Not too long ago, we experienced many years of a “Goldilocks” economy: interest rates were low and were kept low while equity markets enjoyed seemingly endless expansion. Now, when you turn on a financial news channel or read a financial periodical, all is doom and gloom. Even in the best of times, financial journalists use fear to keep us engaged. Right now, clearly in a bear market, they are dancing around the bonfire. Fear sells, and less experienced investors may have begun to panic.

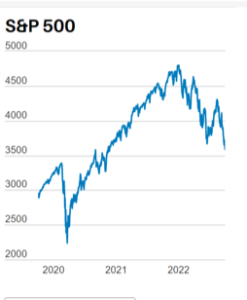

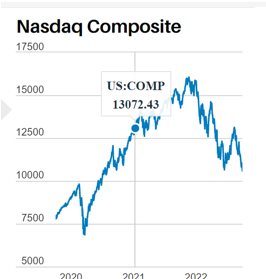

It is useful to take a look at the past ten or so years for the US stock market. From the Great Recession low in March of 2009 through the end of 2021, equities produced attractive double digit rates of return. There was not a single loss year for those invested in stocks as measured by the S+P 500 index. Notably, for the last two years of that time period, 2020 -2021, despite a global health crisis that saw millions die and massive economic disruption, the stock market continued to compound favorably.

Over this twelve year period, equity markets approached or exceeded bear market territory on three occasions – in 2011, at the end of 2018, and in early 2020. Along the way there were multiple intra-year corrections exceeding 10%. Yet those twelve years saw one of the greatest runs of all time, rewarding patient investors.

Part of that market expansion was undoubtedly due to excessive monetary stimulation by the Federal Reserve Board (the “Fed”) and profligate spending by Congress. This has led to the highest inflation since the 1970’s. Now, the Fed is raising the cost of borrowing so as to slow down the economy and reduce inflationary pressures. Further, they are selling Treasury bonds into the market, bonds that were bought by the Fed to pay for deficit spending for Covid relief. This absorbs excess cash from the financial system. Both moves cause interest rates to increase, which makes borrowing and spending less attractive, and slows demand, which should depress inflation. In the short run, this “cure” is painful as markets must give back some of the gains we’ve enjoyed. In the long run, however, when inflation moderates, retirees’ savings will last longer, and young people will have a chance of finding affordable homes.

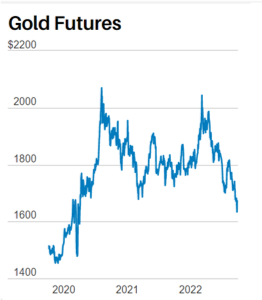

My goal is always to achieve a balanced group of investment holdings for you, so as to reduce volatility and soften the effects of a bear market. This means your portfolio will “underperform” a raging bull market but avoid the worst effect of bear markets that periodically plague the economy. In the current situation, so far, most clients have experienced less erosion as compared to the broad stock market. However, there have been few places to hide – both stocks and bonds have had a difficult year. Real estate, which we have owned in the form of real estate investment trusts (REITS) have been one of the worst sectors. Gold has failed to offset the effects of inflation, or the uncertainty caused by the first ground war in Europe in 75 years. The one asset that has become relatively attractive is short term money market investments. As you will see, your allocation to this asset class has risen as your allocation to equities has fallen, and the good news is that for the first time in over a decade Money fund yields are rapidly increasing.

While I’ve certainly reduced stock exposure for clients, this is not a function of market timing. I have never claimed the ability to predict the market’s next move. However, by paying attention to the behavior of individual company stocks and by keeping a finger on the pulse of specific company finances, many long time holdings have been sold or trimmed over the past 12 months, and especially in the recent quarter.

Virtually all clients, especially retired clients, now have a larger-than-usual holding of cash. Allocating to cash is just as important as choosing a good stock, a good bond or a good fund. Temporary refuge in a money market fund or short term bond leaves us with dry powder, to be re-deployed by purchasing good companies at bargain prices and good bonds paying attractive interest rates. I’ve already begun to add back bonds and preferred stock to many portfolios and am patiently awaiting signals that a bullish trend change is happening for certain good quality stocks.

The late Marty Zwieg, author, television pundit and mentor to Liz Ann Sonders, who is Schwab’s Chief Investment Strategist, famously advised: “Don’t fight the Fed”. That is, while our central bank is raising short term interest rates, equity market will likely underperform as a whole, although some bullish exceptions may be found. Liz Ann, in an interview last week, noted that virtually every asset class except cash has had a poor year.

|

|

|

|

|

|

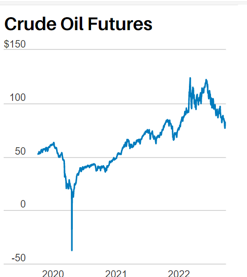

Consider real estate: housing affordability has fallen sharply, as mortgage interest rates have doubled this year. Shopping malls and downtown shopping districts are endangered by online shopping. Commercial real estate, like office buildings, are reeling from the effects of the Covid 19 pandemic, which has sparked a work-from-anywhere movement among white collar workers. Even the price of oil, which was giving us some gains on paper earlier this year, is sagging as the world stares at a recession.

We are clinging to some companies that appear to be recession resistant and that pay a good dividend, but I’m not expecting them to suddenly turn north and buck the major downtrend. Although there are some attractive, well run businesses that I’d like to buy, the climate is not encouraging. Patience is an asset. Your longer term returns, reflected in your quarter end report have been good, and they are the result of the very approach I’m describing above. Time will, I believe, reward patient investors.

Although stock market behavior appears irrational to the casual observer, there are some mathematics at work that institutional investors learned in school. The price you pay today for a stock should be, in large, part derived by taking expected future earnings, then by translating those projected earnings into current dollars. Remember, inflation makes your dollar worth less in the future. So, if analysts determine that in ten years “XYZ Battery Co.” will be worth $100,000,000,000 ($100 Billion). What should we pay for that company today in order to earn a good return? A year or so ago, the general assumption was that inflation would remain at about 2%. Using 2% as a way to discount $100BB future enterprise value projected into today’s money, the enterprise would be worth $83,675,000. But if inflation over the coming ten years is expected to average 8%, that same enterprise will today be valued at only $46,319,000.

This is a simplified example. Analysts don’t discount future values using inflation directly, but rather by using the cost of money, typically the interest rate on a ten year US Treasury bond. But the interest rate on a bond almost always rises, as inflation increases. Educated investors understand this math. So, when inflation (and with it, interest rates) soar, their math warns them not to pay as much for stocks (or for real estate or for any other asset). This downward revaluation is what we are seeing today.

The inflation outlook is very important when prognosticating the direction of equity prices. If and when the Fed conquers inflation, we can expect a market rally and if inflation looks to remain tame, we will likely enjoy a sustained bull market.

In the meantime, I am positioning clients so that they will receive income from their investments while waiting for the turn.

Inflation Outlook

Let’s look more closely at this important consideration for valuing assets. There appears to be little doubt that the high inflation levels seen during the first half of 2022 will fall. However, getting from the current rate of about 6.5% to the Federal Reserves’ stated target of 2% will, it seems, require a major slowdown for some key inflation drivers: Wages, Housing prices and Credit.

Wages have risen because there is a labor shortage. This shortage appears due to demographics and extraordinary shift in worker attitudes. Baby Boomers are reaching retirement age in record numbers. About 10,000 people per day are reaching age 65. To replace them, their kids, the so-called “Gen X” and “ Millennials”, need to be enticed to work full time. Many in that generation, however, appear to have a different view of work than their parents. Jobs that require a long commute and long hours toiling in an office or factory or even on a farm have to compete with jobs that allow a young mother, for example to be at home much of the day with her children while working from home on the computer or telephone. It also appears that a significant number of workers have gone part time. During the Covid 19 lockdown, the number of people working full time fell significantly, but has now fully recovered. From April 2020 to August 2022, full time employed rose 15.8%. In contrast, the number of part time workers rose 35%! 1Demand for full time workers exceeds supply, so far, and businesses are being forced to pay higher wages and benefits to attract workers back – that’s inflationary. As generous Federal emergency payments, granted during the Covid lockdown, phase out perhaps some of theses part-timers will return to full time jobs, but Millennials often have different expectations about work than did their parents. Many want plenty of personal time in their daily lives. Productivity is not increasing and that too is inflationary. Economists are watching the labor situation with trepidation.

Demographics also play a part in the soaring price of homes and rental units: As Millennials marry and have families, they compete with their long-lived baby boomer parents and even their grandparents for the available housing stock. Yet in many parts of the country established communities oppose dense housing growth or environmental factors limit new housing units. This in part explains why prices for homes and rentals have soared and to some degree explains the population shift south and westward to states that have cheap land and less regulation.

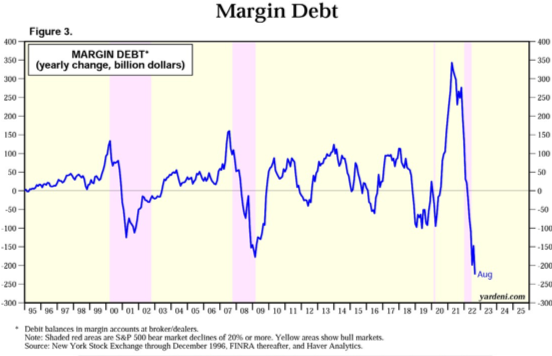

Finally, with the cost of money rising and financial assets falling in value, it appears we are seeing a subsidence in the amount of borrowed money that has contributed to the bull market for both stocks and for real estate. When speculators get burned, as they have been this year, this begins to set the stage for forming a base and eventual return to a bull market.

Source: Yardeni.com

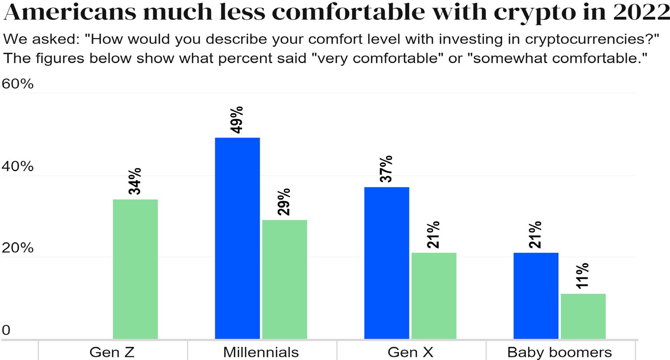

Demographics have also been a factor in the form of psychology. It seems to be a rite of passage for successful young people to use some of their discretionary capital to speculate. In my day, there were pyramid schemes and commodities, Beanie Babies and baseball cards. Younger people today have speculated in cryptos and NFT’s, SPACs and Meme stocks. First time speculators are now having their day of reckoning, a costly lesson paid by every generation. Once burned, most investors are more careful before again committing their hard earned money to a “flyer.” So, it may be a while before these investors can or will return to financial markets.

Source: Bankrate.com

I’m glad to report that I never recommended Bitcoin or any other crypto investment, never considered a NFT or “meme” stocks for your portfolio. The losses in these fad investments dwarf what has happened to stocks, real estate or gold.

This is not to say that our preferred stock and bond positions have been immune to rising interest rates, as even good quality fixed income holdings have been marked down in the secondary market. But these pay a nice income, giving us a reward for our patience. Consider the portion of your quarterly report that focuses on the income you have enjoyed over the past twelve months. Since we’ve re-oriented your portfolio toward more income generating investments, the coming twelve months may well see even higher cash flow.

Conclusion

As with other market observers, I’m wary that some piece of bad news could spark a further down leg to financial markets. When interest rates rise sharply, poorly capitalized businesses may fail. Credit Suisse is under stress, although the banking system in the US appears resilient. Last week the Bank of England took extraordinary steps to stop the British Pound Sterling from collapsing, although it briefly touched its lowest rate against the dollar in history. We must also consider the international situation. Mr. Putin has his back to the wall as his brutal invasion of Ukraine is being repulsed. Will he use nuclear weapons? Chinese war mongers appear to have too strong a hand and are lobbying for an invasion of Taiwan, a major source for semiconductor manufacturing. The news media can do a fine job of listing all the boogeymen that may hurt investments or end the world, so I’ll not continue with a gloomy list.

I’ve been in the financial markets since Gerald Ford was president, and it seemed the economy was staring down the barrel of a gun many times in the years that ensued. I am glad to report that the collective ingenuity and determination of humankind has triumphed over adversity. I believe the collective sanity of the vast majority of humankind will pull us through again, but the going may get rough for a while.

So, here’s the good news: the only asset that has recently gone up in value is the US dollar, when compared to most other currencies. Consider that this may be a good time to plan for travel abroad!

Please call or email me to discuss your particular situation if you wish. Thanks for the confidence so many have expressed in the past year or so. I intend to continue to earn your goodwill!

Gary

1 Source: US Bureau of Labor Statistics