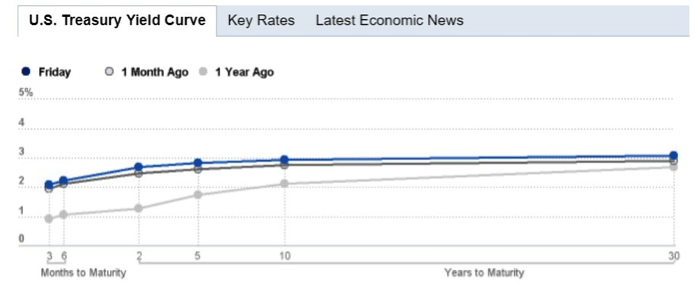

Improbably, U.S. stocks rose this past quarter, finally surmounting January’s record high, achieving yet another record. I say “improbably” because the summer is often a seasonally weak time for stocks, and the tone of acrimony and discord in the political arena had the potential to sap investor confidence. The picture for bonds was less exciting, however. With short and intermediate term interest rates on the rise most bond funds struggled to hold their value. During much of the past decade, bonds sustained portfolios nicely, paying income and rising in value. They are an important diversifier, usually suppressing portfolio volatility. and remain an important part of a well-balanced portfolio. Ten-year treasury bonds, yielding just above 2% at this time last year offered 3.05% on Friday, September 28. This rate is a basis for setting mortgages and the rise is believed responsible in part for a softening housing market as some buyers are priced out by the cost of borrowing. But there does not appear to be stress among existing mortgage borrowers, as lending standards were severely tightened after the 2007-2009 crisis. This is reassuring.

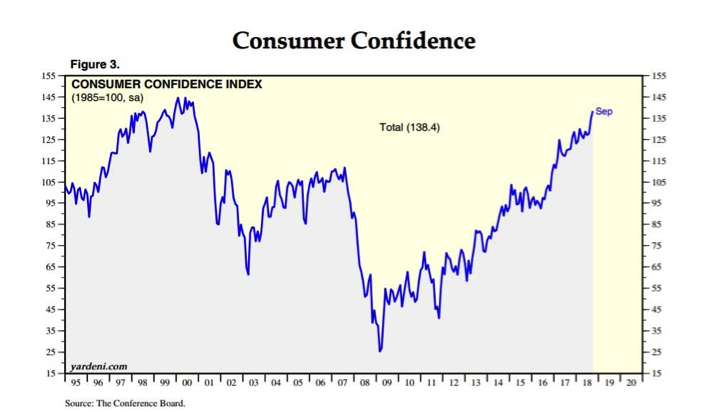

Economic contractions rarely happen when consumers are feeling good, and they are in the best mood in twenty years:

Source: Yardeni.com

Line to buy New Apple iPhone, Mission Viejo mall Sept. 2018.

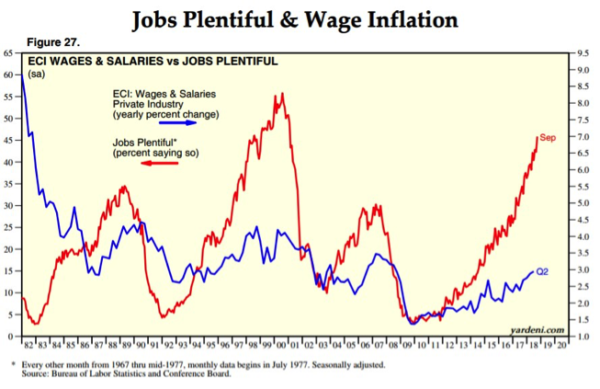

U.S. employment levels are near records and help wanted signs plentiful. Wages are finally rising, too. These are not conditions leading to an imminent financial contraction.

Source: Yardeni.com

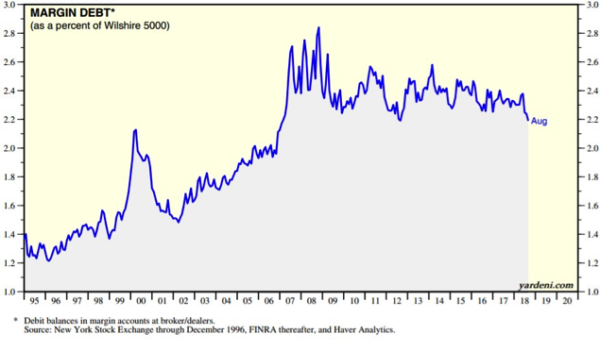

True, record high corporate debt and rising levels of margin borrowing by investors have some suggesting we are living in a house of cards that will collapse. Further, IMF Director Christine Lagarde worries that trade barriers erected in recent months could meaningfully hurt global growth[1]. The Federal Reserve is on course to raise short term interest rates and the intermediate to long term costs of money has also floated higher. Perhaps worse, rising interest rates are attracting foreign money, driving the U.S. dollar higher. Why is this a worry? Many foreign nations have large amounts of debt denominated in dollars. A rising dollar means the cost of repaying this debt is growing. Some fear default by the likes of Argentina, Turkey or Pakistan could threaten the health of international lenders, sparking another banking crisis. But recall that banking regulation was strengthened by international accords (Basel III) and banks are in far better shape than they were ten years ago. This is especially true of North American banks. Less clear is the answer to the question of how exposed shadow banks may be. Where information is plentiful, for example in the USA, trends of rising debt do not seem to be at a point of excess, once the asset side of the balance sheet is considered. When margin debt is divided by the rising value of equities using the Wilshire 5000, a very broad stock index, margin debt remains pretty much where it has been for the past nine years, so not a worry:

Source: Yardeni.com

Likewise, mortgage borrowing has risen and returned to levels from ten years ago, but with far better-quality borrowers today. Except for cannabis stocks and cryptocurrencies, there seem to be few excesses in the financial world!

So, it may be puzzling that there is some discomfort felt by securities investors. Nearly all our clients who have significant holdings of stock are doing quite well this year, many having achieved the greatest investment net worth of their lives, and yet more than one of them has expressed worry that the gains could rapidly melt away. I suspect this is due to what behavioral psychologists call "recency bias." The gut wrenching set back of the Tech Bubble followed by the real estate crash and Great Recession are still relatively fresh memories for anyone over age 40, a demographic that has built equity in stocks, bonds and perhaps their home.

Added to recollections of bad times, current politics driven headlines suggest our country is coming apart at the seams. But worried investors are a good thing! It is overconfidence that usually precedes a crash. "Markets climb a wall of worry", goes a familiar adage in finance. While researching this phrase on the internet, I encountered an article,[1] three years old, from Businessinsider.com enumerating all the terrible things that could end what was then a six-year long bull market. This sort of gloom-and-doom warning by financial writers is a staple: people have been predicting the imminent demise of stock prices for the entire 9 years of the current expansion! By the way, since that article appeared, the Dow Industrials have gained over 50%. Put another way, the psychological climate is positive for stocks.

Recent Quarter and a theme that appears rewarding

The equity markets achieved new all-time highs and some popular names like Apple, Microsoft, Mastercard and Home Depot also achieved record levels. These continue to be names I like.

During the quarter, for many clients, we initiated positions in Digital Realty Trust (DLR) a REIT that owns and manages multi-tenant data centers or "server farms." Today much of your personal data is stored away from the computer or mobile phone in your possession, on what is referred to as "the Cloud." Because high speed internet service is available to millions if not billions of people around the world, it is often as easy to access your stored information from a remotely located computer. The trend to cloud storage is accelerating. Most large companies, including Amazon and Microsoft for example rent space on powerful computers housed in specially designed buildings that have back-up power sources, high capacity cooling systems and a crew of skilled IT specialists to keep these centers running 24/7. This recent holding dovetails with a mega-trend: the movement of data from localized computers and into high-capacity data centers so that the information can be available at a moment’s notice from any place on the earth.

This trend is expected to grow apace due to the innovation of "Smart" devices, essentially robots. Morningstar analyst Scott Pope, in an article dated September 27 ("Industrials: Labor shortages Driving Innovation") asserts that the current labor shortage is accelerating the push into robotics and industrial automation, including autonomous mining and farming. This suggests the earliest adopters of the "Internet of Things" (abbreviated IoT) may be enterprise rather than, as widely touted, automobiles companies. An example of this might be a project initiated by Germany’s Thyssen-Krupp to design "smart" elevators that run not just vertically but horizontally using "linear motors" and managed by a command and control module that links to a building (or group of buildings) via the Web. Tenants will be able to call an elevator from their smart phone. During busy times of the day such as arrival of tenants or lunch hour, the building’s owners can efficiently manage internal building transportation dynamically, changing availability as needed.

As artificial intelligence and "Smart" devices become more present in our society, there is an investment opportunity for conservative investors: digital data infrastructure. Rather than try to guess which software company will wow Millennials (Snapchat or Instagram; Apple Music, Spotify or Amazon Music) or trying to figure out which chip maker, (Intel, Advanced Micro Devices, or Nvidia) is going to dominate, we want to own the universal pipeline that everyone needs to stay in business. It may be that a company like Kion (KGX) will dominate automated lift trucks, but Kion and its competitors, as well as dozens of other businesses will all be dependent on rapid, reliable data transmission. As with your cable TV or Direct TV service, those accessing digital highways are required to pay regular, recurring fees, or tolls. Embedded in your monthly cell phone bill is the cost of mounting and maintaining transmission facilities on a cell tower owned by American Tower (AMT). Embedded in your internet provider’s charge is the cost to send information along fiber optic cables. Think about the internet related services to which you have access: your bank account, brokerage account, medical portal, Amazon, Netflix and the like. All these providers are accessed over the internet through cable, fiber optic and wireless channels and all of them pass through data centers like those operated by Digital Realty Trust. Investment in such "toll road" companies offers the opportunity for regular revenue that can then be reflected in the form of increasing dividends flowing into portfolios such as yours.

Because many of our client equity holdings benefit from a recurring revenue stream, as with the example above, I believe they will be less vulnerable to a cyclical economic downturn when that finally arrives. To further ensure against too great a retrenchment in portfolio values, we also own fixed income positions that have a senior claim on company assets. More on these next quarter.

Summary

To summarize: corporate earnings are healthy, interest rates have not risen enough to snuff out economic growth in the United States, the psychological climate ("wall of worry") remains positive for stocks and the excesses that usually lead to a crash or recession are not significant enough to suggest that we are on the precipice of an economic setback. That said, every economic retrenchment begins with unexpected surprises. I am on guard and watching for danger on your behalf and will continue to be selective for you and will be accessing a variety of instruments so that you maintain a well- diversified, low volatility portfolio. Thank you for allowing me to be of service.

Gary E Miller, CFP

[1] As this was being written a Canada has resolved its trade issue with the USA.

[2] https://www.businessinsider.com/stocks‐always‐climb‐a‐wall‐of‐worry‐2015‐11/