As we approach the half-way point for the current quarter (was New Year’s Day that long ago?), I wanted to briefly summarize financial market news and our response thereto. Hope was surging along with the market as the books were closed on 2013. As indicated at our client Holiday Luncheon in December and in private conversations with some clients, value investors such as ourselves have been uncomfortable with the dramatic lift off in share prices that manifested itself so widely during the last three months of 2013. In recent weeks, the advance was halted and a mild correction seems to have begun. A battle between optimists and pessimists is in progress – a battle that I suspect will be won by the bulls.

The Fixed Income Story

Only a year ago, investors were throwing money at bonds and bond mutual funds in a desperate attempt to improve their yields and income. Disintermediation from banks and credit unions resulted in large inflows to popular bond mutual funds such as PIMCO Total Return fund. Then, Fed Chairman Bernanke let the world know that extraordinary money creation was unlikely to go on forever. This was, to many bond investors, equivalent to crying “Fire” in a crowded theater. In a matter of days bonds were dumped and interest rates rose over 30%. The rest of 2013 was filled with bond Bears citing the end of a secular bull market for bonds: it was inevitable, they explained, that with economic recovery gaining momentum, interest rates would head higher and that ownership of long-dated debt instruments carried the risk of locking in lousy interest rates. The problem with this argument is that it has been wheeled out repeatedly since 2009, when the Great Recession put in a bottom. We are happy to report that through most of the past five years we refused to dump our high yielding, high quality bonds and preferred stocks, thus enjoying yields of 6% – 7% – 8% or more. We did begin our own form of “tapering” by generally not replacing maturing bonds in client portfolios when they matured, since interest rates on replacement candidates had plummeted. However the dramatic reaction in May and June 2013 to Mr. Bernanke’s warning, with wholesale outflows from bond mutual funds, caused me to re-consider whether interest rates may have, indeed, finally bottomed. When interest rates begin to rise, this puts a damper on the value of older bond holdings. We felt it was time to acknowledge the weight of history: after 30 years of falling interest rates in the USA, the odds are they will be rising in coming decades. As a result, we liquidated some bond mutual fund holdings and have been selling off lower yielding preferred stock. As of today most client portfolio allocations to fixed income instruments have been reduced from about 40% one year ago, to around 25% at this time.

While stocks have been in turmoil in recent sessions, it is the year-to-date reversal for interest rates that is surprising. Yields on the 10 year Treasury bond have dropped from 3% down to 2.65%, although still up from last year’s low in the 1.7% area. This seems to portend that an economic slowdown may be anticipated. It may also confirm the belief of some that new Federal Reserve Chairman Janet Yellen is more of an inflationist than was Ben Bernanke, and that Quantitative Easing (aka: “QEI” or “QE II” or “QE III”) may continue for longer and at a hotter pace than previously believed. It may also be the result of Asian money warming once again to the stability of the US dollar – there was a near meltdown for a large Chinese income fund last month, apparently averted by swift Chinese government intervention. However, investors are likely to receive back less than their original investment, unhappy news for income oriented Asian investors, who may find renewed comfort in owning US T-bonds.

Equities – a bit of a Puzzle

While the stock market correction, so far, is well within the normal range of minor adjustments, certain cyclical stocks have been sounding a warning. A stock widely held by clients, W.W.Granger, hardware store to professionals, took a nauseating tumble. We were already concerned when the stock, despite decent growth in earnings, failed to participate in the Fall Rally. In late January, shares began to crater.

We closed out the position, puzzled, but in most cases with a profit. A couple of years ago,”GWW” had been our second choice for a cyclical investment, after competitor Fastenal (FAST) “got away” in the early days of economic recovery. But Fastenal’s stock, too, has been equivocating. Are these the canary in the coal mine for an economic slowdown? It seems possible, given recent reports that auto sales are slowing from last year’s torrid levels. Likewise, a look at shares of Lowes and Home Depot which have given back some recent gains seems to confirm that cyclical stocks are warning of an economic slowdown later this year. Stocks usually anticipate economic activity about five to six months in advance. If this rule holds true then these construction oriented companies are signaling a Summer Slowdown. If this is in the offing, what would be the cause?

I’ve yet to hear an economist provide a coherent explanation for current market turmoil. This leads me to wonder if disruptions in spending patterns are arising due to the implementation of the Affordable Care Act (AKA “Obamacare”). As households experience sticker shock in the form of significantly higher insurance premiums, this “tax” may serve as a damper on personal spending and consumption. Perhaps this is a stretch, but unhappiness with ACA, so closely identified with Democrats, may well lead to significant losses for that party in the autumn elections. Captains of Industry may be delaying capital spending while awaiting a more business friendly environment in Washington, one that includes new incentives for investment in plant and equipment. Such fiscal (as opposed to monetary) incentives could only emerge from a Republican controlled Congress. I’ve no evidence to back up these musings, but 40 years in the markets entitles me to hypothesize.

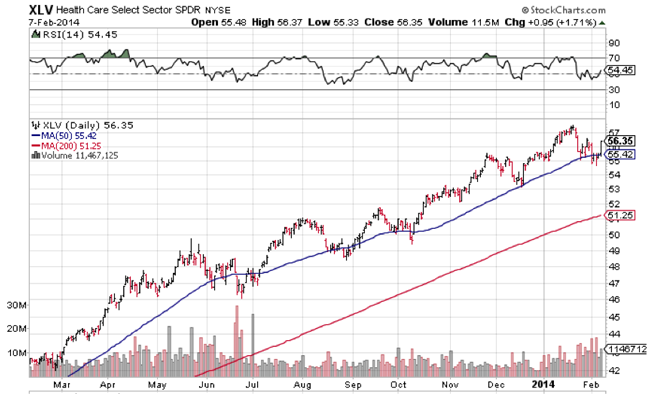

Looking elsewhere in client portfolios, we have had some weakness in two large energy holdings, Exxon Mobil and Kinder Morgan, but resiliency in health care oriented funds:

and Enterprise Product Partners:

While managing money in an ever changing financial environment is a challenge, Trusted Financial clients own businesses that have superior characteristics that justify long term positioning. Even the best businesses periodically experience price weakness due to factors that may be more related to fickle investor sentiment than to any fundamental flaw in the company. We remain optimistic that superior returns can be had from a diversified portfolio of high quality investments.

Gary Miller

February 10, 2014