For 2021, U.S. stock markets were up about 19% to 27% depending upon which index is chosen for measure. The Standard & Poor’s Index notched seventy new all-time highs during 2021. Strength centered on well- known Big Technology names and integrated circuit (“chip”) companies, as well as oil and gas producers. Our energy transportation holdings also did well.

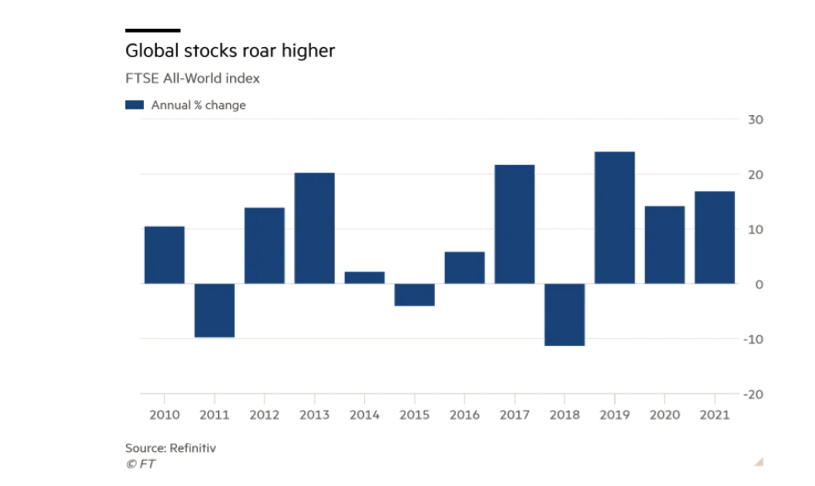

Globally, equities rose 17% following a strong 2020. Looking at the bar graph below, one would hardly realize that a worldwide pandemic began in 2020 !

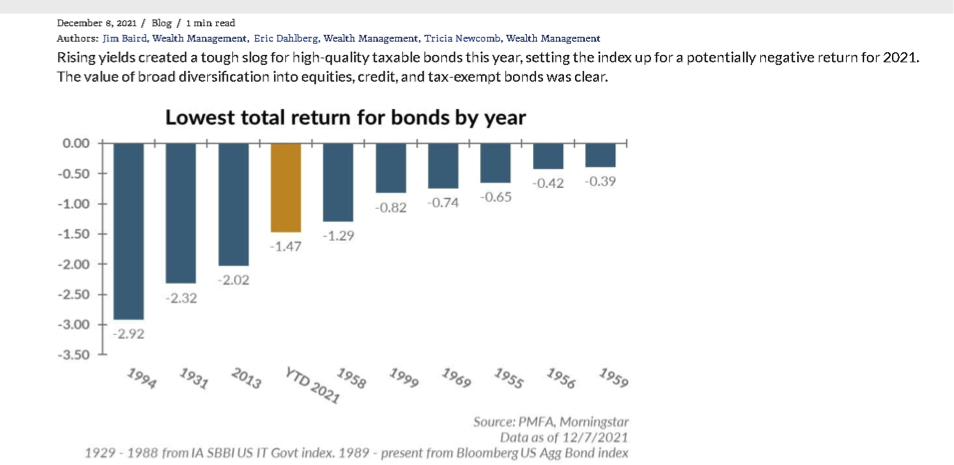

Fixed Income Securities had one of their least impressive years in decades, as the graph below illustrates. However, our preferred stock holdings generally rose in value, in addition to pumping out mid to high single digit dividends yields.

On December 9 we held an in person meeting with clients who were able or (in a pandemic world) willing to attend. My remarks along with a presentation can be found here: https://www.trustedfinancial.com/. The observations I made in my presentation to clients on December 9 are intact. The outlook for equities continues to be more positive than the outlook for fixed income investors.

Here are some key observations, which will be guiding us in 2022:

- During the Covid shutdown of 2020 to 2021, American families paid down debt and built savings at a record rate. As many people felt safe returning to a more normal lifestyle, spending drove the nation to a Gross Domestic Product increase (adjusted for inflation ) of nearly 5%. This is over twice the annual growth rate of recent decades.

- Housing prices soared. Demand from people fleeing apartment living in big cities is cited and a demographic shift was also a factor. When people buy a home, they typically spend more money to make it their home, which generates positive economic activity. As a result, shares of Home Depot (HD) and materials stocks enjoyed a strong year. Further, existing home owners are experiencing the so called “Wealth Effect” wherein they feel wealthier and thus more willing to spend and invest.

- Inflation has returned to unacceptable levels, but it is likely not endemic. Rather 2021 inflation was the result of pent up consumer demand as the world began recovering from the Covid-19 shut down. Bottlenecks in the supply chain have contributed to shortages, but this is being resolved.

- Corporate balance sheets are strong. During a period of record low interest rates, many public companies, even those with lower credit scores, were able to retire high interest rate bonds and preferred stock and finance these by borrowing at very low interest rates.

- Follow the Millennial and Gen X generations for clues as to where to place investment capital. This group has entered the life cycle stage of family formation, which contributes to the jump in home values and demand for products such as cars, appliances and home improvement goods. It may also explain why inflation should remain elevated, although not to the degree experienced in 2021.

- The Covid-19 Pandemic has accelerated the importance of technology like robotics and artificial intelligence, remote work and even remote medical care. We are undergoing what I believe to be a generally positive shift, facilitating commerce and accelerating all manner of economic and social interactions.

- A labor shortage is a current drag on economic expansion. However, two positive outcomes are likely. Human capital (workers) should begin to see improved income and benefits as businesses seek to retain skilled workers. Younger workers are finally enjoying upward mobility as the Baby Boomer generation retires.

- We favor companies whose top line is driven by recurring revenue. The “toll road” or subscription model, seen with such companies as Costco, Microsoft and Amazon, is a common denominator for the most profitable investments we hold.

Worries

Markets enjoyed a torrid rebound from early 2020, when a panic regarding Covid-19 threw stocks into a worldwide correction. Even with widespread vaccination rates in developed nations, and reopening of face-to-face service businesses, it is unrealistic to expect a third boom year for stocks. Summarized below are a few things that could shift investor opinion to negative:

- Repeat of Covid driven economic shut downs

- Continued supply chain bottlenecks

- A labor shortage, good for workers, but challenges corporate profit margins

- IPO’s (Initial Public Offerings) raised a record amount of money in 2021, but those who rushed in to sexy names like Rivian or Robinhood lost money, on paper, as these “story” stocks sagged by year end. A related phenomenon, SPAC offerings (Special Purpose Acquisition Companies) provided further evidence of speculative froth. Millennials are an important and growing force in financial markets. Many have been learning to invest during a positive run for stocks, real estate and crypto assets. As with most “newbie” investors, initial success my lead to overconfidence and a willingness to take too much risk. Millennial favored themes are vulnerable, but the overall equities market should be relatively impervious to a major sell off.

- Sharp rise of interest rates

- International turmoil/cyberwarfare: North Korea, Iran, China, Russia, Ukraine

Corrections come in two varieties: Market driven and Specific. Most of the dangers listed above would affect the market as a whole. It is difficult if not impossible to predict these events, which is why you own a portfolio that is diversified. However, we must be vigilant with regard to changes in the sales, profit margins and management of our specific corporate holdings. Please be assured that I keep an eye out for meaningful challenges to companies in our collection.

Still, a major correction is not imminent. Important publicly traded corporations have refinanced their debt at low interest rates, and balance sheets are generally strong. Further, corporations are enjoying strong positive free cash flow. This suggests they are likely to expand dividends and buy back their own stock, especially if a correction sets in. This should limit downside risk for your investment portfolio.

While the short run is as unpredictable as ever, the long run currently looks pretty good!

Thanks for allowing us to be of service,

Gary