“Losing 5% was the Best you could do in Stocks and Bonds this quarter” Headline on Bloomberg.com March 31, 2022

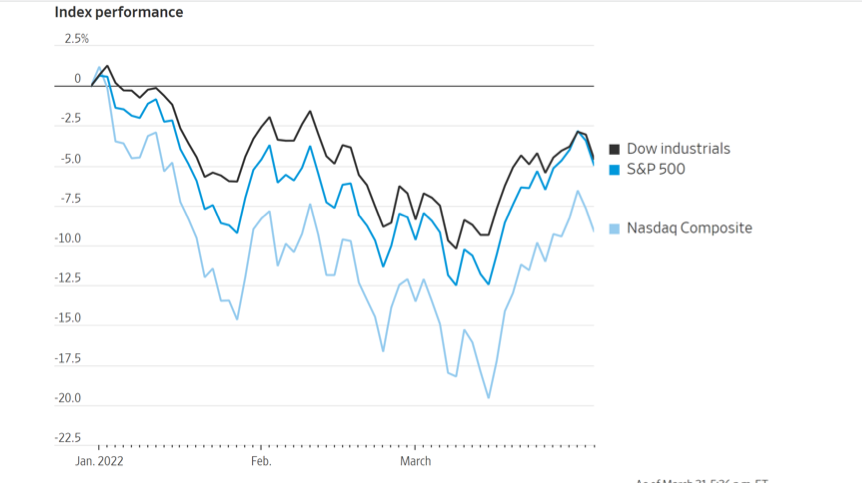

It was not a fun quarter in which to be responsible for people’s investments. While equities, especially high flying tech stocks, were surrendering back much of their 2021 gains, the traditional hedge, bonds, supplied no respite from the Bear. The standard deviation ( a measure of volatility) of the Standard & Poor’s 500 is about fifteen. At one point, the S&P 500 was off by 12%. This is within the range of normal corrections. By quarter end equity valuations were off by just under 5%. But a steep dive in bond valuations (see further discussion below)compounded the misery for moderate investors who expect bonds to reduce not increase portfolio volatility.

Although this was a challenging three month period, virtually all clients are up over the past twelve months, five years and ten years.[1] Fundamental company analysis underpins our choice of client holdings, but I felt it necessary to make significant stock sales as the result of seeing technical indicators flashing sell signals.

Inflation was the dominant worry in the recent quarter. Recall that Congress authorized unprecedented amounts of deficit spending to support workers and businesses that were shut down during the early days of Covid. The Federal Reserve Board also did its part to support the economy by maneuvering interest rates down and making it cheap to borrow money. Money creation, for that is what these activities were, led to inflation that began to show up in mid-2021. The Fed believed inflation was “transitory” and continued do what it felt necessary to fight a Covid-driven depression. Supply chains were disrupted by sporadic lock downs both here and especially in China. Much of U.S. consumption relies on imported products. This led to shortages of many in demand goods, especially semiconductors the brains embedded in everything from mobile phones to thermostats. The situation was a perfect storm of “too much money chasing too few goods”. As society re- opened we’ve seen soaring demand for cars and trucks, a snapback in demand for oil, a speculative boom in real estate, risky new stock issues[2], crypto assets[3] and collectibles like rare cars and paintings. But many of these things are in short or limited supply, so prices soared. Last August, in our ” Market Update”, (See www.trustedfinancial.com/financial-commentary/ ) I warned about inflation, and showcased our inflation resilient stock picks, most of which are still in client portfolios.

On March 16, 2022, the Federal Reserve raised interest rates for the first time since 2018, with a Fed Funds increase of .25% , more symbolic than effective in cooling inflation. Considering the Fed has been a paper tiger on inflation for so long, even this slight change in direction caused traders to adjust to a more hawkish tone. Parts of Treasury yield curves inverted, with long-dated rates falling below short-dated ones — a development some view as a warning that the economy may head into a recession. Growing numbers of economists are now predicting steep increases in short term and long term interest rates. It appears a 40 year long secular trend of falling interest rates has come to an end. When the cost of money goes up, and when inflation is strong, savvy investors must adjust the way they value equity investments. This is called discounting and is widely applied to pricing of all sorts of assets, including stocks. The market began this adjustment process late in 2021 and it continued with a vengeance in the first three months of 2022. Price earnings ratios, and similar metrics have been compressed. Even sound, highly profitable companies saw the price of their shares fall. Without a background of soft interest rates, it will become more challenging for money managers to find good companies.

Investors (and money managers) risk being deceived by so-called “stagflation”, a term much in vogue when I began my career in 1974. Common stock companies may seem to report healthy growth, say 8-10% a year. But this belies that fact that, after inflation has drained buying power, those earnings are not particularly impressive. We must be wary of such distortions going forward.

By early February, we’d placed a historically high percentage of client assets into cash, awaiting the end of the bearish wave and opportunities to buy bargains. When, mid quarter, Russia invaded Ukraine, subsequent embargos on Russian commodity exports like oil, gas and aluminum, to name a few, improved the outlook for commodity oriented non-Russian businesses. This presented an opportunity to deploy some of the cash raised earlier in the quarter. We initiated purchase of oil and gas producers (EOG and Coterra) and expanded exposure to refiners and shippers like Enterprise Product Partners and Magellan Midstream. Commodity related companies made sense. For the first time, I purchased Alcoa Aluminum (AA) and Freeport McMoran (FCX), a copper producer into certain portfolios. These commodity oriented stocks achieved new price highs by quarter end, did Enterprise Product Partners, our longest held position.

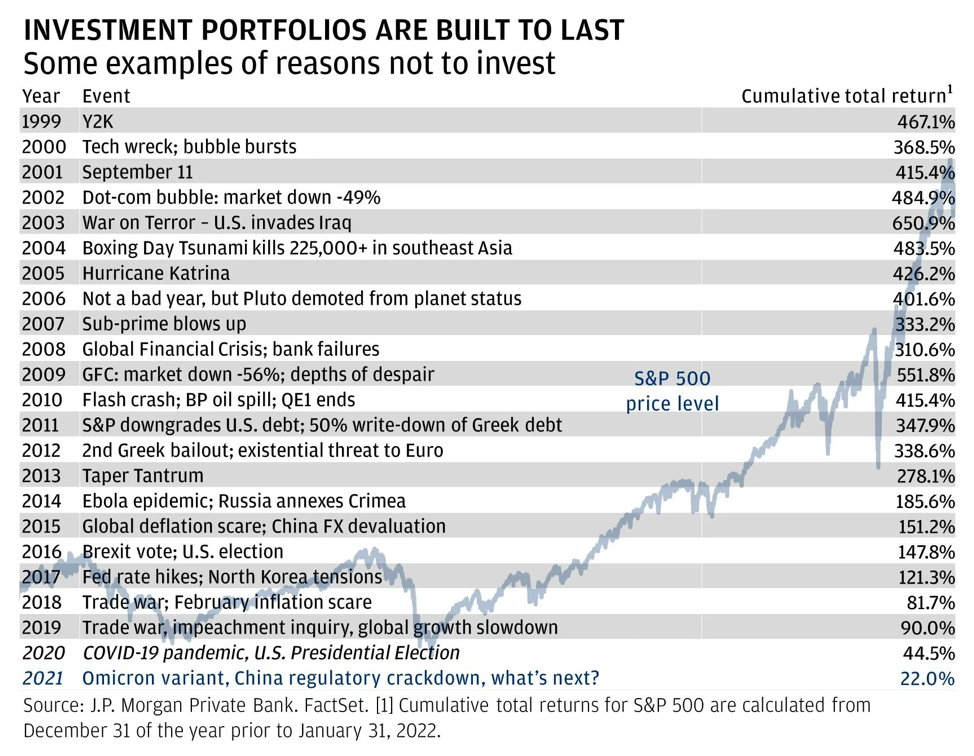

Lest we become too brainwashed by bearish chatter, the table below, chronicling headline “crises” of the past twenty three years reminds us that equity prices may react dramatically to current news events, but over time they have rewarded patient investors.

I feel pretty confident that the current tension will pass, and fundamentals for superior companies prevail. Belying the gloom that appears to prevail at the moment, the breadth of equities quietly turned positive as the quarter waned. A broad index of U.S. based equities is the Standard & Poor 500. When the majority of these five hundred issues trades above its “200 Day Moving Average”, the market is considered by me to be Bullish. When below this average it is considered by me to be a Bearish indicator.

This quarter saw the indicator drop below the critical 250 level, which caused me to be a little quicker about exiting some stock holdings. It is always difficult to reduce or to exit a stock or mutual fund that “has been good to us”, like Amazon, Netflix, Adobe, or Intuit. Never the less, recalling that my first job is to avoid losses, I did a considerable amount of selling of yesterday’s winners and went to cash, expecting to wait some months for new buying opportunities. As the chart above shows, market negativity has been nowhere near that of the Covid Panic, or the previous attempt to raise interest rates in 2018. I am hopeful we have seen the worst of this market’s “whoop-dee-do”.

Some three years ago, while advising another money management company, I warned them about over exposure to bonds. With historically low yields, bonds seemed an unattractive place for client money. I worried that we were nearing a time of rising interest rates, which means falling bond prices. Analyzing their contribution to balanced client portfolios in the recent quarter, Morningstar noted: “bonds had their worst quarter in 20 years, with long-term core bonds down 11.3”(“13 Charts on the Market’s First quarter Performance” Morningstar.com April 1, 2022). Since reopening my advisory practice last summer, I’ve trimmed or eliminated the bond funds that were put in portfolios by a previous money manager, but not aggressively enough. While reducing bond fund holdings losses in this sector were lessened. Yet the size of the swoon for bonds still hurt. I’ve not abandoned fixed income holdings. For some clients I added preferred stocks of energy companies. These offer quarterly dividends equating to annual yields over 7%. Most client portfolios hold some preferred stock. Their high dividends should help these issues hold up as interest rates rise further, something I expect.

My conversations with other financial advisors suggest many are at a loss as to how to manage under a new financial regime, one in which bonds may become a drag rather than support for balanced client portfolios. For nearly all of their careers, a “balanced” portfolio mix meant 60% placed into stocks/ 40% into bonds. This is no longer working. For advisors without the skill to drill down into balance sheets and income statements, who have simply bought stock and bond funds and delegated portfolio management to others, now is a worrisome time. Not so much for this advisor. Having navigated similar waters, dating back to 1974, I feel pretty confident that clients will see their portfolio values preserved and eventually return to growth rates that exceed inflation.

One can always find reasons to fear the future, but please remember: we are blessed to be able to have our money work for us, because we live in a democratic, capitalist society. Global financial markets, and especially those of the United States, Canada, Australia-New Zealand and Western Europe enjoy an underlying respect for property rights and an independent judicial system that protects those rights. Such a judiciary exists because respect for the rule of law abides in democracies. Here, we play by rules, and those rules say that, in principle, the government may not randomly take away your wealth and your livelihood.

An unjustified and brutal invasion of a democracy like Ukraine makes clear that Vladmir Putin has disdain for the rules. This is typical of tyrants who tend to “ dispose” of people who get in the way. Entrepreneurship and creativity rarely flower in dictatorships because inventive people find that the fruits of their labor are often stolen, at gun point, or worse[4]. This happened to Mikhail Khodorovsky, once the wealthiest man in Russia, until he hinted at challenging Putin for the presidency. After ten years in jail (the lucky to be alive), he has escaped Russia and now can been heard widely on the news offering unflattering portraits of Russia’s Little Hitler. Similarly, American investor Bill Browder, whose post-communist Russian financial empire was also expropriated, warned us about Putin. His book, Red Notice chronicles Putin’s orchestrated theft of Browder’s successful businesses, and the imprisonment, torture and murder of his attorney, Sergei Magninsky, a young father. I’ve worried about Putin for a long time, and believe he has been a negative force, spreading disinformation and fomenting dissention throughout the democratic world.

We are fortunate to live in the USA.[5] I believe our system will continue to produce investment opportunities as young entrepreneurs come to market to finance their revolutionary, society bettering products. Our prosperity rests on a foundation of respect for the rule of law and property rights. The sad events of the past six weeks are a reminder of our good fortune.

[1] It should be noted that this advisor did not have exclusive control of investment decisions for the period from about September 30, 2016, until approximately September 30, 2021. During that period, he operated as Chief Investment Officer for another registered investment advisor, whose investment committee made or approved investment decisions for that period.

[2] SPAC’s “Special Purpose Acquisition Corporations became a fad. These were ways for well-known names (and huckster) to cajole retail investors to park with their money, buying a pig in a poke. Few have rewarded the Rubes who bit.

[3] Think Bitcoin is a scam? Consider the instant popularity of “NFT’s” -Non-fungible Tokens. These typically are digital images of …basketball players and the pop stars, allegedly original works of art that cannot be duplicated because they have a cryptographic blockchain code embedded. Have you bought a Will Smith NFT yet?

[4] Try to think of one consumer item you own that was made or conceptualized in Russia…?

[5] I’m sure some readers will demur citing incidences of government abuse, over taxation, eminent domain and the like, but imperfect as it may be, our independent judicial system allows us to assume we can profit from taking risks and investing in our dreams, our inventions and in corporate securities.