Quarter End Report June 30, 2023

As we entered the second quarter, investors were spooked by an ongoing rescue of smaller banks after suffering "runs." Since one of these, Silicon Valley Bank (SVB) held liquid assets for start-up technology companies as well as the financiers who invest in these ventures, the government decided that these were effectively, systemically important institutions. In other words, they should not be allowed to fail. The FDIC sought to reassure markets by backstopping deposits, even those exceeding the stated $250,000 cap for FDIC insurance.[1] Still, assets have been leaving smaller banks in favor of the big names, forcing many to access so-called brokered deposits, an unstable base .[2] Even as this quarter was nearing its end, and without further bad news from the banking sector, a client expressed worry about making a deposit in excess of the $250,000 FDIC insurance coverage at a local bank. Our financial system is very much dependent on public confidence. It is fragile. It is being made more fragile by the sharpest increase in short term interest rates in memory.

Back in the early 1990’s my business included helping some large corporations manage short term cash. Companies like Farmers Insurance know that it is unwise to maintain large, uninsured balances at banks, and there are alternative instruments like bankers acceptances, short term T-bills and commercial paper, so it is puzzling to learn that supposedly sophisticated investors like Sequoia Capital were so careless. But have no fear – the taxpayers will forgive this stupidity! [3] After the crisis was somewhat defused, the FDIC mistakenly shared information that showed they were protecting some $1BB of Sequoia’s money along with a Chinese investment entity’s $900,000,000.

The apparent lesson here is that no one will be allowed to lose money when left in a bank. While this is all well and good for depositors, it only encourages irresponsible lending and investment decisions by bankers. We’ve been led to believe that strict stress testing of major financial institutions, initiated after the Great Financial Crisis, meant our banking system is strong. But after these test criteria were weakened in 2017, it took less than 6 years for mid-sized banks who slipped through the testing loophole to get into trouble.

We’ve seen an inverted yield curve for about a year now. Sheila Baer, former Chair of the Federal Deposit Insurance Corporation (FDIC) recently[4] worried that a prolonged situation in which short term interest rates offer higher yields than long term interest rates (inverted yield curve), will further stress the banking system. Regulated lenders derive a profit from having a positive profit spread (AKA "net interest margin".) They normally can offer a lower rate on a 3 or 6 month CD, say 1.5% then turn around and lend money for four years on a car loan at a higher interest rate of, for example, 5%. Today the banks have to offer about 4.5-5.0% for a six month CD in order to attract deposits from savvy savers. Net interest margin is thus harmed. Further, if loan demand drops off, as it does during a recession, the banks then might have to park their excess cash in 5 year T-bonds offering only 3.5%, or like Silicon Valley Bank, invest in volatile long term bonds to obtain a higher return. If rates then rise further, their investment portfolio will be under water. No wonder Ms. Baer is concerned.

A capitalist financial system allows poorly run businesses to fail. However, when too many banks fail at once, we have a potential depression. That regulators believe our system is so fragile they must guarantee the safety of everyone’s bank accounts tells me they are not confident at all. Is it any wonder I’ve been cautious with your money?

A New Tech Bubble?

Despite the many worries that abound, a certain portion of the investing population currently shows itself all-too-willing to throw money at any entity that includes the initials "AI", "artificial intelligence" in a self-promoting press release. This feels like a replay of the 1990’s:

- Growth and Valuations:

- 1995-2000: The period from 1995 to 2000 is often referred to as the “dot-com bubble” or the “tech bubble” because of the exponential growth and high valuations of technology stocks. Many internet companies experienced rapid growth, and investors were willing to pay significant premiums for these stocks, often based on future potential rather than current profitability.

- Current: The current market for technology stocks has also witnessed substantial growth. Technology continues to be a key driver of innovation and disruption, with companies involved in areas such as cloud computing, artificial intelligence, and e-commerce experiencing significant expansion. However, valuations today are generally more balanced, with investors placing greater emphasis on sustainable business models and profitability.

- IPOs and Investor Sentiment:

- 1995-2000: The dot-com era saw a surge in initial public offerings (IPOs) of technology companies. Many startups went public with little or no profits but attracted substantial investor interest. Investor sentiment was often driven by excitement and the fear of missing out (FOMO), leading to a speculative frenzy.

- Current: Similar to the dot-com era, the current market has also seen a wave of IPOs, particularly from technology companies. However, there is now a greater focus on financial viability and profitability. Investors are more discerning and cautious, emphasizing sustainable growth and solid business fundamentals.

- Technology Landscape:

- 1995-2000: The late ’90s witnessed the emergence and proliferation of the internet, e-commerce, and other groundbreaking technologies. Companies like Amazon, Microsoft, and Cisco became dominant players during this period. However, there were also numerous startups that entered the market with ambitious ideas but failed to sustain themselves.

- Current: The technology landscape has evolved significantly since the late ’90s. Technology is deeply integrated into various industries, and companies like Apple, Google (Alphabet), Amazon, Facebook, and Microsoft continue to dominate. New areas such as blockchain, cryptocurrencies, electric vehicles, and renewable energy have also gained prominence, attracting investor attention and capital.

- Regulatory Environment:

- 1995-2000: The regulatory environment during the dot-com era was relatively lenient, allowing companies to innovate and grow rapidly. This resulted in a lack of oversight and contributed to some speculative excesses.

- Current: The current regulatory environment has become more focused on technology companies due to concerns over privacy, data security, antitrust issues, and the societal impact of emerging technologies. Regulatory scrutiny has increased, potentially impacting the growth trajectory and valuations of some tech companies.

It’s worth noting that while some similarities can be drawn between the two periods, there are also notable differences. The current market has learned from the past and generally exercises more caution and scrutiny when it comes to technology investments, with a greater emphasis on sustainable growth and profitability.

The above discussion of technology stocks, in blue and in larger type font was written using ChatGPT, an artificial intelligence application. It saved this writer a bit of time and pretty much rehashes history in a manner with which I can agree. However, below is a more personal opinion, and what I feel my clients want from this advisor:

I remain skeptical when observing certain market participants, especially those younger and less experienced, so enthusiastic about "AI." Artificial Intelligence no doubt will provide a much needed productivity boost to our economy. Arguably, it could bring us closer to a day when the average household can again survive off of just one salary. AI offers accelerated solutions to many problems such as curing the most puzzling diseases. However, the "when?" of this bonanza is a mystery. Many of the promises of the World Wide Web were reflected in the soaring price of ".com" stocks in the late 1990’s, long before many of them were able to report profits. When earnings did not materialize at the anticipated rate, technology companies cratered. At the time, the new game of investing online without professional advice was in vogue. As .com companies or companies posing as ".com" soared, these armchair investors became bolder, often going on margin to leverage up their bullish bets. When the music stopped, the collapse was swift, paper fortunes melted away and dashed the hopes of do-it-yourself investors who believed they were about to enjoy an early retirement. A good friend of mine, a bright fellow and a partner at a major national law firm, managed to fritter away most of his accumulated wealth in a matter of months. He could not retire in his ‘40’s and is still working, twenty-two years later, in his ‘60’s.

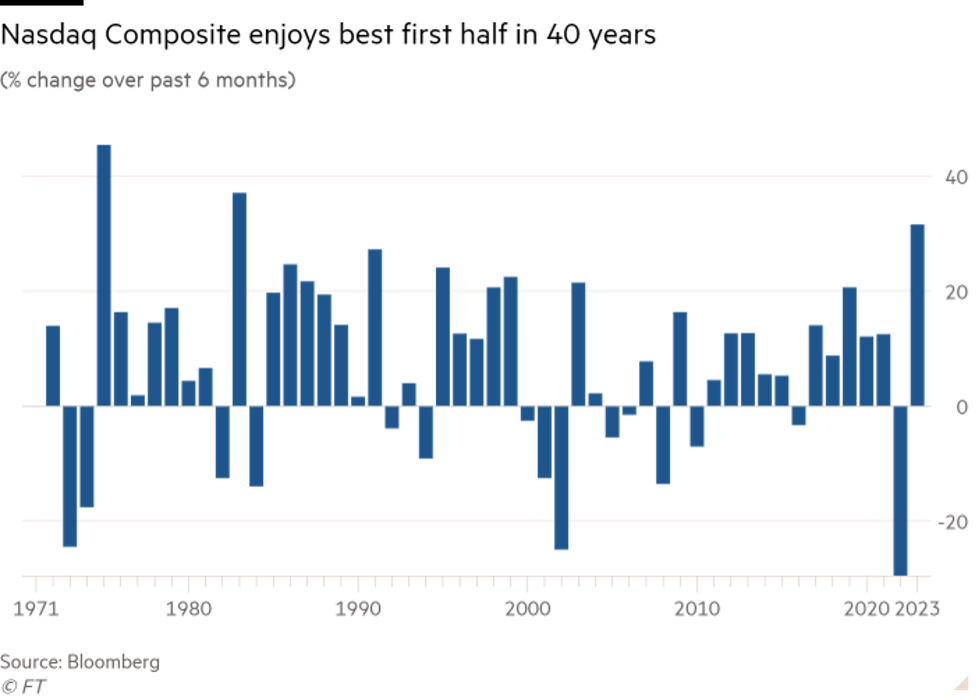

To me, this year’s meteoric rise of certain tech stocks, especially those who are associated with "AI" feels a bit like the 1995-2000 experience. The action has been focused on a handful of big technology companies whose price rise or fall distorts the performance of a stock index. It may not be a bad idea to look at the below chart, courtesy of Financial Times (www.ft.com) :

While the year to date increase, some 36%, is impressive, the plunging bar graph from just a year earlier suggests that most of members of the small cap index have only recouped their losses from 2022. Morningstar refers to this year’s tech winners as the "Magnificent Seven", but let us recall that all seven stocks closed 2022 with deeply negative returns. Tesla took the worst hit, falling 65%, and Meta was close behind, down 64%. Nvidia and Amazon both lost 50%, while Alphabet declined 39%. Shares for Microsoft and Apple suffered the least, losing close to 25%.

Going back two years, we owned many of this year’s winners, including Amazon, Google (Alphabet) Nvidia and Netflix. All remained profitable and mostly trending higher into the beginning of 2022. Then someone pulled the plug. As interest rates were driven higher by the Federal Reserve, the present value of future cash flows from stock dropped like a stone. During the 2022 bloodbath, it seemed wise to book profits, and I would make the same decisions again.

Most Trusted Financial clients continue to own meaningful positions in Apple (AAPL) and Microsoft (MSFT), two of the strongest performers year-to-date. These two, like the other beneficiaries of the recent rally, are likely to experience some retrenchment in the weeks ahead. Why? There is psychology behind the manner in which equity prices advance. A certain group of Investors, fearing they will be missing out, tend to rush in near the end of a rapid run-up, naively expecting the trend to continue unabated. They are usually impatient types and if the rally stalls, often quick to abandon their new buys, especially if they’ve borrowed money (margining) or used options to fund the purchase. This explains the periodic corrections in a major uptrend. More patient investors wait for this retrenchment to begin nibbling. I suspect we will see such retrenchment for the Magnificent Seven. However, there is more than usual uncertainty lurking in the background, so that if we do begin buying, it will be in small increments.

Besides the mini banking crisis, much of the quarter’s business news was dominated by the issue of raising the national debt ceiling. As is now customary with a Democrat president and a Republican House, those seeking certain spending cuts threaten to cause a default as a negotiating tactic.

It is important to remember that two thirds of annual Federal spending is mandated by long term commitments to social welfare entitlements like Medicare and Social Security or the interest on accumulated debt. This leaves relatively few places where true spending cuts can be achieved, except the military, which is akin to an Entitlement for most politicians.

Default is an economic threat of massive proportions…which is why a Congressional compromise is usually reached in the nick of time. In early June, a last minute agreement was ostensibly reached, trimming back some of the spending initiatives in the so-called "Inflation Reduction Act" passed in 2022. A minority of Republicans backing Congressman Kevin McCarthy managed to make a deal with Democrats. But in recent days, there have been rumblings from Republicans in the Freedom Caucus suggesting they may not vote for certain specific appropriations already agreed in the compromise. So another cliffhanger may reappear before year end. Replaying this scenario would not be good for financial markets.

Looking at the Macro trend, in which a historic cohort of retirees will be expecting government and private pension benefits in retirement, economists warn that Federal promises made to retirees cannot be met without some sort of major tax increase or spending cut. In fact, there has been a Republican proposal to raise the ability to qualify for Social Security gradually to age 70. I happen to agree with this idea, given lengthening life expectancies, but Democrats are using the proposal to make political points. We need adults in the room.

Is there any doubt we will have to bear future cliff hangers with regard to the reliability of Federal debt payments?

For many of the above considerations, I’m parking a good percentage of client capital in short term money market instruments, including T-bill – backed money market funds. A safe yield nearing 5% is, after all, not a bad place to be while awaiting sustainable growth opportunities.

Meantime, I’m looking to take advantage of steadily rising CD and bond interest rates to make a somewhat longer term commitment of client capital. Still, the recent banking crisis was a stark reminder long term maturities carry risk.

A recent Bloomberg.com article explains that while government IOU’s are expected to pay off at maturity, longer term bonds have plummeted in value in the secondary bond market. A lot of folks do not know that the actively traded secondary market for bonds is much larger than that for stocks. This is an over-the-counter (dealer-to-dealer) market. Prices for bonds can fluctuate a lot. Picture a teeter-totter in a playground. On one side a kid goes up while on the other, a kid goes down. When interest rates rise, the secondary market price of older, low interest paying bonds goes down. Now consider that in 2022-2023 we’ve seen the most rapid rise for interest rates in living memory. What do you suppose has happened to the value of older bonds, especially long term bonds?

It was this bond market crash that led to the collapse of Silicon Valley bank: they placed too much capital into long term Treasury Bonds, then were forced to sell these in the secondary market at a loss when depositors began demanding their money.

For my clients, holdings of long dated fixed income securities like preferred stock have depressed portfolio performance. However, clients are well diversified, so that while fixed income vehicles constitute a manageable, minority portion of your portfolio. Should you have a sudden need for cash, we will not have to sell long dated paper at a loss, since there is plenty of money in a market fund, holding a stable value that can be turned into cash overnight. Let us not forget, too, that even when the price of a bond or preferred stock is down, it continues to generate income.

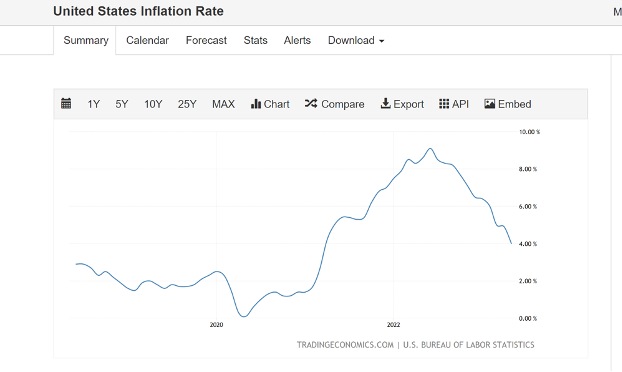

Fixed income holdings are an integral part of a well balanced portfolio. At some future time, the Fed will finish pressuring interest rates higher, so my plan is to lock in good yields for a substantial portion of client portfolios. But, in my opinion we are not yet near that trend change. In fact, the Fed Board seems to be convinced that inflation must be stopped at all costs, so there is a good chance they will overshoot. Employment remains strong as does consumer spending. Resistance to inflationary price hikes appears to be absent. Therefore, I would not be surprised to see 10 Year T-bonds at 6%, even near 7% before the fever breaks.

Dan Iverson, who manages over $1.8 trillion for PIMCO Bond funds, seems to agree:

"A great trade will be to take advantage of the violent repricing of the public markets and then wait for private markets to adjust over the next few years and then rotate into what should be a really attractive opportunity. Hold some cash because we think the next two, three years is going to be quite target rich for opportunities in the higher yielding space."

Are Stocks back in a Bull Market?

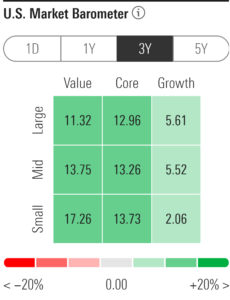

While the financial media, as usual, stokes the flames of FOMO, highlighting how well some technology company stocks have done, in truth the average stock has not yet regained its value from just 18 months ago:

It is also useful to observe that, while technology stocks are all the rage right now, they’ve underperformed the so-called "Value" companies in the past three years :

Source Morningstar.com June 30,2023

Source Morningstar.com June 30,2023

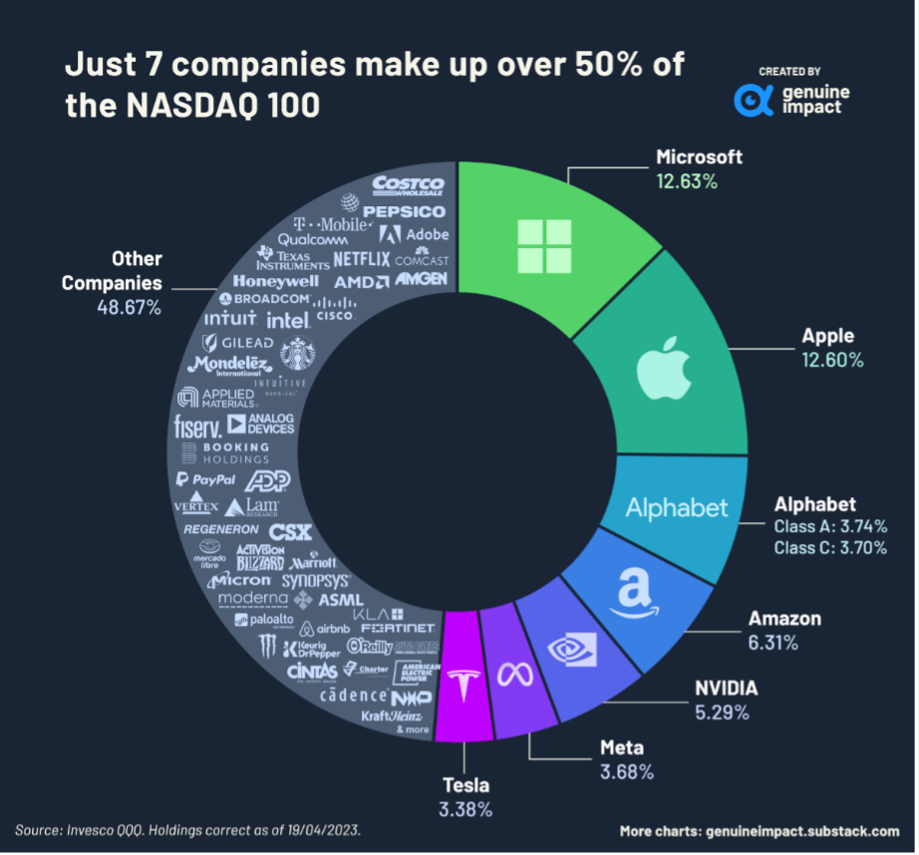

Further, most equity investors have seen nothing like the sharp recovery enjoyed by only a handful of technology giants. The broader indexes are "cap weighted", meaning the largest companies have the most impact on the index’s value. This graphic is pretty astounding, as it explains that very few companies have participated in the dramatic rally that helped just a few technology firms.

Still, there is some justified optimism emerging, primarily from the fact that inflation in the US is apparently cooling off although it is running at twice the Fed’s target of 2% inflation. If and when the Federal Reserve suspends its interest rate increases for overnight money and if and when the Fed no longer needs to sell off its record holdings of bonds and if and when a top has been reached for interest rates, we’ll have an "all clear" signal to proceed buying stocks, along with bonds. That moment will be unclear, as such turning points often are. Some believe we are already at that moment. I do not.

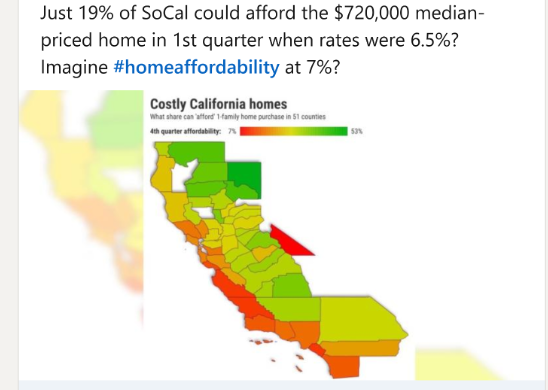

Signs of an economic slowdown are appearing in sectors where the cost of borrowing is important, like real estate. Consider this graph from Orange County Register commentator Jonathan Lasner, suggesting that few home buyers can afford Southern California. Homes have stopped appreciating here and this graphic helps explain why:

Coming Commercial Property Debacle

With $Billions of commercial property loans due to be refinanced, a lot of properties no longer make financial sense, and some big name developers like PIMCO and Brookfield have been handing the keys back to lenders, rather than continuing to try to hold on to properties with large vacancies. See footnote for a good article summarizing the situation in Los Angeles.[5] However, we are told that it may be some years before the re-financing "wall" arrives. In the meantime, securities tied to commercial office buildings in particular seem risky and we’ll avoid them.

The place that seems to offer promise for equity investing right now is Asia. Inflation is coming under control in Korea; a younger generation of Japanese business and political leaders are opening corporate investing to outside technocrats and India, with its enormous young population is a hopeful place where investors can feel more comfortable than investing in China. I am looking at doing something in these three venues.

Fear of Missing Out

Lately, the talking heads on CNBC, FOX Business News and Bloomberg have been frothing at the mouth, highlighting how much money you could have made if only you’d owned Nvidia, Meta, Amazon, Alphabet, Tesla, Apple and Microsoft beginning in January. Memories are short in the popular media world. All of the stocks they are promoting got killed last year.

Fear of Missing Out (FOMO) has caused more losses on Wall Street than just about any other emotional factor. There is another, more traditional word for it : "greed."

FOMO is not an investment philosophy. I’m driven more by FOCO – Fear of Crashing Out!

Thanks for your confidence and patience!

Gary E Miller, CFP

[1] https://fortune.com/2023/06/23/fdic-accidentally-released-list-of-companies-it-bailed-out-silicon-valley-bank-collapse/

[2] https://www.bloomberg.com/graphics/2023-us-banks-expensive-fix-declining-deposits-problem/

[3] FDIC accidentally reveals the Silicon Valley Bank depositors it bailed out | Fortune

[4] Wall Street Week, Bloomberg Television June 30, 2023

[5] https://www.bloomberg.com/graphics/2023-downtown-la-office-vacancy-sets-record-causes-distress/