Mid Quarter Update

As it has been a particularly worrisome time for financial markets, with a slow-moving banking crisis putting investors on edge, I felt a brief update to be appropriate.

This Saturday will see two of the most respected investors in the world, whose combined ages total over 180 years, sit next to one another at CHI auditorium in Omaha for the Berkshire Hathaway annual meeting. Warren Buffet and Charlie Munger will likely generate headlines that could affect market activity on Monday. Buffet usually has a rosy long-term view, but the dour Munger has recently predicted more crises for financial companies and will likely expand on this topic.

Besides regional banks, it is widely agreed that real estate is a problem, and I would not be surprised to hear this concern echoed at the Berkshire annual meeting. Retail properties are under secular pressure from the relentless expansion of online shopping while commercial office space is in oversupply, given what appears to be a permanent shift of the workplace environment to online and from-anywhere. I am certain that there are going to be continued headlines regarding the failure of banks and perhaps insurance companies who may be at risk due to their wide commitment to the property sector. Like others, I do not have a crystal ball as to who will announce problems. So for conservative investors like my clients, we’ve shifted many assets to overnight money market funds that now offer yields in excess of 4.3%.

A number of preferred stocks or notes owned by clients have in recent weeks fallen below their purchase price. As an example, a preferred stock yielding 5.95%, American Equity Life, whose yield was quite attractive when purchased 2 ½ years ago, is less attractive now that interest rates are much higher. If sold, there would be a loss of principal. The issuing company’s balance sheet appears to be sound. So, it appears that weakness in this preferred’s market value is mostly a function of competing interest rates in the new, higher yield environment in which we find ourselves. The same is true for a number of preferred stocks in client portfolios.

This mark-to-market effect is more pronounced in long dated securities. The good news is that income continues to flow, and that no client will be forced to sell such a security while it is down in price, certainly not in the near term. This is because our clients’ portfolios consist of a variety of securities, including short maturities that have not fallen meaningfully despite rising rates. More importantly we began shifting into “cash” that is, money market funds last year. The result is decent dividend rates and instant liquidity. Looking at the worrisome overall landscape, I remain comfortable with the way our clients are currently positioned.

That said, it looks as though market psychology will be burdened by seemingly intractable negotiations with regard to the Federal government’s debt. Each year Congress eventually approves a further increase in debt, as it has done for over a century. Responsible voices worry about profligate spending, but those who vote for that spending accuse budget hawks of putting the nation’s credit standing at risk. To my mind this is backwards thinking. Endless debt is not a way to manage a government or a business. Yet the Feds have been getting away with it since the days of the Great Depression. We all know that eventually Congress will cave in, and the current debt ceiling will be raised, but the Kabuki Dance of Death between Democrats and Republicans over this issue appears destined to keep investors on edge.

So, please note that most clients now hold a money market fund backed by US Treasury bills. In the event of a government default, it is conceivable that you would be unable to sell your fund for cash or that the fund could even fall below its usual $1.00 per share value. I do not believe that such an occurrence would last long. However, there is an alternative to T-bill backed money funds and bank affiliated money funds. This would be an overnight money market fund backed by state, county and similar municipalities. These entities are required by law to balance their budgets and to my knowledge no state or local entity is at risk of imminent default. The yield on this fund is about 3.25%, less than the T-bill backed money market fund yield of about 4.3%. If you would like to consider a switch to such a fund, let me know right away.

Stocks are presenting a mixed picture. Certain companies have shown healthy earnings (Apple, Microsoft and McDonald’s for example) while others seem to be in a downward spiral – especially financials. As suggested these many past months, I feel that we are heading into a prolonged bear market and so am keeping a good deal of powder dry. For the first common equity purchase in at least six months, I added McDonalds (MCD) to certain accounts but it is a relatively small allocation. While McDonalds looks good and is likely to do well even in recession, a general market weakening may pressure the price of even the best companies.

Friday’s employment report shows no slowing of labor demand. This implies continued wage pressures, countering Federal Reserve efforts to quash inflation. This in turn suggests that there will be no reduction of interest rates any time soon, something that is not bullish for markets.

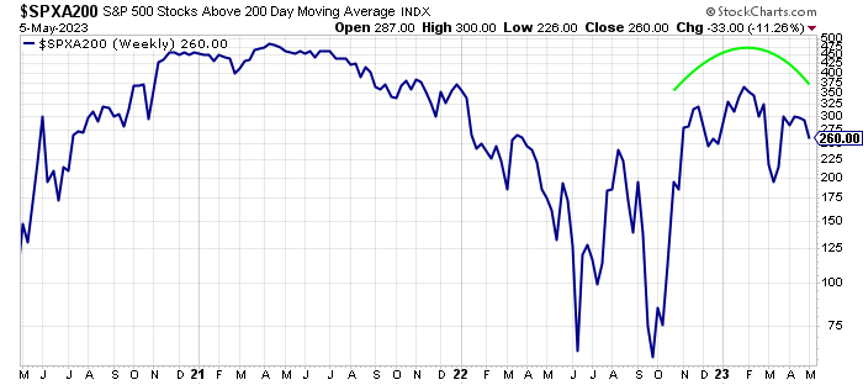

The chart below offers a way of assessing the relative strength of the broad market. It tracks the number of companies whose stocks are trading above the 200-day moving average of historical price. Many technicians, including me, believe the market is bullish when most stocks are running above their 200-day moving average, but this is not the only indicator I track. You can see that most stocks plunged below their 200-day average in April of last year. There has been a recovery in place since late last year. Being skeptical of this rally, I did no buying, even when the average rose above 300, excepting the recent purchase of McDonalds. Now there appears to be a “head-and-shoulders” top formation, a bearish indicator. Again this is not the only metric that I follow, but given my bearishness, I do not find it reassuring.

What about investing in inflation hedges? If inflation drives the price of gold much higher, we will be seeing a “technical” break out, at which time I will likely add gold in the form of SPDR Gold shares (GLD) to certain client accounts, or possibly a mining stock that can pay a good dividend.

To sum up, Trusted Financial clients are defensively positioned. This does not mean you will avoid further account shrinkage. However, the damage should be well controlled. Having lived through numerous recessions and bear markets, I am comfortable with our client positioning, as I believe it allows them (and me) to sleep at night. But if you are worried, we should have a chat.

Gary