‘brain’ of the computer. As a general-purpose processing unit, the CPU executes the commands and processes needed for a computer and its operating system.

While CPUs are the backbone of general-purpose computing, GPUs are especially useful for computational tasks that can be divided into many parallel tasks (sometimes called ‘massive parallelism’) such as computer graphics, competitive gaming, cryptocurrency mining, and large language models (a type of generative AI.) This makes them attractive for handling extraordinary loads and offers “computational bandwidth” not available from traditional CPUs.

Nvidia has surrounded its chips with tools to encourage wider use of GPUs. ‘CUDA’ is a parallel computing platform and programming model developed by NVIDIA for general computing on graphical processing units (GPUs). It allows developers to program in popular languages but adds capability for running programs on Nvidia’s proprietary chip sets. With CUDA, developers can dramatically speed up computing applications by harnessing the power of GPUs. CUDA allows developers to quickly come up to speed in designing embedded software to run Nvidia chips. So, the company has astutely created its own ecosystem: chips, software to design systems using Nvidia chips, and now even produces tooling for this function based on its own chips.

Nvidia is believed to control some 80% of the market for the kind of semiconductors required to drive “deep learning”, the process by which computers become smarter and incorporate a global range of information and knowledge into artificial intelligence. The company has been growing sales at 40% per year with high profit margins. Competition is supposedly on the way from AMD and Intel. However, Nvidia’s first mover advantage will be difficult to overcome. Some of Nvidia’s biggest customers, companies like Amazon, Apple and Meta, are seeking to develop cheaper alternative chips and systems in house. Still, working with Nvidia is attractive for many companies because it is not captive and offers a “cloud agnostic” development package.

On March 19, 2024 CEO Jensen Huang illustrated how Nvidia is pulling ahead again with a new chipset that is multiple times more powerful than their current “N-100” chip. The new offering, “Blackwell” is being customized for some hyperscale companies like Amazon, Google, Dell and Microsoft. This suggests that the competition, as it is, may be a long way from eating into Nvidia’s market share.

Nvidia is now the third largest corporation by market valuation on the planet. They are using their financial advantage and size to form alliances and or to acquire smaller tech companies who can provided augmented features.

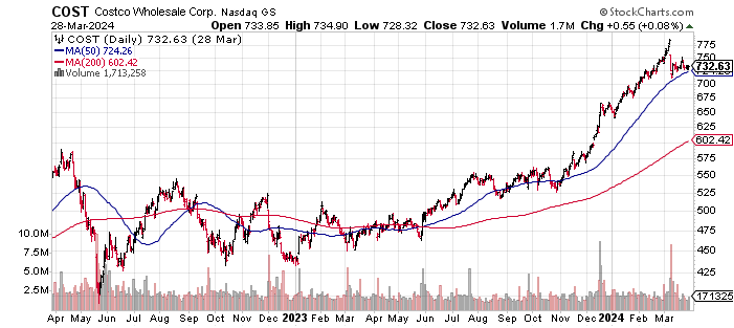

COSTCO

This quarter, Costco (COST) continued to be a favorite retail stock. Having begun an accelerated price increase in late 2023, the momentum continued into the most recent quarter, with a price rise of about 35% since November 2022. Although the stock is currently correcting, there are few other retail operations that appears able to cross Costco’s moat. Given its income structure, which is mostly funded by annual membership fees, I believe we can continue to rely on Costco’s relatively predictable income to support continue stock price increases. Interestingly Costco appears to be one of the few American companies growing in China, and so far, has not fallen out of favor with China’s capricious dictatorship.[6]

Alphabet (Google): Threatened by Artificial Intelligence? Threatened by political “intelligence”?

I reduced most clients’ holding of Google in March. Justifying this reduction are reports that Google’s artificial intelligence offering is struggling. AI search from other sources seems likely to compete with Google search. Why? Large language models like ChatGPT can search multiple online sources, thus broadening the possible sources of information. Unlike Google search, AI like ChatGPT provides succinct summaries of subjects under search, while offering multiple supporting citations. In fact ChatGPT can create a report, in understandable and grammatically correct language, incorporating the information it has found. This leads me to worry that Google may see erosion in searches[7] on its platform by the second half of this year. Additionally, Meta is apparently attracting search with a marketplace that competes both with Google and Amazon. Then there is the political: both the EU and U.S. governments have taken significant regulatory actions and legal steps to rein in the power and intrusiveness and dominance of Alphabet (Google) and other major tech companies, including Apple. While the EU has already forced some changes, a U.S. antitrust trial against Google represents a major escalation in the government’s efforts to curb the company’s market power.[8] [9] I felt it wise to reduce, but not eliminate exposure to Google, as it is likely to be under pressure for a while.

International Appeal

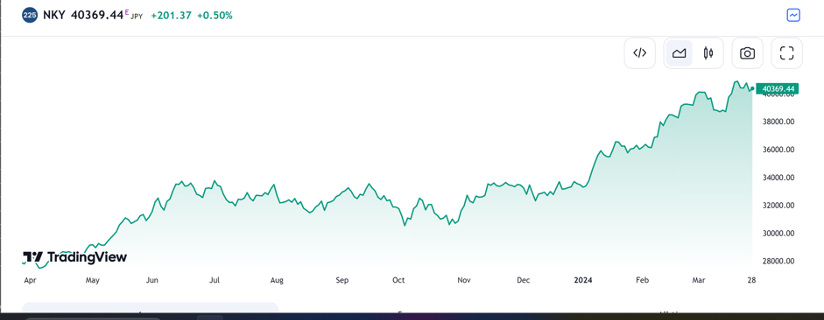

For the first time in many years, I made small but meaningful investments in foreign stocks. Why international investments? First, certain foreign markets’ metrics are more attractive than those of the United States. Shares of good companies can be purchased at considerably lower multiples than in the U.S. markets. India is enjoying investment inflows as it is rapidly modernizing and is seen as an alternative to China, a nation mired in stagnation. Japan has significantly reformed its economy which has made investment in public companies more attractive to foreign investors. Creation of NISA, (Nippon Individual Retirement Savings Account) is expected to entice the Japanese public, historically conservative, to commit some of their notoriously high bank savings to investment in stocks.

Japan’s Nikkei 225 Stock Index:

Conclusion

Lest this report appears too ebullient, let’s be mindful that any number of short term shocks can ripple through the market and frighten investors out: another failed bank or stressed insurance company, [10] widening conflict in Europe, the Middle East or Asia. There are also longer term or Macro forces that offer the opportunity to worry. For me and many others, there is the ominous growth of government debt. Ten years ago, Republicans at least gave lip service to a balanced Federal budget. Now both political parties are carefully ignoring a solution, and debt has piled on at an accelerating pace. With worsening gridlock and irresponsibility in both political parties, it will no doubt take a crisis of some sort to force reforms to our underfunded retirement programs, which are backed by I.O.U.’s from a government deeply in debt. Yet, for every dark prediction I’ve heard over the decades, commodity shortages, incurable disease, political upheaval and the like, it has been remarkable how society fashions solutions. By investing, my clients helped fuel the remarkable expansion of technology, infrastructure, medicine and productivity that promises answers to difficult problems and opens up many investment opportunities today. Let’s be grateful for our success!

Gary E Miller, CFP

[1] https://www.barrons.com/livecoverage/stock-market-today-032524/card/treasury-yields-up-as-u-s-rate-cut-remains-iffy-u3gpze5VzCkgTDFnzsRs?mod=md_bonds_news

[2] Of course, the opposite is true, and we experienced the opposite during 2021-2022 bear market.

[3] https://www.cnn.co/2024/02/17/business/productivity-boom-inflation-economy-strong-soft-landing/index.html

[4] Secured Overnight Fund Rate. This has replaced LIBOR: https://www.forbes.com/advisor/investing/secured-overnight-financing-rate-sofr/

[5] Clients have owned Nvidia and Broadcom prior to the 2022 bear market

[6] https://www.bloomberg.com/news/articles/2024-02-27/hong-kong-s-hottest-new-store-is-the-costco-in-shenzhen?srnd=businessweek-v2

[7] Nearly 80% of Google’s revenue is from advertising driven by “clicks”, generated by search.

[8] China has already driven Google out of the country, Europe clearly wants to bring down American firms, so why are our anti trust regulators piling on to one of the most successful American companies?

[9] Since the stock shot to a new high on April 1, this appears to have been an overly cautious decision.

[10] which appears likely, given the ghosted office building acreage plaguing many cities.