It’s a Wrap…2020, the year of the long term investor

While it is popular to dismiss 2020 as a terrible year, stock and bond investors who refused to panic can celebrate better than average portfolio gains. If one chooses to focus on the negatives, 2020 felt as though we were living through a dystopian movie: the death of a beloved basketball star, the sudden appearance of a pandemic that nearly shut down the economy, hospitals faltering under the weight of a plague, racial unrest, democracy under assault and…perhaps worst of all, a shortage of toilet paper! A sudden plunge in the stock market in March shocked those who had been lulled by record high employment and reassuring economic indicators. When investors suddenly began paying attention to a rapid spread of Covid-19 cases in the United States and Europe, the Standard & Poor’s 500 index gave back about 1/3 of its value in just five trading sessions! Liquidity began to dry up and money market funds were under liquidation stress, a haunting reminder of the financial meltdown of late 2008. Global markets briefly fell into serious bear market territory. This led the U.S. Federal Reserve Bank and U.S. Treasury to a coordinated effort to reassure markets, by promising to buy debt instruments and even equities, if necessary, to stop the hemorrhaging. Central banks throughout the world also turned on the charm and the money taps, which served to brake the fall in financial market.

With a virtual floor under asset values assured, much of the money that had run for cover came flooding back. Then Congress, much to everyone’s surprise, acted quickly to push fiscal stimulus into the system, borrowing a $trillion or so and declaring a national moratorium on evictions and loan default declarations. The voices that usually decry “Big Government” seemed more than happy to endorse Big Government intrusion into the free market to halt a possible Depression. While small businesses, especially restaurants, entertainment and travel suffered, the balance of the year saw a breathtaking recovery and rise to new all-time highs for equities and other financial instruments. By year-end the Standard & Poor’s 500 Index rose 68% from its March lows. Our banking system held. Bank regulation developed after the Great Recession, in 2010, succeeded in avoiding a wave of failures. This offered welcome reassurance to financial markets. The markets’ rapid turnaround was suspect, given the apparent size and spread of the Covid-19 pandemic. While we trimmed positions in cyclical holdings, particularly Mastercard, to raise some as a safety measure and in anticipation of bargains to come, swift government support measures, as mentioned, made bargain hunting difficult. Importantly, our clients retained positions and a strong allocation to equities. This positioning has been responsible for what clients tell me has been a satisfying 2020 performance.[1]

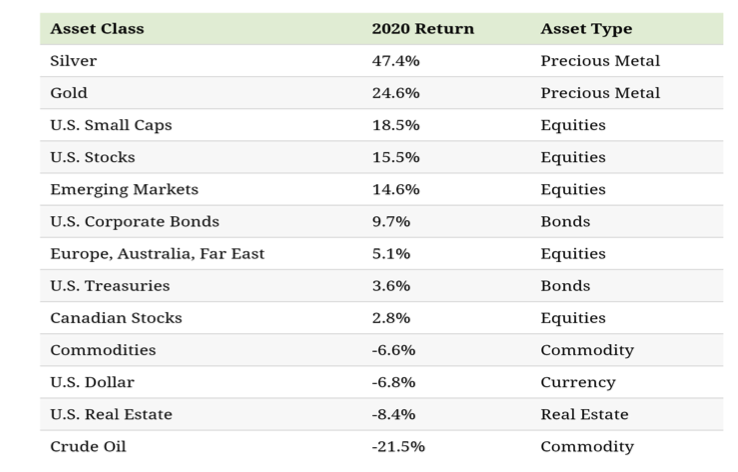

Selected Investment Performance 2020

Notably, precious metals did a nice job of hedging against panic, as the table above shows. However, Equities are what most investors rely on to improve their net worth, and the strong performance by equities nearly defied comprehension.

As the Covid Panic hit in March, “Value” investors, like me were just about to pull out their wallets and begin buying bonds and stocks of good companies at panic prices. But the swift round of government interventions sent markets into a dizzying U-turn northward, denying us a bigger opportunity to shop for bargains. I was able, however, to pick up some high yielding preferred stocks during the melee.

Technology names led the equity ascent, as investors saw that in-person work and person-to-person connections could be replaced by cloud based platforms via the internet, most famously Zoom (ZOOM). In fact, one of this year’s surprises was that unemployment (other than service industries) failed to soar as much as feared because so many people could continue to work from home online. The top technology names like Apple, Amazon, Microsoft, and Google accounted for most of the rise in the broader indices. They were joined by software names like Adobe and Intuit as well as some computer chip manufacturers like Broadcom (AVCO) and Nvidia (NVDA). Still, this level of concentration is a worrisome trend that reminds me of the Tech Bubble at the end of the century. Moreover, investor bullishness is the highest in three years, also a warning sign.

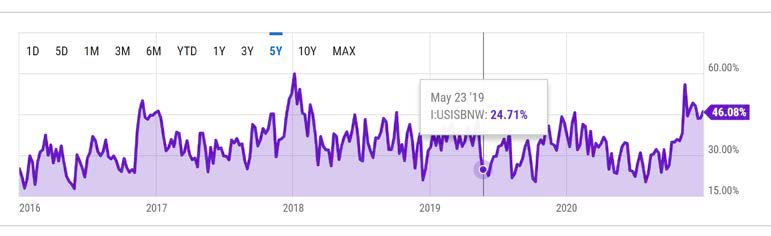

American Association of Individual Investors Bullish Sentiment readings

Equally concerning, initial public offerings are finding eager buyers. The unabashed enthusiasm for issues like Door Dash (barely profitable) and AirBnB (losing money) smells like some sort of top. The worst smell comes from a recent Wall Street “innovation” known as “Special Acquisition Companies” (SPAC’s). This is where a well- known investor name, like Bill Ackman or Peter Thiel raise money for a company whose purpose is to invest in other companies, yet unnamed. These black box companies are in high demand from speculative investors. Talk about buying a Pig in a Poke!

While difficult to nail down, we suspect that the arrival of the Millennial generation as a financial force is a factor in current market froth. Like the Baby Boomers before them, this influential and rising tide, 90,000,000 persons strong, represent a demographic tsunami that will be key to social, financial, and investing trends of the coming fifty years. Their economic power is, as yet relatively small, but their investment interest appears to be focused on technology, with which they are more familiar and comfortable than their Boomer parents. Millennials buying may be the driving force behind a new enthusiasm for crypto currencies, which managed a Lazarus like rise from the dead and rocketed to all-time highs.

Most Millennials were too young or too poor to suffer from the “education” that the Tech Wreck of 2001-2002 and the Great Recession of 2008-2009 meted out to naïve, overly enthusiastic investors. This seems to explain the seemingly unjustified valuations for certain companies, especially those in technology. But watch out: when both Millennial’s and their Boomer parents love products from companies like Apple, Amazon, Tesla , Facebook, Netflix and the like, valuations can become stratospheric. In other words, the same names that account for most of the strength of the stock indices tend to be those loved by multiple generations.

Valuation as measured by price to earnings ratio of the NASDAQ 100 a small cap, speculative index is the highest in 6 years:

Still, Liz Ann Sonders, Schwab’s talented Chief Strategist claims PE ratios are a poor predictor of market tops. We are hoping she’s right.

While tech companies enjoyed much love, a funny thing began to happen as the Covid-19 pandemic disrupted spending patterns. Companies related to home improvement (i.e., Home Depot, Sherwin Williams, Fastenal) found business suddenly booming during the summer as people emerged, at least in part, from the lockdown. Staring at the same four walls or the same yard for months on end motivated many families to divert travel and restaurant money toward upgrading their nests.

Similarly, a realization that dense urban living environments may not be ideal in a pandemic-prone world, there was a surge in demand for suburban housing, turbo charged by low mortgage interest rates. This change coincides with a time of family formation for the powerful Millennial households. Demographers believed this late starting cohort would be forever content to rent in large cities. Now, with Covid as a boost, more Millennial families seem to be seeking a home with a yard, like their parents and grandparents before them.

In November, with prospects of a Covid-19 vaccine coming, stock markets broadened. By year-end, about 450 of the Standard & Poor’s 500 index were trading above their 200 day price moving average. This is an unabashedly positive technical indicator.

I could go on citing the positives or the negatives, but trying to formulate a masterful macroeconomic overview that can provide a certain guide to investment selection is, frankly impossible. Surely macro-economic trends, especially secular demographic forces, provide a beam to light up certain industries and companies as likely opportunities. I’m what’s known as a “bottom up”[2] value investor. Like an omnivore primate cruising through the forest, I’m willing to nibble on any ripe fruit or berry encountered. The fun part of investment research and portfolio management is the endless joy of learning required. Learning about the challenges of powering and cooling server farms (AKA “the Cloud”); learning about infrastructure growth opportunities in the energy industry, food delivery, water resources and 5G telecommunication. Learning how different generations see the world and how they approach investing. With 47 years on the job, I bring a foundation of knowledge that allows for ready assimilation of new information and a framework to spot similarities remembered from that experiential history, to recognize outstanding opportunities and more importantly, to avoid sink holes.

Where are the values today?

Banking and finance, healthcare, energy, materials, and cyclical construction/housing/home improvement – related names are the current obvious candidates. Travel and leisure have already had a too – fast recovery, in my opinion, but may offer a great ride from here if one wants to go out on the skinny branches to chance the virulence of a virus, the ability of our fractured health care system to administer vaccines, and the willingness of some to venture out and travel. Another factor will be the ability/willingness of government to allow a return to restaurant operations and public gatherings.

Where’s the Beef Income?

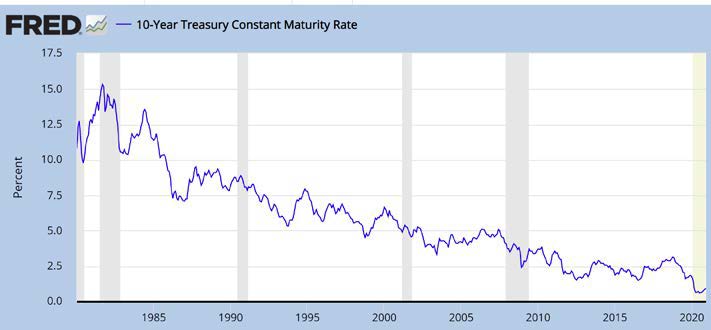

How about another challenge: income? While it’s all well-and-good to enjoy an expanding portfolio value, as so many did in 2020, many of our clients prefer the certainty of regular income. The challenge of finding safe cash flow has become difficult with the recent round of interest rate suppression. Ambient interest rates have been falling for 40 years (see chart below). This is probably the longest such decline in American history. Until there is a sustained economic recovery, it is likely the Fed will keep rates down.

Bond Yields have been Falling for 40 Years

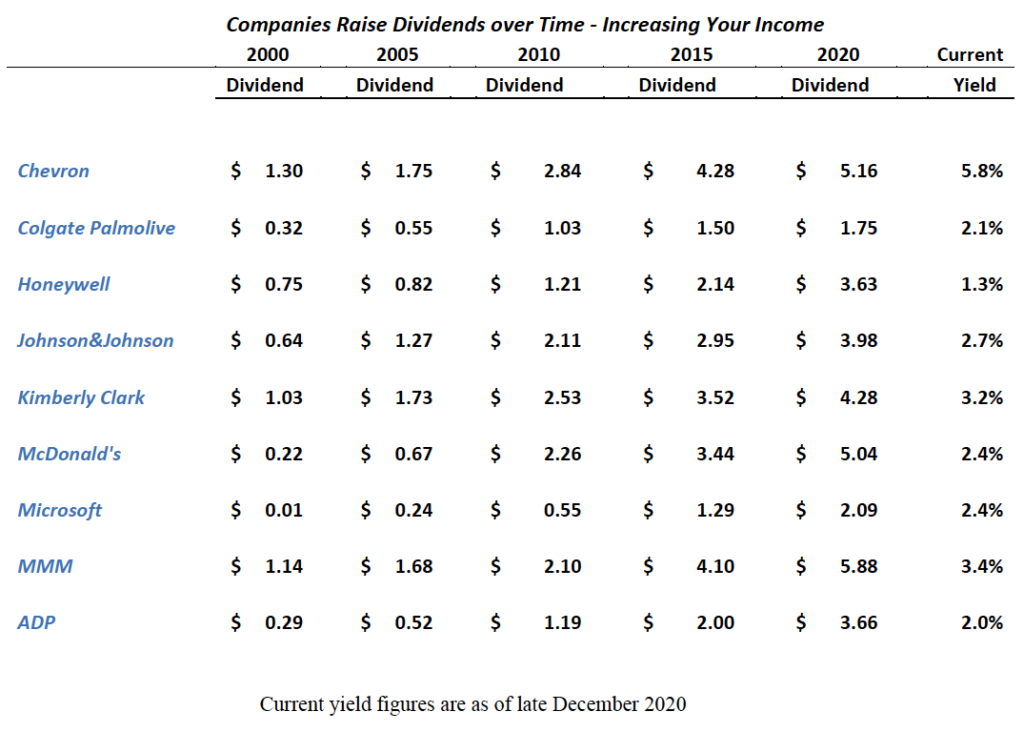

Earlier this year there was even talk of government bonds offering negative rates of interest when the Covid Crisis began. While few economists now expect this, it is good to recall that when a 10 year treasury bond is yielding around 1%,” safe” becomes “silly.” Inflation, running near 2% will cause such an investment of lose buying power each year. As an important source of income, I’ve long advocated for owning common stocks, yes, common stocks, from sound companies with a long history of raising dividends. While some of the names in the table below (provided for illustration, not as specific recommendations) lack the pizzazz of the tech darlings, they offer dividend yields greater than Treasury and many high quality bonds with the added prospect of continuing dividend increases for years into the future. “But stock markets can crash”, you say? Sure, stock prices fluctuate, but so do bond prices. Absolute investment safety such as CD’s guarantees lost buying power for your dollars, after the effects of inflation.

Study upon study[3] show that for patient investors, there is greater total return to be had from stocks. Today there is also greater current income available from stocks than from bonds. For long term money, 5 years plus, the lure of rising cash dividend income (and perhaps stock buybacks) will likely result in a rising price of shares for “Dividend Champions.” Here’s a 20 year dividend history of some historically reliable names:

Stepping into the Future

As highlighted earlier, some investors became willing to bet on a dramatic recovery for pandemic damaged sectors, especially travel and leisure companies. Did they move too soon? As we enter the new year, the vaccine roll-out appears to be slow and fitful at least in the United States, and a meaningful number of citizens distrust vaccination. In addition, some feel the current amount of political division is a threat to our democracy and the stability of Western world order. This stability is crucial for a thriving capitalist financial system. In other words, much uncertainty remains. We continue to advise long termism when it comes to investment positioning and we will continue to search to bring you investments that can withstand what is likely to be another six months (or more?) of 2020-like challenges.

To finish on a positive note, however, the Covid Crisis has called forth the faith, ingenuity and resiliency in humankind. Never before has a vaccine been developed in seven months. Where possible, society has adopted available technology to continue operating and interacting in business, in medicine, in the world of entertainment and in personal communication. This is likely the tip of a virtuous cycle. As the Covid 19 scourge recedes, technology, compassionately employed, is poised to advance humankind.

And, as always, opportunities for profit abound!

Gary Miller, CFP

[1] Note: each client account is separately managed with stated risk and reward goals in mind. Performance will vary depending on individual criteria

[2] “Bottom up” vs “Top down.” Analysts who focus on individual opportunities are bottom up buyers; those who focus on the bigger economic picture are considered “top down” and often favor owning indices through exchange traded funds or mutual funds rather than individual companies.

[3] The best known study comes from “Stocks, Bonds, Bills and Inflation” available from www.Duffandphelps.com