“…the Fed Board seems to be convinced that inflation must be stopped at all costs, so there is a good chance they will overshoot. Employment remains strong as does consumer spending. Resistance to inflationary price hikes appears to be absent. Therefore, I would not be surprised to see 10 Year T-bonds at 6%, even near 7% before the fever breaks.“

-Trusted Financial Quarterly report June 30, 2023

“Jamie Dimon says Americans are on an economic ‘sugar high’—and he’s urging clients to batten down the hatches and prepare for rates to hit 7%”

-Headline in Fortune Magazine online September 26, 2023

Mr. Dimon gets the headline, but you heard it from me back in June: at a time when many thought the Fed was done raising interest rates. I felt such optimism was premature then and continue to believe interest rates will track higher still. Endemic inflation is tough to kill, and the last time it was this persistent, it took historically high interest rates and a recession to wring it out of the system. Recalling 1981 when I obtained a home mortgage in Irvine at 14%, current interest rate levels are likely not yet high enough to bring inflation to the targeted 2% level.

What we have is a return to more normal interest rates. For younger folks, accustomed to artificially low borrowing rates, it feels like mortgages, now nearly 8%, are oppressive. It’s kind of a crummy deal for Gen Z and even Millennials who are going through the marriage and babies stage of life and want to own a home. This same group has seen their schooling and careers disrupted by a pandemic. Now, just as they may wish to have a nest of their own, the cost of nesting has soared. But their parents and grandparents, the Baby Boomers, had to deal with much higher mortgage rates in the 1970’s and ‘80’s. Our generation never thought of “quiet quitting” or work from home. While we may not have been the tireless workers that the World War II generation were, most Boomers managed to own a home and keep it. Home ownership is a path to financial security.

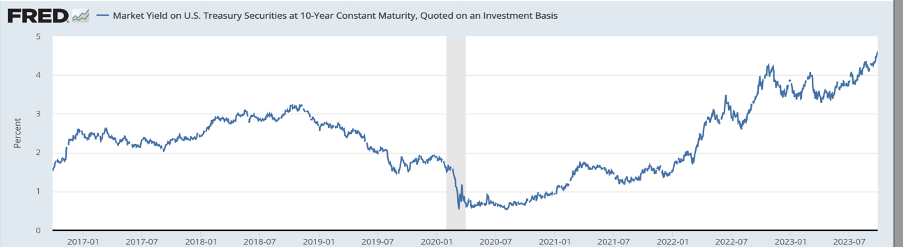

In previous reports, I’ve noted that it’s not just short term rates that have risen. Because the Federal Reserve bank bought an enormous amount of Treasury bonds in recent years, the intention is to return to a more normal balance sheet, so they are steadily selling bonds back into the private market. The result is a spike in the ten year yield as shown below.

Source: Federal Reserve Bank of St. Louis

A “technician” (chart watcher) will mark the recent spike above the 4% level as signaling still higher yields to come. I‘ve been holding on to a great deal of “Cash” for clients in anticipation of this very thing. The goal is to lock in the highest rates that may come available during this business cycle. In fact, significant corporate refinancing in 2024 may push available yields still higher allowing us to enjoy high grade corporate bond income above the rate of inflation.[1][2]

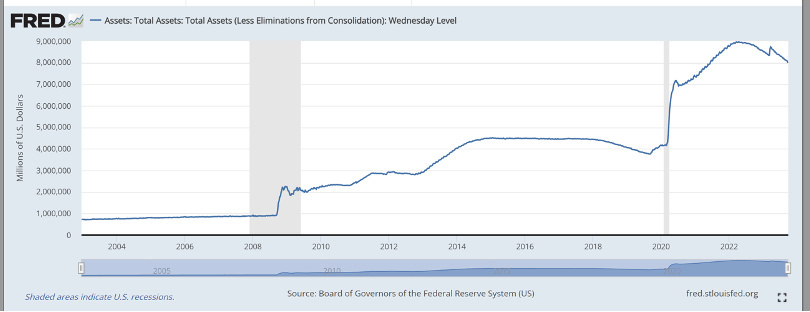

Rising interest rates are naturally seen as a negative by most of society. But, since many of my retired clients enjoy the idea of reliable, regular income, they will benefit from the end of a fifteen year “Yield Drought.” Liquid bond or bond-like securities offered paltry yields, even negative yields until 2022. This began with the Federal Reserve’s response to a near financial melt down from 2007 to 2008. Financial markets remained reactive to any rise in interest rates well into the twenty-teens. For some 5 years after the Great Financial Crisis, the Federal Reserve kept holding interest rates artificially lower by purchasing bonds issued by the Treasury, an action termed “Quantitative Easing.” At the first sign that the Fed was going to gradually reduce or taper off this process in 2013, there was a panic called a ”Taper Tantrum.” Interest rates spiked and the stock market hiccuped. Ben Bernanke, then Fed Chair, rushed to assure the markets that the Fed would remain accommodative. This continued what some believe was an unhealthy pattern of the tail wagging the dog, as if the Fed’s primary job was to keep stock market investors happy.

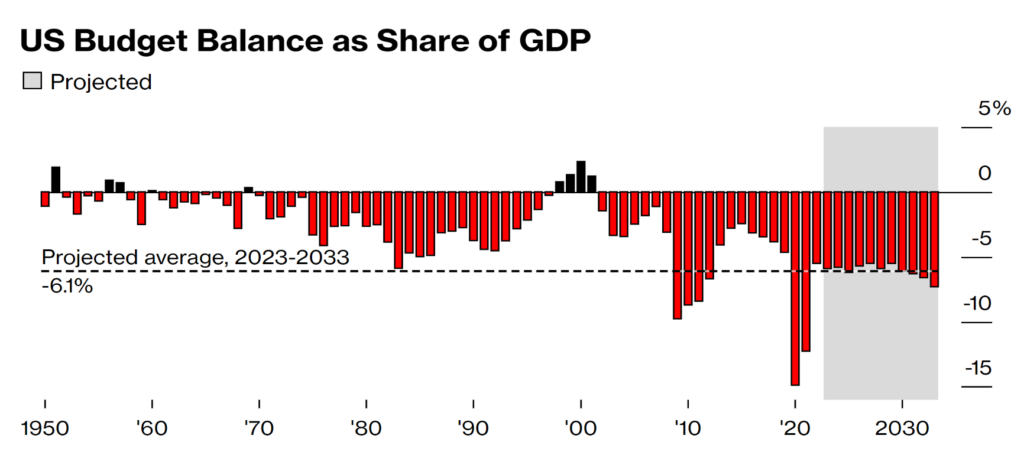

As confidence grew, the Fed began reducing its vastly expanded holdings of T-Bonds in 2018. But, when the Covid shut down occurred, the debt dam broke. A flood of spending by Congress to counter the dire effects of a frozen economy was accommodated by the Fed buying $ trillions of T-bonds, to keep interest rates low. The first chart below illustrates how debt is expanding, year after year. Federal spending has soared, it has been accommodated by bonds purchased and held by the Federal Reserve. It puzzles me how this process goes on and on, but so far it seems to have worked.

Balance Sheet of Federal Reserve Bank

Source: Federal Reserve Bank of St Louis

With the end of the Covid pandemic, the Fed is again attempting to reduce its hoard of bonds. This is the proper approach because somewhere in the future will be another crisis and the need to accommodate emergency spending to stave off recession or depression. The Fed’s credibility is at stake. Most financial commentators have fixated on short term Fed funds rates which were jacked up rapidly by the Fed beginning last year, as a sign of tightening. But I’ve been watching an equally ominous pressure coming from the unwinding of the Fed’s bond holdings. In the last few days of September, ten year T-bond yields leapt toward 5%. Long term yields are directly tied to mortgage rates. Mortgages are priced at a spread above ten year T-bonds and currently a traditional 30 year mortgage charges about 7.75%. Our building industry, a major employer, suffers when buyers cannot qualify for mortgages. Likewise, corporate investment initiatives such as new manufacturing lines do not pencil out due to the cost of money. Both trends result in lost jobs.

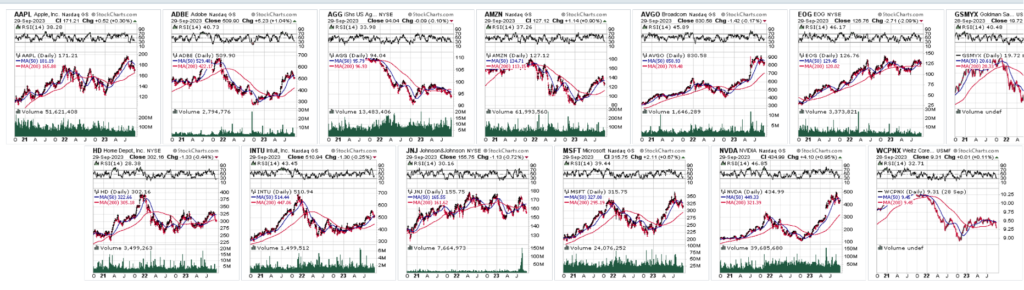

Rising interest rates usually depress the price of previously purchased bonds. Rising interest rates also pressure stock prices. Note that the broad market has failed to rise above the post-Covid euphoria seen in 2021. Even some of the highly loved “Magnificent Seven” technology firms have failed, so far, to scale their previous price highs.

As this process unfolds, my strategy has been to maintain an historically high allocation to short term money market funds with yields above 5%. This money will eventually be allocated largely to bonds, paying better interest rates than even today’s. Patience will allow us to obtain still higher yields on longer term debt instruments of good quality, and yes, once rates peak, the stock market should also have a good rally.

Remaining Cautious

During 2022, as interest rates clocked their most rapid rise in two generations, the stock market swooned. Some of this year’s most loved stocks have risen Phoenix-like from a serious collapse just the year before: In 2023 Apple was down 27%, Microsoft off 29% Amazon down 50%, Netflix dropped 51% and Nvidia, off 50%, We owned them all of these and exited or reduced exposure as the tidal wave rolled in.

Some will wonder why I did not pile back into those same stocks earlier this year as these technology related names roared back. Blame it on experience. Last year’s Tech debacle reminded me of the pain felt by overly optimistic investors when the Bubble burst between 2000 and 2002. Most held on too long and lost their dream of early retirement or paying for their kids’ college education. I’m understandably skeptical of this sudden Tech Comeback. But many of those we exited have so far failed to achieve a new price high. I have to wonder if what we’ve seen this year is but a bounce to be followed by another down leg. Below is a series of graphs covering the past three years, showing the performance of the stocks we exited last year. Most rose as we exited the Pandemic Era, peaked in late 2021 then suffered a serious reversal. Few have returned to the all time price highs seen at the peak, with the exception of Apple and Microsoft,[3] and even these two great companies gave back much of this year’s gain in the recent quarter:

There is always a list of worries in financial markets, and one can always cite reasons to stay out. The longer term record strongly favors owning equities, especially US equities for patient investors. However, stocks can be volatile, and unless an investor balances her holdings with more stable income producing assets, like bonds, stock market gyration may result in an untimely exit and permanent loss of capital. Holding bonds and preferred stocks with steady income smooths the ride and gives a nervous investor staying power. While I’m a believer in the long term usefulness of stocks as a road to wealth I believe there may soon be a once-in-a-generation opportunity to lock in attractive bond yields. Besides, equities may be subject to a sharp down draft with these considerations in mind:

- The highest interest rates since 2007 available on low risk instruments make stocks relatively less attractive than bonds.

- Quantitative valuation (like price-to-earnings ratios) suggests publicly traded companies leading market indices are priced above their customary levels.

- Global efforts to bring inflation back to manageable levels are running up against rising energy prices and restive work forces seeking better wages and benefits.

- The Federal Reserve Chair suggests rates will remain higher for a long period of time.

- Fiscal chaos and election uncertainty appear to be chronic components for the world’s leading economic engine (USA)

- Geopolitical forces appear to have returned to Cold War status in contrast to the period from 1990 to 2020.

What’s working?

Diversification and a heavy allocation to overnight money market funds yielding over 5% make this a modestly profitable year for most clients. Energy related holdings have performed particularly well as world oil prices surged. This may be some consolation for Californians staring at gasoline prices over $6.00/gallon. I’ve always had an affection for resource companies. Like many of my generation, during the Arab Oil Embargo of 1973 I found myself waiting on gasoline lines and this awakened me to the importance of commodities, especially oil and gas, as a foundational force in economics.

Lately, oil prices are trending higher, and this has been great for many clients’ holdings. The long-held position in Enterprise Product Partners has not always been a smooth ride, as the chart below shows. But this security has consistently generated distributions[4] at a rate far above competing securities. In the midst of the Covid panic, when shares briefly surrendered 50% of value, we held on. The fat dividend was compensation for patience. I’m happy to report that this quarter EPD reached an all time price high.

Another energy related holding, Magellan Midstream partners was acquired at a nice premium. Our position in Coterra Energy a North American driller was up 17% in the quarter.

Cisco Systems(CSCO) achieved an all time high, and even after giving back some of its gains, remains higher than our purchase price. Finally, preferred stocks have done remarkably well with most achieving new price highs. This is a surprise since when interest rates rise, fixed income instruments usually fall in price. Most of our preferreds are issued by energy companies which may explain this dichotomy.

In contrast to the winners, I’ve been surprised to see shares of McDonalds (MCD) slump, along with most of the restaurant industry. This does not appear to be due to anything specifically weighing on Mickey Dee’s. Rather, investors may fear that rising gasoline prices will force a reduction in discretionary spending especially for lower income consumers. Wells Fargo analyst Zach Fadem thinks MCD is well positioned and share price will come back next year, He makes the case based largely on their embrace of technology. I’m not a regular customer, but when on the road McDonalds is my usual quick stop. The company has smartly invested in a smoothly functioning phone app that allows me to order while driving, then quickly pick up and drive away with a Happy Meal and a prize! You may not want to be a passenger in my car.

Tech Talk

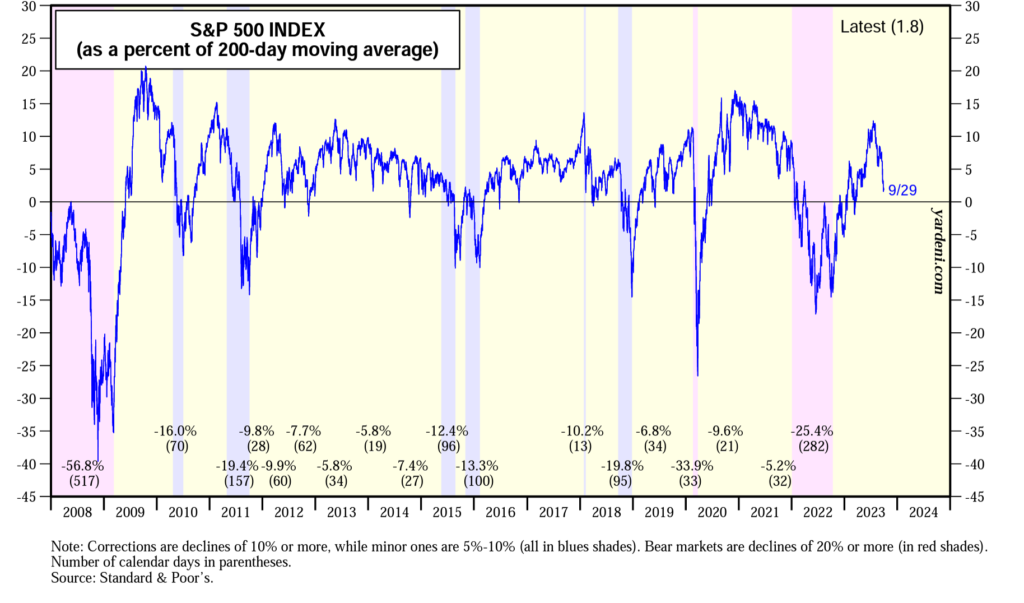

Although I tend to be a “bottom up” stock picker, it is important to keep an eye on the macro trends for stocks. Below is a graphic that tracks a market indicator that offers some perspective on the broader market. Taking the 500 stocks tracked by S&P, the general rule is that if the majority of stocks are trading at a price that is above the average price of the past 200 days (200 day moving average), the market is trending upward. I like to see this on my checklist when considering a specific stock purchase. Of course, the opposite is true as well. This indicator is especially telling in 2023. The most followed index, the Standard & Poor’s’ 500 is up nearly 12% this year. But, as illustrated in the mid quarter report in August, monster companies like Apple, Microsoft, Google and the like have a heavy weighting in that index. They have made it appear that a generally strong market is under way. By contrast, the chart below is an equally weighted index and is not distorted by overweighting the giant tech corporations.

As this chart shows, we’ve oscillated all year around the 50% line. Some companies are trending up, others not, and while there is a slightly positive bias, there is no compelling trend we can ride at this time. This is but one indicator I consider, and it belies the bullish case. “The Market” is not consistently trending higher, rather, this indicator suggests that stock picking is crucial and that simply throwing money into an index fund may not be a reliable road to profit.

Source: Yardeni.com

Looking Ahead: Doom, Gloom or Vroom?

I’m with Warren Buffet who has warned folks to never bet against America. At this moment ours is the strongest major economy in the world. We have a labor shortage with demand from our industries for skilled engineers, software coders and even unskilled laborers (one of the reasons McDonalds is going digital is difficulty finding workers.) Further, manufacturing appears to be returning to our shores given China’s idiotic treatment of successful foreign businesses that try to operate there.

While my plan is to lock in good yields on fixed income instruments in the new interest rate environment, equities will remain an important driver of portfolio success. We appear to be in a new, higher interest rate era, but I’ve operated in such an environment before. I feel confident that my clients will do well.

Thanks for your confidence and please reach out with any questions.

Gary Miller, CFP

Disclaimer:

The opinions expressed herein are those of Gary E Miller, CFP. The contents of this report are not to be construed as investment advice. Investment advice is provided only under contract to clients of Gary E Miller DBA Trusted Financial Advisors. Readers are advised not to act on any statements herein. Any investment choice made by a non-client is solely the responsibility of that non-client and Trusted Financial Advisors assumes no liability therefore.

[1] https://www.bloomberg.com/news/articles/2023-09-01/fidelity-international-says-wall-of-corporate-debt-to-spark-recession-in-2024

[2] https://www.bloomberg.com/news/articles/2023-08-24/bond-market-flashes-warning-as-us-budget-deficit-surges?srnd=premium

[3] Client portfolios are individually managed in an attempt to properly meet the stated risk tolerance, income goals, so not all clients owned these names. Some mutual fund holdings did have exposure to many of these stocks, so even if a client did not see one of these in his/her portfolio, these names are relevant.

[4] NOTE: Enterprise is a master limited partnership. This means distributions are largely tax free. However, a significant portion of the distributions are treated as a return of capital (principal) by the IRS. Upon sale, much of any gain recorded will be treated as ordinary income taxed not as long term capital gain. There are potential unrelated business taxable income (UBTI) implications too. Even a sale of share held within an IRA may result in a current tax. Still, long term holders have enjoyed a rewarding economic benefit from this company.