Preferred stocks are an often ignored corner of the investment world. The author was alerted to them in the early 1990s when, for a time, I worked in corporate cash management. [1]

None other than Warren Buffet’s Berkshire Hathaway corporation helps out companies in need of financing through the purchase of their preferred stock. This has happened on a number of occasions but perhaps most notably was when Berkshire gave money to iconic wall street investment firm Goldman Sachs in 2008 to help them weather the financial meltdown now known as the Great Financial Crisis. In return for a $5Billion bailout from Buffet, Berkshire received preferred stock paying a 10% dividend and later sold this investment at a substantial profit.[2]

Preferred stock is a form of equity that may be sold to investors by a company who does not wish to borrow money by incurring more debt, such as bank loans or bond issuance. It is called “preferred stock” because it has priority over common stock. All of us are familiar with common stock such as those traded on the New York Stock exchange. Common stock represents a small piece of ownership in a giant corporation. So does preferred stock, but preferred stock generally pays a bigger dividend than the common. The dividend is fixed and cannot be reduced, unlike common stock. It also enjoys preferred status should the company go into liquidation (bankruptcy). If a troubled company has its assets sold off, preferred shareholders have priority in being repaid before common stock holders.

Preferred stocks also earn a better yield than bonds. Further, their dividend has priority because a company must eliminate its common stock dividend, if necessary, in order to service the preferred stock dividend.

This is not to imply that preferred stock is only issued by troubled companies. However, preferred stock enjoys a lower bar for success than required by a common stock holder. For success, a preferred stock buyer needs the issuing company to simply remain solvent. As a result, I’ve used these in client portfolios in place of bonds or common stocks, depending on the objectives of a particular client.

During the Covid year 2020, a remarkable thing happened: certain preferred stocks outperformed even the best known and hottest common stocks, while paying far higher dividends. Who knew?

Here is an example:

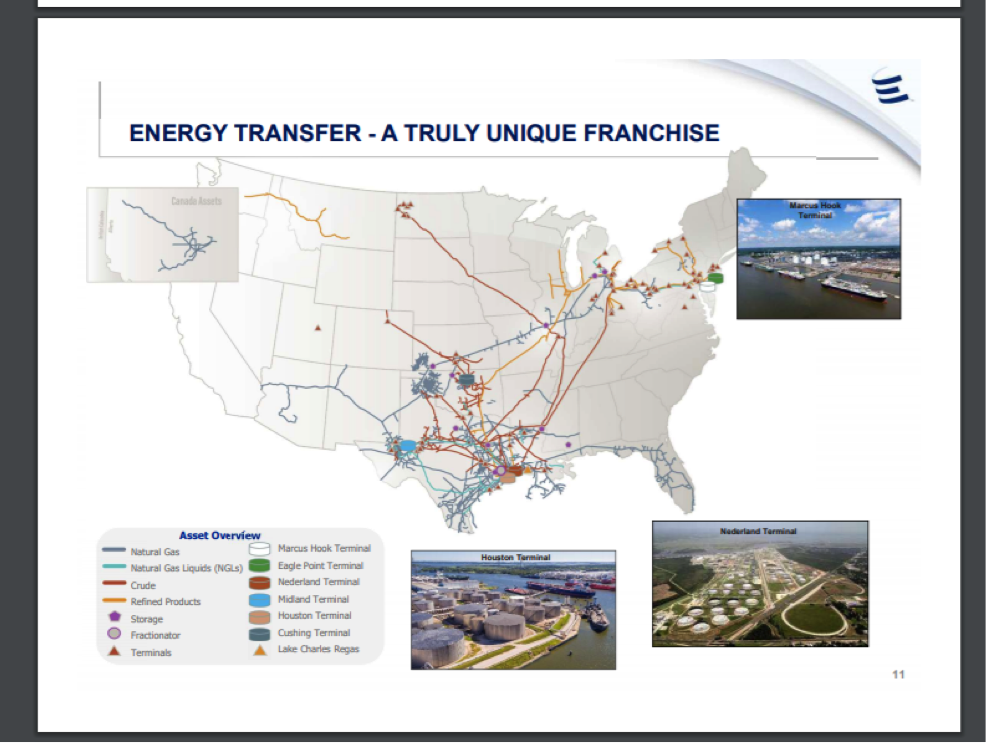

Energy Transfer, LP (Common stock symbol ET) is one of the largest energy pipeline companies in North America. Here is a route map showing where their energy transportation and storage system operates:

Source Energy Transfer presentation March 2, 2021

As with most common and preferred stocks, the shares of Energy Transfer Series D preferred stock collapsed in the late March 2020 panic that swept through financial markets as Covid-19 became the number one story worldwide. Energy Transfer’s Series E preferred was issued in April 2019 at a price of $25.00 per share (AKA “par value”) and cannot be redeemed by the company before May 2024. It pays a dividend of $1.90 per year in quarterly segments. At the original issue price of $25.00 per share this preferred stock offered the attractive yield of 7.60%. But wait! As markets fell in early 2020, this stock briefly traded as low as $6.00 per share.

Let us assume you were smart enough to pick up some of this preferred stock as it began a rapid price recovery and you bought at $16.00 per share. With a stated, fixed dividend of $1.90, you’d have a current yield of 11.875%. Further, consider that if the company remains solvent and the stock is redeemed at $25.00 per share (par value) in May 2024, you will also enjoy a capital gain of $9.00 per share. This suggests a possible total return of about 56% plus the fat dividend. That’s roughly a 100% return over a four year investment.

It is important to understand that the company issuing the preferred stock has the right, but not the obligation to redeem the stock at par. Typically this option runs for five years so the purchaser has some certainty as to the duration of his/her investment. On the other hand, if the issuer does not choose to redeem the stock after five year, it may remain outstanding for years.

The example of Energy Transfer LP preferred series E[3] is not a fictional tale. This author actually made the above purchase and is currently enjoying a generous rate of return. While there are a few more details to this story, for clarity this article will focus on how this investment has stacked up in the twelve months following the Covid Collapse.

Consider the price chart of this preferred stock from its date of issuance to the date of purchase March 27, 2020:

Astute readers will note that the last price shown on the chart is $14.57, below the author’s purchase price of $16.00. True, I received the high price of the day and was off almost immediately on my investment! Also, as this chart amply illustrates, preferred stock is not a risk free investment. The shares of ET preferred Series E briefly collapsed in value along with most of the rest of the preferred and common stock market (as well as bond prices!). Had the government not stepped in to stem the panic, this issue as well as most of the rest of the financial markets might have remained in the doldrums for months, even years. No one said investing is a riskless venture.

However, Federal government support was brought to bear and financial markets staged a remarkable recovery. In the year following this purchase, the Energy Transfer, LP preferred series E stock recovered nicely:

All the while, the company continued to pay that healthy dividend of $1.90 as well.

Consider the two year picture of price performance for this stock and then we’ll compare it to other investments:

Quite a roller coaster ride, no? What I find fascinating is that in the twelve months following the Covid Collapse, financial media was enthralled with the meteoric recovery of common stock issues. Let’s compare Energy Transfer Series E with the broad average, the Standard & Poor’s 500 common stock average, which experienced a 56% rise in the twelve months following the Covid bottom:

Remarkably, the broad averages (gray line) took quite a while to catch up to the ET preferred Series E. Let us not forget, however, the broad averages generated a dividend yield of only about 4.25% assuming a purchase near the market low in late March 2020.ET/PE was paying an effective yield near 12%

The story gets still more interesting. Consider how investors were enthralled by certain prominent stock names over the past 12 months or so. Names like Tesla (TSLA) or Apple (AAPL). How did they stack up to the performance of a relatively unknown preferred stock?

Here’s Tesla (Pink line) vs ET/PE (orange) :

Tesla shares had a meteoric rise that cheered its true believers. ET preferred Series E not only matched Tesla, but also paid its generous dividend all along the way, which Tesla did not.

Now, here’s Apple (AAPL) vs Energy Transfer preferred series E:

It was not until August 2020 that Apple shares bested ET preferred series E, and since then, have fallen a bit so that as of the end of April 2021, ET/PE would have been the better choice (let’s not forget the high dividend, not tallied on the chart above).

Ok, OK you say, but how about the much vaulted Bitcoin? The primary way an investor was able to access bitcoin as a liquid, publicly traded investment over the past twelve months was through a company called Grayscale Bitcoin Trust (GBTC). How did that investment perform compared to Energy Transfer Preferred E? The chart tells the tale:

For most of the past twelve or so months, Grayscale was not exciting. By early 2021, nine months or so after the assumed purchase of both instruments, Grayscale/Bitcoin caught up – but remember it pays no dividend at all, compared to a yield of nearly 12% on the preferred stock.

Incidentally, this superior behavior was not unique to Energy Transfer preferred E. Another Energy Transfer preferred stock, the Series D provided much the same return. Here it is shown in blue alongside Series E.

Further, this preferred stock opportunity was not limited to Energy Transfer or even to the energy industry. For example, Goldman Sachs preferred Series K enjoyed a similar ride down and then dramatically back up during the past two years:

The above preferred stock pays a dividend of $1.5935 per share which translates to a 6.375% yield at the par (original issue) price of $25.00 per share. Had the stock been purchased during the Covid meltdown an effective yield of about 7.5% would have been locked in, to say nothing of the upside potential.

By now, the reader understands that preferred stocks, which are senior to common stocks, are well worth considering, especially in times of financial panic.

There are more things about preferred stocks that one should understand. These issues trade in far lower volumes than the common stock of their issuers. This means that they may be less liquid and less tradeable in times of crisis. They are also junior to the bonds, if any, of the issuer.

Further, in normal times, a preferred stock’s price will not move dramatically down or up. These instruments are purchased for their attractive yield and generally held for income. They are not usually an opportunity for price growth, because unlike common stock, their dividend is not increased even if the issuing company sees years of expanding earnings. Preferred stocks are best compared to bonds when one is considering them as an investment. Still, in times of market disruptions preferred stock can offer an opportunity for impressive profits. This author was able to purchase many for clients and himself in the aftermath of the Great Financial Crisis, in 2009 and 2010 with happy results.

For a more detailed explanation of this instrument, please see:

https://www.investopedia.com/ask/answers/difference-between-preferred-stock-and-common-stock/

Thanks for your consideration.

Gary E Miller, CFP

NOTE: THIS ARTICLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT DOES NOT CONSTITUTE INVESTMENT ADVICE OR AN INVESTMENT RECOMMENDATION. AUTHOR PROVIDES INVESTMENT ADVICE UNDER WRITTEN CONTRACT ONLY.

[1] Large corporations, like you and I, need ready savings, day-to-day funds available at a moment’s notice to pay bills. We need to know that we can access our funds readily, with little risk at the ATM or credit union. We have monthly spending on phone bills, utilities, gasoline and repairs for our vehicles and other day-to day expenses.

Similarly, large corporations need what is known as “working capital.” They often have to make payroll every two weeks, pay for equipment repairs, utilities and for payment to vendors. Working capital is money that cannot be risked on longer term investments. Just like you and I, corporations would like to earn a little interest on this money, but usually assume they will not make much, because ready access is the primary goal.

Thirty years ago, an investment product was pioneered to provide both liquidity and attractive rates of return on working capital to corporations. These were known as “Dutch Auction preferred stock”, and I was fortunate to be one of the pioneers in providing this tool to corporate investors. It’s not useful to explain this instrument here but suffice to say that I became familiar with the concept of preferred stock at that time and would perk up whenever this instrument was mentioned in business news articles.

[2] https://www.msn.com/en-ca/news/other/warren-buffetts-berkshire-hathaway-raked-in-more-than-dollar3-billion-from-its-goldman-sachs-bailout/ar-BB14hDJi NOTE: Berkshire often obtains convertible preferred stock which has the additional option of allowing them to later convert the preferred shares into common shares at a fixed price. The above discussion is limited to non-convertible preferred shares.

[3] Preferred stock symbols are not uniform. The New York Stock Exchange, where the referenced preferred is traded uses the symbol ET/PE. Charles Schwab uses ETprE. Other brokerages or information services use other variants.