As of 3/31/2019

Mirror Image

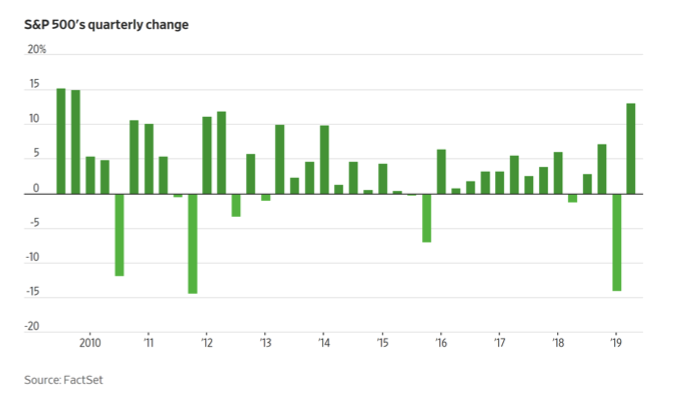

We’ve just completed a very good three-month period for investors in liquid assets, one of the best quarters for equities in a decade and a healthy rebound for the bond market as well. This quarter was a mirror image of the prior quarter, which saw the markets briefly drop 20% before a recovery began. The chart below, courtesy of www.wsj.com also illustrates how serious was the decline during the last three months of 2018, the worst in about six years.

Source www.wsj.com March 30, 2019

In last quarter’s review, we indicated puzzlement at the swoon, because economic indicators, especially the high level of employment did not seem to support the sudden downturn of investor sentiment. We reminded clients of the necessity of portfolio diversification. As a reaction to the decline we did shave some equity holdings and increased the allocation to fixed income or “cash”. We were not alone. According to the Investment Company Institute, on a US dollar–denominated basis, equity fund assets decreased by 12.4 percent to $19.92 trillion at the end of the fourth quarter of 2018. Bond fund assets decreased by 1.2 percent to $10.14 trillion in the fourth quarter. Balanced/mixed fund assets decreased by 7.1 percent to $5.84 trillion in the fourth quarter, while money market fund assets increased by 1.6 percent globally to $6.08 trillion (www.iciglobal.org). With the Federal Reserve manipulating short term interest rates higher, certain money market funds were yielding close to 2%, the highest level for this overnight investment in about a decade. Still, cash is a resting place, not an investment strategy. Due to diversification, most clients suffered little from last year’s swoon. Likewise, they did not capture all this quarter’s rally. This is to be expected from a diversified portfolio. The goal here is to help our clients sleep at night while delivering a return above that available from low- yielding “safe” investments like CD’s or Treasury bonds. We’re not trying to outperform the hot sector of the moment, be it stocks, bonds, real estate, gold or crypto currencies. We believe the past six months with its swoon and recovery reaffirm the value of portfolio diversification. A portfolio that avoids extreme fluctuations is one that provides peace of mind.

We recently heard a talk by JP Morgan Chief Economist David Kelly. He pointed out that the four most important indicators of U.S. economic health (in his opinion) are not giving off worrying signs. These include: residential investment as a per cent of Gross Domestic Product (GDP), business fixed investment as a % of GDP, motor vehicle and parts consumption as a % of GDP and change in private inventories. There is no sign of excess in any of these indicators. To these four we would add the high level of employment, unseen since the halcyon days of the 1950’s.

Last year’s stock market benefited from the effect of a major corporate tax reduction, that allowed corporate America to reunite stakeholders with some of their own money in the form of stock buybacks and dividends. This souped up market performance, particularly in the first half of the year, but it was never likely that this one-time stimulus would be repeated. In late 2017, after passage of the “Tax Cut and Jobs Act”, Goldman Sachs correctly anticipated that after a pop in 2018, the growth of GDP would decline in 2019. As this outlook became the consensus softening of stock markets was to be expected. This does not mean we are going to fall into a pothole, but apparently some investors thought so just three months ago and panicked. Still, several respected economists remain in “worry” mode.

Liz Ann Sonders, Schwab’s talented market analyst is skeptical of this quarter’s rally: “…we believe a pullback is becoming increasingly likely. Investors should remain disciplined and diversified and continue to prepare for the inevitable end of this cycle—without needing to pinpoint the timing precisely.”(Schwab Market Perspectives March 29, 2019)

Other worried economists point to slowing economic growth in Europe and Asia, where central banks are deferring moves to reduce money supply and/or increase interest rates, the normal late cycle prescription. As earnings for US based publicly traded companies for this quarter are reported in the coming weeks, many are expecting disappointment based on the costs of a prolonged government shut down and slowing orders from abroad. Others argue that lapping a big first quarter 2018, slower earnings growth is simply expected, not a sign of impending recession.

At the end of the quarter, Larry Kudlow, former TV economist, who now works for the Trump administration, echoed the president’s call for the Federal Reserve to lower interest rates, which they were increasing throughout last year. But this seems premature- there are signs of moderating growth, not a recession, and this is an important distinction Mr. Kudlow appears to have missed.

In the recent quarter, some client holdings not only recovered from their declines last year but achieved new price highs. These included Doubleline Total Return fund (DLTNX) and the Invesco S&P Midcap Low Volatility exchange traded fund (XMLV), widely held by Trusted Financial clients. New highs were seen in American Tower (AMT) and Enterprise Product Partners (EPD) as well.

While this has been a feel-good quarter and no recession seems to be in sight, there are meaningful if distant storm clouds on the horizon. 10,000 Baby Boomers per day are becoming eligible for Medicare and Social Security, two underfunded programs that increasingly will rely on outside support from the general federal budget. While Social Security is currently self-funded, this is projected to end in the 2020’s when an additional source will need to be tapped, likely general revenues. Medicare has never been self-funded. According to the Petersen Foundation (www.pgpf.org) Medicare relies on a subsidy from general Federal revenue to cover 43% of its budget, with this cost bound to grow as America ages.

Jeffrey Gundelach, manager of the afore-mentioned Doubleline Total Return fund, has sounded the alarm about the explosion of national debt. Noting that even most people who describe themselves as Republicans, in a recent survey, no longer worry much about the national debt. This is a major shift as the Republican party for decades made balancing the budget part of its platform. Of the two major parties, national debt is that crazy relative who lives in the attic…we don’t talk about him, but we can hear him pacing around above us, and we know he will have to be dealt with.

Gundelach expects the cost of servicing Federal debt to gobble up more and more of the budget. 1/3 of US debt issuance is purchased by foreigners, with China a prominent investor. If you want to feel the hair stand up on the back of your neck, click on this link to see the National Debt clock spinning in front of you: (http://www.usdebtclock.org/). According to this source, the average American’s portion of this liability is $181,000 (for a family of four this totals $724,000). China is a major source of loans to the USA. They sell us a lot more goods than they purchase. What do they do with all those U.S. dollars they earn? Well, much of it winds up invested in T-bonds, funding our deficit. Bill Campbell, a fund manager, who is also part of the Doubleline group warned in a Financial Times article (“China’s appetite for US Asset Imperiled at Worst Possible Time.” March 13, 2019) that as the Chinese middle class is growing, the nation is importing a greater volume of things to satisfy consumer demand. As a result, they have less investment surplus to drop into T-bonds. This evolution in the Chinese economy comes as there is a sharp rise in U.S. deficits. If China does not continue to do its share to buy dollar denominated bonds, Campbell warns, the result could be a sharp rise of interest rates, then a recession.

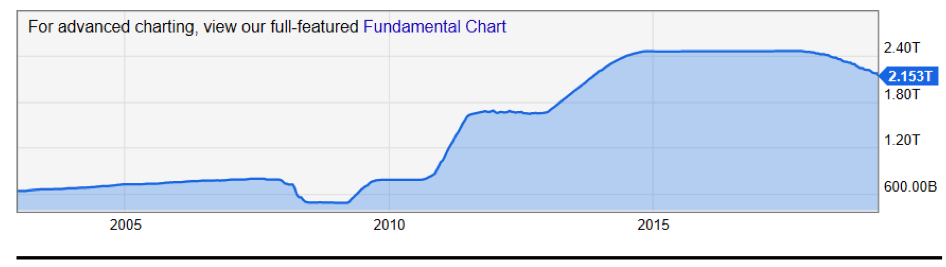

During the financial crisis, in 2008, the Fed saved us from a depression by making cheap credit available to failing financial institutions, after obtaining Congressional authorization to lend money to marginal borrowers, like AIG, Goldman Sachs, Citibank etc. This and subsequent bouts of “quantitative easing” led to a swollen Fed balance sheet as shown in the graph below. It took ten full years before the Federal Reserve Board felt there was enough sustained momentum in the US and world economy to reduce its lending, as the graph indicates. But the balance sheet remains historically inflated, and the Fed is being jawboned by the President to keep things loose. Should another recession arrive, should financial institutions again become unstable, the ability of the Federal Reserve to buy up private sector and government bonds is hampered by its already highly indebted balance sheet.

Federal Reserve Holdings of Fixed Income Securities

Although deficit hawks, monetarists and gold bugs have long predicted a collapse of the dollar and our economy due to federal indebtedness, the world currently appears to have confidence in US financial institutions, rule of law and military superiority. There appears to be plenty of buyers of bonds (AKA “lenders.”) At present, the system appears to be working and the US economy, stock market and bond markets appear sound. This suggests that economists’ gloom be taken with skepticism, but also with alertness.

With that, be assured of our concern for your well being. Job number one is to avoid or at least minimize loss in your portfolio. We never forget this responsibility.