Trusted Financial is now accepting clients!

Please contact us!

1-949-249-2057

Trusted Financial Advisors – Gary Miller: Certified Financial Planner®

serving Orange County, California and

investors throughout the United States.

We are authorities in the following services:

- IRA Rollover

- Financial Planning

- Retirement Planning

- Investment Advice

- Wealth management

- Portfolio management

- Insurance needs analysis

- Annuity review

- Income tax analysis

- Estate Plan analysis

- Business planning

Why We Are Unique:

Few financial advisors match the depth and variety of our years of investment experience. We have advised people during market crashes, high inflation, soaring stock markets, wars, political uncertainty – you name it – over a 30 year span. We have direct experience in stocks, bonds, options, real estate, estate planning, financial analysis, corporate cash management and risk management.

Why We Are Proud:

We are proud of the strong relationship of trust we have developed with our current clients and urge sincerely interested prospective clients to speak with those we currently serve. Please contact us for references.

Why We Enjoy Our Work:

We enjoy being trusted by our clients. Our name is also our calling.

Investment Principles

We have learned through many years of investment experience that it is vital to have clearly articulated investment principles and to follow them.

READ MORE

Service & Fees

We offer two services: Investment Management and Financial Planning. First we define the financial planning assignment, then assemble our proposals.

READ MORE

Current Commentary

We relate the latest business news and how it is affecting our clients. We offer many helpful tips, advice for all investors including our valuable 2 cents.

READ MORE

Trusted Financial Advisors’ Latest Commentary

March 2025 Quarterly report

After touching historic highs in mid-February, US stock indexes slumped, with most technology winners of the past three years falling into a meaningful correction. All told, it was a first quarter that began on a positive note as markets cheered what they hoped would be a Trump 2.0 administration focused on deregulation and tax cuts. It ended not with a bang, but a whimper. All three major indexes lost ground this quarter, with the Dow off 1.3%, the S&P 500 shedding 4.6% and the Nasdaq sinking 10.2%; the latter two snapped a five-quarter winning streak. [1]

The strongest two sectors were energy and precious metals. Our clients had exposure to both, plus the usual diversification into bonds, preferred stocks and “cash”. While nearly all clients saw a decline, it was considerably cushioned by diversification.

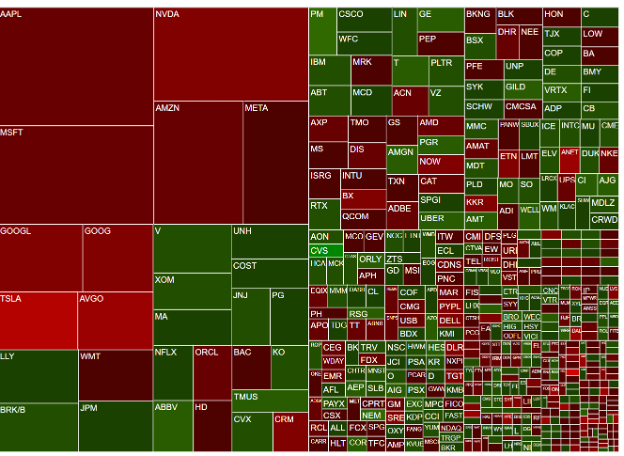

Below is a so-called “heat map” courtesy of Charles Schwab Institutional. Boxes in green indicate stocks that rose during the quarter, those in red stocks that fell. The relative size of the box indicates the degree of change. Plainly this quarter saw a correction for companies that were over loved.

This graphic shows performance of market sectors during […]

Understanding the AI “Cloud”

Want to better understand “the Cloud”? AI? There are revolutionary changes washing through our North American and world economy. Here is a great article with interviews to help shed a light on some of the areas we have seen as opportunities for investors:

Wall Street Journal “Banks Loan $2 Billion to Build a 100-Acre AI Data Center in Utah” By Peter Grant