Hooray for the Wall !!

No, we’re not talking about the controversial wall along the southern US border proposed by the Trump administration. We’re talking about the legendary “Wall of Worry“ that is said to give the most traction to a bull market. With nearly all economists in a recent Wall Street Journal survey (some 50 people) predicting a slowing US economy and with many investors favoring only the most conservative equities, US equity markets finished the quarter at record high levels.

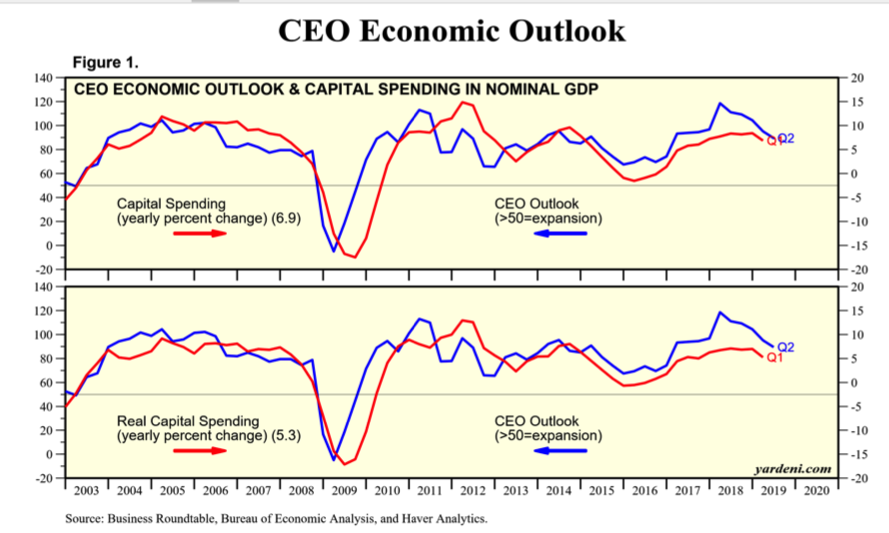

There is evidence that talk of trade wars has caused industry decision makers to postpone some capital expenditures due to uncertainty. In the two charts below, note the blue line, indicating chief executive officers’ responses to a Business Roundtable survey of plans for capital projects turns downward in early 2018 just as President Trump begins loudly jawboning China during the first quarter of 2018.

Business Conditions indices provide a mixed picture

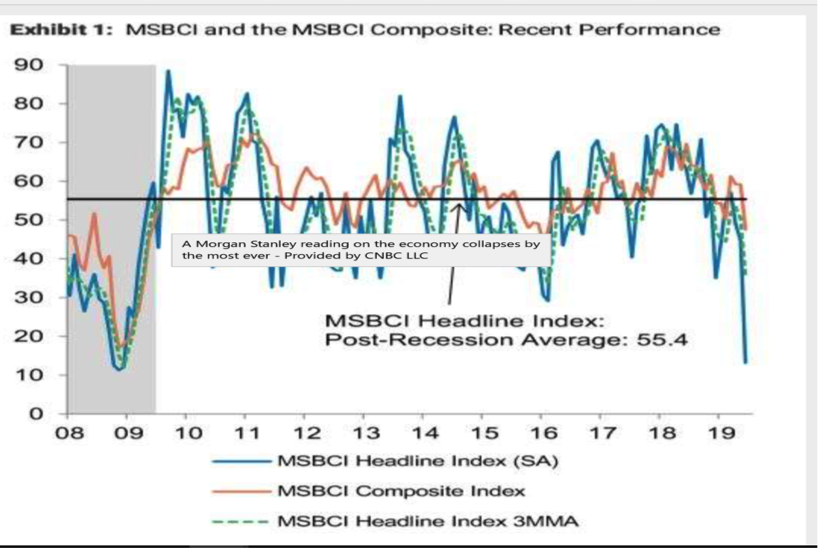

Mid-June found the Bears fortified by a Morgan Stanley survey of business conditions showing a dramatic plunge:

The graph above would appear to indicate we have returned to recessionary conditions unlike anything seen since the financial crisis of 2007-2009. Yet, anecdotal evidence does not suggest anything extraordinarily negative is going on. Shopping malls appear busy, online retailing appears healthy, college graduates are being hired rapidly and Americans are expected to set travel records during the July 4th holiday week.

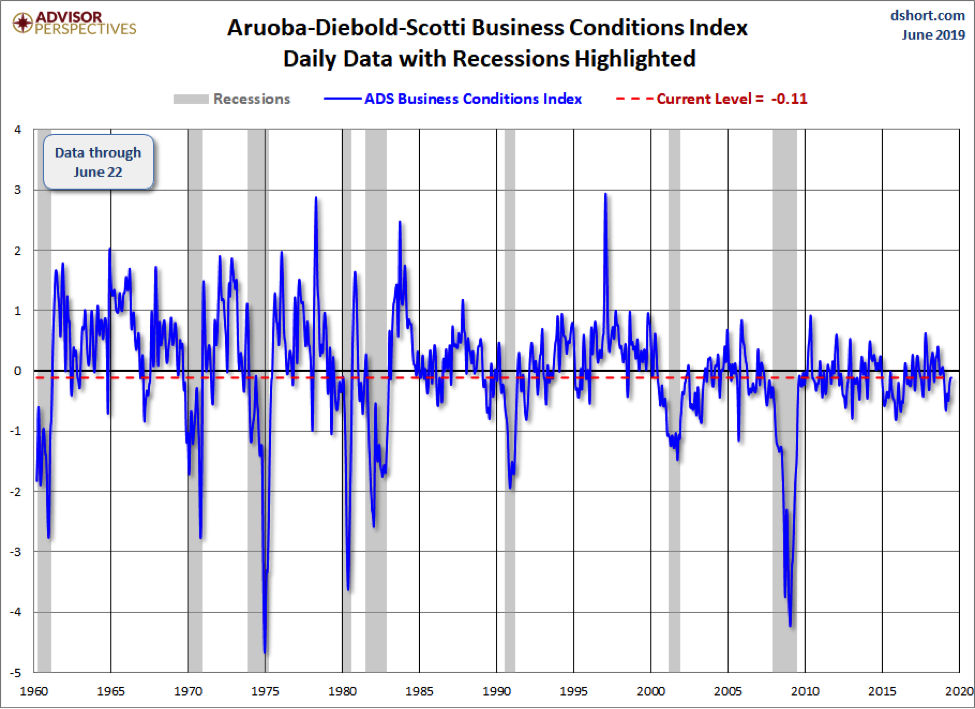

We went looking for confirmation for the dire indicator above, but this is not widely apparent. There is some evidence that the growth of the economy is tapering – The Philadelphia Federal Reserve Bank, using national data offers this graphic:

Advisor Perspectives June 2019

At -.11, the index was, as of mid-June’s survey, below the midline, but far from the crucial -1 reading that in the past signaled a full-blown recession was under way. The recent level is within the range recorded since the end of the last recession, a period of oscillating strength for the economy in which equities, real estate and similar widely held assets have provided generous returns. On July 1 Creighton University’s Rural Mainstreet Index rose for the sixth month out of the past seven months. This, despite tariff worries and some extreme flooding in the heartland. [1]

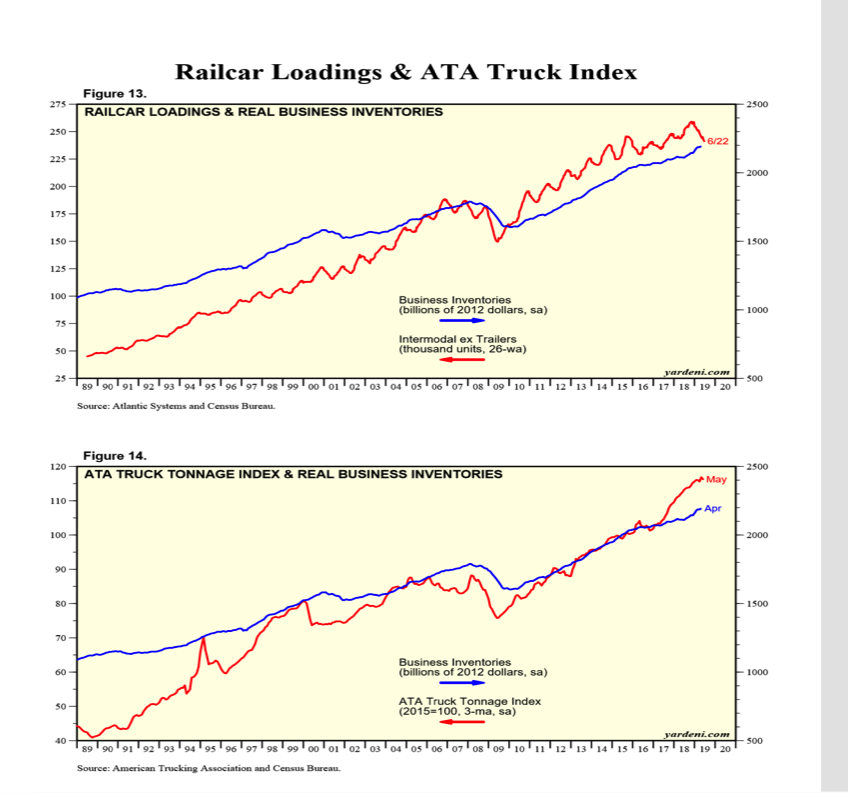

Continued momentum in the US economy is also suggested by strength in transportation:

While railcar loadings have, in fact sagged this year, this may be explained by a decline in coal consumption, a commodity shipped by rail. Last year, the electric power sector consumed 154,803,000 tons during the winter months January to March. In the same 2019 period, that figure fell to 145,000,000 tons.[2] (U.S. Energy Information Agency, March 2019). Perhaps a more accurate indicator, truck tonnage (lower graph) has been soaring.

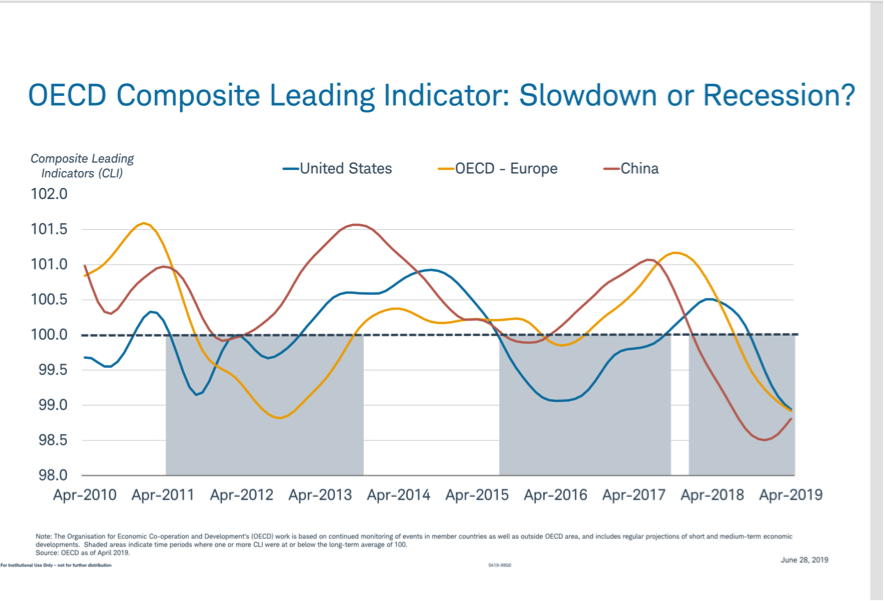

Leading Indicators are in fact giving us a bit of concern. As the graphic below shows, the three largest economies are seeing a slowdown. Except for China, the oscillation is within a range seen throughout the recent economic expansion. Further, let us put this in context. While China appears to be heading into a deeper financial slowdown than in the past, their absolute growth rate, north of 6%, would represent a boom in either Europe of the United States. We believe there may be a slowdown afoot (probably a healthy thing) but one must be careful when using the word “recession.”

Source: Charles Schwab, Inc.

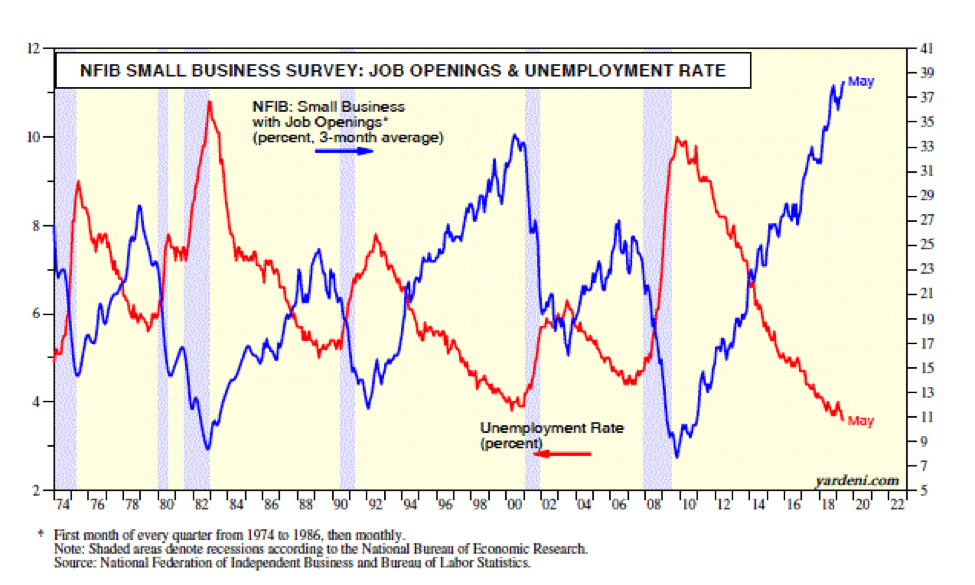

Finally, as evidence the economy is looking healthy, here in the USA consider this graphic showing record job openings at small businesses:

Small business is the seedbed for the future. It is where high school kids find experience, where new and creative products and services are launched, products and services that may become the life changing BIG product or service of our future (Apple, Facebook, Google all began small.) It is hard to be bearish when considering factors like the above. In conclusion, the Morgan Stanley business conditions survey graphed at the beginning of this discussion, appears to be an anomaly. Still, with the Federal Reserve board’s apparent plan to drop short term interest rates, we suspect there are lingering sources of concern that need to be monitored.

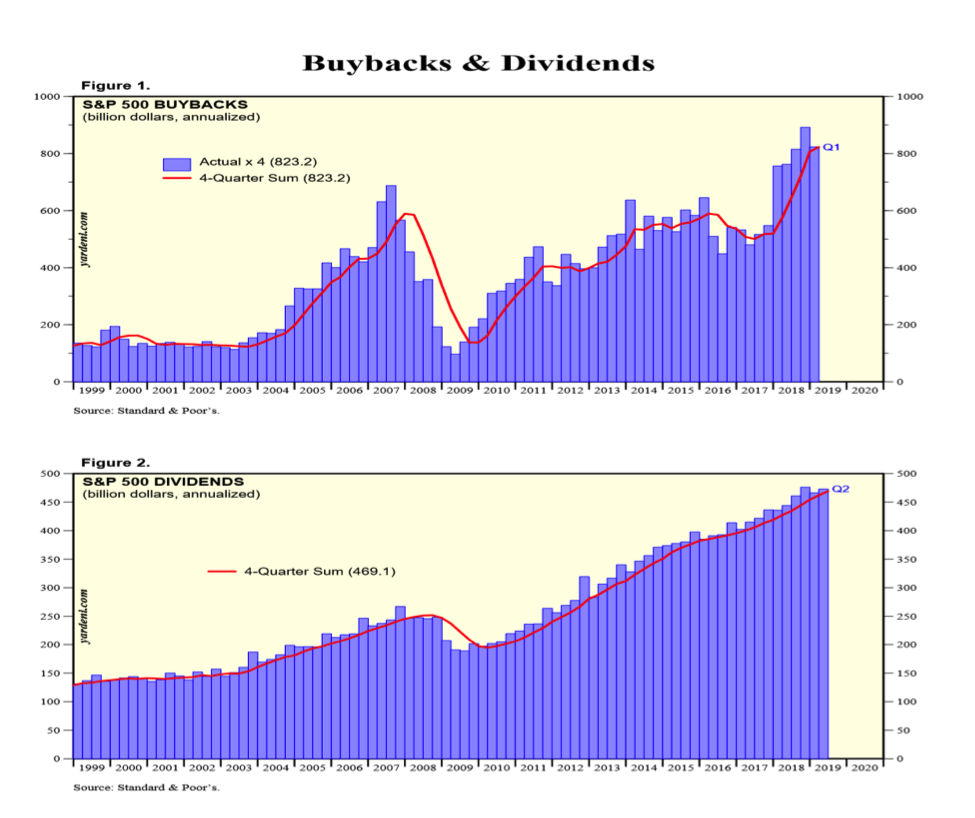

Stock market Benefiting from Unprecedented Support

As predicted by many, radical cuts to corporate taxes in the United States have, among other benefits[3] helped equity holders through record levels of stock buybacks and strong dividend increases.

Source: Yardeni, Inc.

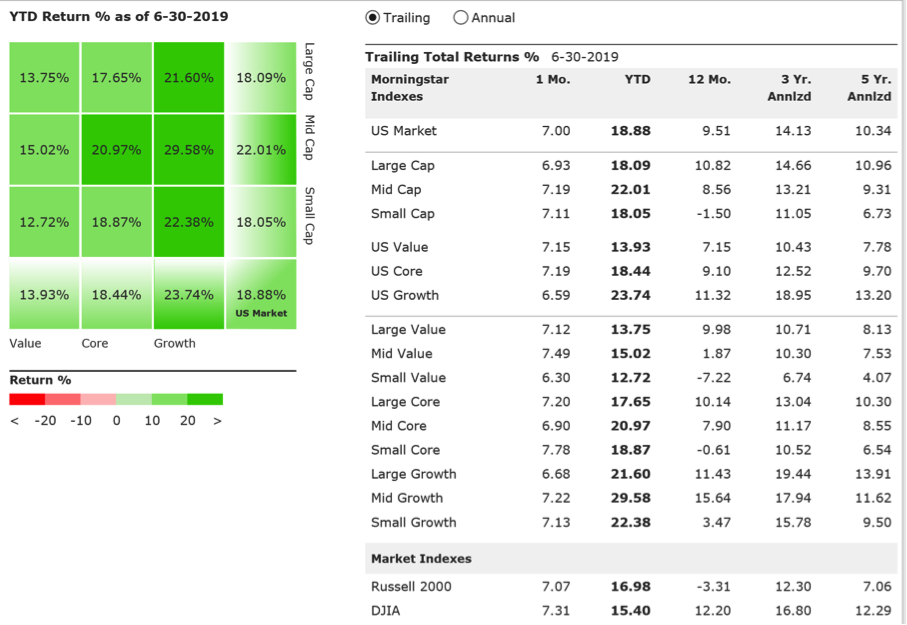

The stock market’s bull cycle has been able to reach a record length of ten years, perhaps due to this late cycle stimulus. Virtually every category of equity did well this quarter for the past twelve months and certainly for many years. All green is all good!

Source: Morningstar.com

Arguably we are living in a Golden Age: record high employment, stocks in a ten-year long bull market, with low inflation and low interest rates. But you would not know this by observing investor behavior, as the below Reuter’s headline suggests:

Fearing stock market rout, investors seek shelter in dependable dividends

7:01 PM ET, 06/30/2019 – Reuters

The Reuters article that follows the headline above provides numerous examples of how caution continues among the investor class.

Bear markets rarely grow in soil fertilized with caution. Think about the past two bubbles, Technology and Real estate. In both, investors were confident in their judgment and often borrowed excessively in order to plow money into investments. As the euphoria peaked, so did the price of equity. Given today’s investor psychology and with lender caution, we do not seem to have the conditions that will cause dominoes to fall.

As always, we recommend well

diversified portfolios that hold assets with a low correlation coefficient.

We’ll be back at the end of September, with another quarterly update!

[1]www.Creighton.edu/economicoutlook/mainstreeteconomy/

[2] The downward trend of coal consumption is also a secular phenomenon. Five years ago, over 200,000 tons were consumed over the first three months of winter 2014. Cheap natural gas is steadily eroding coal as a fuel for electric power plants

[3] Some would argue that the corporate tax cut, forcing the Federal government to borrow record amounts is not a societal benefit