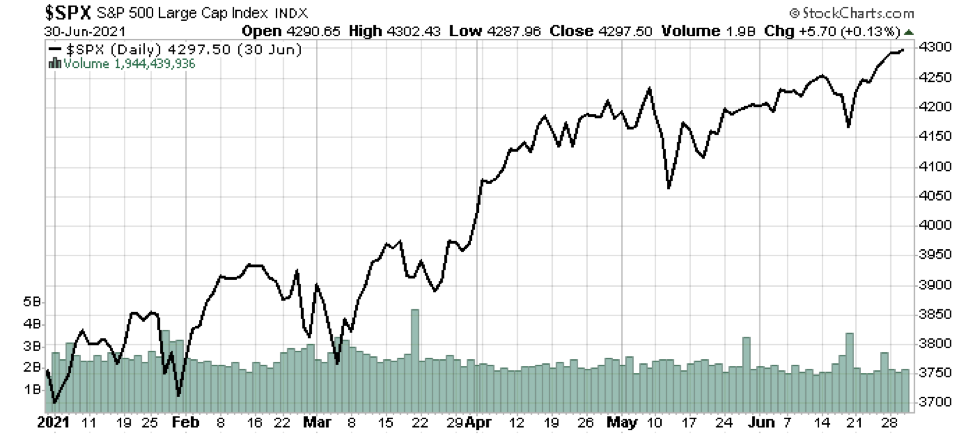

Source: Stockcharts.comYear -to- date has been a joy for equity investors, thanks largely to the promise of a reopened economy. The Standard & Poor’s 500 is up 15.25%, and value stocks have outperformed growth, up 17.03% vs 14.60%, according to the Morningstar advisory service. While technology stocks have largely trod water after a blistering advance in 2020, materials, services and financials, all of which are tied to economic cycles, rewarded investors, particularly those with well diversified or even index oriented portfolios. The good news was not confined to the USA. Nearly all developed economies had positive stock returns, but China fell by low single digits as its oligarchical government began harassing successful entrepreneurs, like Jack Ma, in a possible attempt, to feather the nests of the political class[1].

By contrast, fixed income investments labored as interest rates floated higher. The first quarter saw a vicious drop in the value of fixed income securities, the worst since 1980. This was due to anticipation of a strong economic rebound, coupled with a tsunami of new debt issuance, causing interest rates rocketed higher. Since then, rates have fallen back a bit. For me, bonds do not hold much appeal as yields remain historically low and the economy is rapidly strengthening. Some years ago, when yields were higher, clients were placed into bonds and preferred stocks. Many of the preferreds have been redeemed, but we cling to whatever high quality, high yielding bonds we locked in. In today’s low yield world, short duration bond funds make some sense and provide portfolio stabilization. However, some portfolio managers use these when they lack fresh ideas and want to appear to be actively managing their clients’ assets. Long- time clients may recall that I prefer placing uncommitted funds into “cash” (money funds) to await a value buying opportunity. Money funds are rarely harmed by a strengthening economy or rising interest rates, and serve as “dry powder. From time-to time transient negative headlines can make good stocks cheaper than their fundamentals justify and ready cash can then be rapidly deployed for such an opportunity.

During the recent period, market sentiment fluctuated from euphoria, based on the resumption of normal life, to worry promoted by economists who warn that an unprecedented level of money creation may have started the trigger device on an inflation time bomb.

An Inflation Alert

Economists I respect, among them Mohammed El-Erian and Lawrence Summers are sounding the alarm that inflation, which has jumped this year, is not a temporary phenomenon.

Why the buzz about inflation? For two generations, the cost of living has risen at only around 2% per year-nothing too noticeable. But anyone over age 65 likely remembers the bad ole’ 1970’s,when goods, services, gasoline and rent rates were rapidly increasing but salaries were not. Inflation is a destabilizer of society. Young families may find that home ownership grows beyond their reach. Elderly people, dependent on fixed income, may find their benefits can no longer pay for their lifestyle.

Still, inflation is just fine for asset owners, who likely will see the value of their real estate or stocks float up along with the overall cost of living. Traditionally, owning gold or collectibles has been a useful way to protect wealth, although history belies the efficacy of precious metals to do the job.

However, for the vast majority of people, incomes usually fall behind the inflating cost of goods and services. This can lead to ill-considered government measures to control inflation by ineffective measures like price controls, something that causes shortages, as it did during the Nixon, Ford and Carter administrations.

Ominous behavior develops in an inflationary spiral: businesses and consumers begin to buy more than they need, out of fear that prices will shoot higher, or a shortage develop. This behavior travels up the entire supply chain, and becomes a self-fulfilling inflation machine. Economists call this “demand-pull” inflation. The economists I trust worry that this will be the next stage in the inflation spiral and it is coming soon.

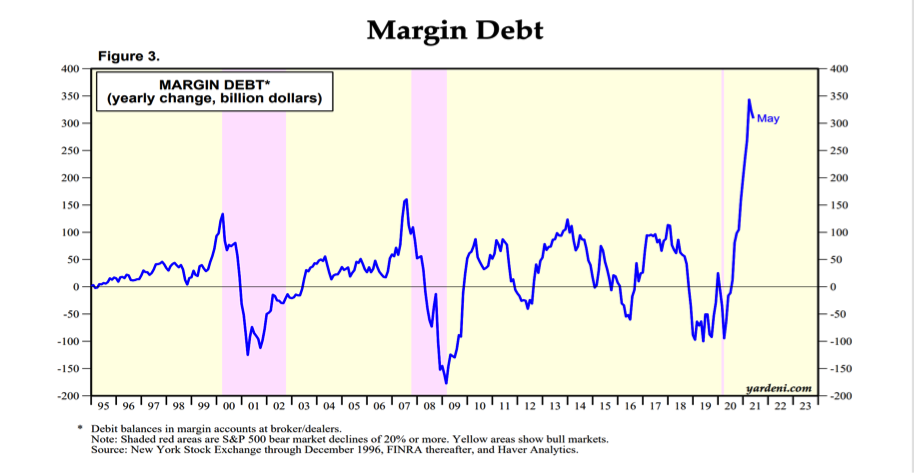

Another aspect of inflation is speculative bubbles. We appear to be seeing one in housing right now. Likewise, the crypto currency mania seems to fit that description as well. A newer phenomenon is that of “meme stocks” wherein speculators, young and wet-behind-the-ears, act on specious advice liberally dispensed by online prophets who lurk on Reddit,Wall Street Bets or similar social media venues. Because the Federal Reserve is manipulating interest rates to absurdly low levels, borrowing to speculate is encouraged. That is exactly what we are seeing in housing and the stock market. Witness what’s happened to margin levels, an indicator of speculation:

When things become bad enough, the Federal Reserve usually has to raise interest rates as it did in the early 1980’s. Under Paul Volcker, in 1981, interest rates soared into the teens and triggered a lasting recession, but finally choked off inflation. Will the Fed be forced to do this again? If so, when?

Some argue that both fiscal and monetary policy today are what has led to the present shortage of building materials, soaring gasoline prices (from $49/BBL to $75/BBL so far this year) and the fastest annual rise in housing prices in 30 years. There is a well-known labor shortage as jobs, from waiters to TSA agents go begging. With the cost of housing up 20% or more in many markets, young families have given up on the dream of a home and remain trapped in rental hell.

In my time, I’ve lived through three very deep recessions, multiple equity bear markets and have seen US T-bonds yielding as high as 14% and as low as 1.5%. Although I have no Ph. D behind my name, much has been learned while being a daily participant in financial markets. The threat of ongoing, high inflation is, in my opinion, very real.

How do we stay ahead of inflation? I believe the answer is to reduce exposure to the low interest rate debt available today [2] and focus on equities with these characteristics:

- High returns on invested capital. This usually favors companies with dominant market share and recurring annual subscriptions (think Costco, Amazon, Adobe, Microsoft, Netflix); Add to this the vital industry of cyber security

- Pricing power (think Costco, Amazon , Microsoft, Adobe and Netflix).

- Utility- like businesses such as energy pipelines, Cloud server farm operators or cell phone tower owners. Such companies tend to be somewhat recession resistant due to their regular cash flow, which reduces the choppiness of their earnings.

- Health care suppliers, especially pharmaceutical companies and durable medical equipment manufacturers. We have an aging population and a government willing to spend seemingly unlimited amounts to keep the Boomers alive and well.

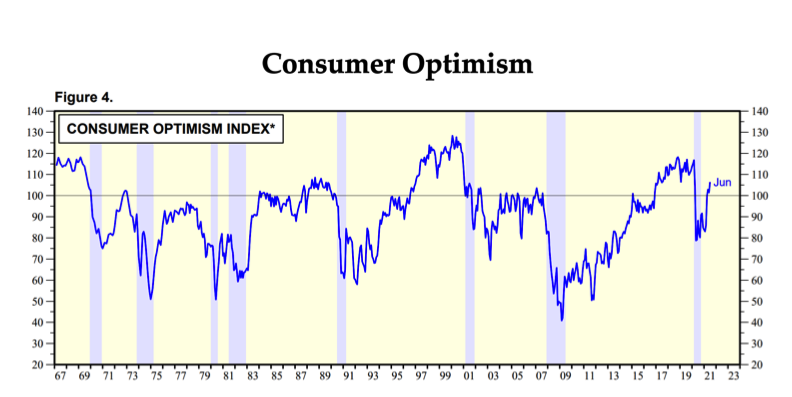

Despite the many worries and some of the negatives outlined above it is reassuring to see that American consumers are returning to optimism. Given that our economy is largely driven by consumers, this bodes well for the future.

Post-pandemic there has been an expectation that a resumption of travel and leisure activities by consumers would dampen their enthusiasm for investment in cars, home improvement and capital goods (stoves, refrigerators, barbecues). Apparently, growing optimism, coupled with unprecedented amounts of government dollars coursing through the economy, is keeping demand for both travel and home spending strong. According to the Kiplinger.com service, the last time consumer spending was this strong was right after World War II in 1946.

I’m ever aware that “job number one is to protect your assets”, so am sensitive to signs that today’s bull market is nearing a correction. My 47 years of market experience has taught that a bear market “tell” is when leading stocks fall below key technical support.[3] As the quarter closed, these “tells” remained silent. I am still bullish.

Questions? Please call Gary Miller at 949 249 2057 or email me at [email protected]

[1] Ominously, in my opinion a version of this is underway in the USA where it seems popular to assault our most successful technology companies, a sport enjoyed by both the left and the right.

[2] Over the past year we saw high yielding preferred stock held for many clients called by the issuers, leaving us, like others, challenged to find good yielding replacements.

[3] I watch the 200 day price moving average and point-and-figure charts for signals