“Watching paint dry” would be an appropriate title to bestow on the first half of 2015 for our client portfolios, especially in light of our holdings in the coatings industry: Both Sherwin Williams and PPG Corporation (Glidden paints) finished June at almost exactly the same levels as they did in December 20141. The companies’ share performance reflected a quarter featured by little price movement in the equities sector.

Long term bond quotes sagged during the period as bond traders anticipated a sustained, if subdued increase for interest rates controlled by the central bank. Likewise, Income stocks like REITs and MLP’s also suffered pricing pressure pressured most of our clients’ portfolios. Preferred stocks actually improved in value, a welcome surprise. The plan is to hang on to these high yielding preferreds and high yielding (institutional grade) bonds for their income properties, and not as trading vehicles. Not only do I see no danger that our fixed income holdings will be hammered, it would not surprise me to see a bond rally: the world economy is just not an exciting place for institutional investors, who need safety and liquidity. U.S. Treasury bonds appeal in both aspects, meaning foreign buying should keep U.S. interest rates near historic lows.

The Federal Reserve uses an increase in the short term rates it controls as a means of keeping inflation in check. Wages are rising a bit, but soft commodity prices are helping to keep inflation in check. I do not expect this situation to change soon. The marginal driver of industrial commodity demand has been China’s economy. While no one expects China to fall into a recession, the torrid pace of growth is slowing2. This has resulted in plentiful global supply of most commodities worldwide. This in turn has hurt resource producers like Russia, Brazil, and Canada. Europe appears to be in a very slow recovery mode but the Greek drama may be delaying business spending decisions there. No fear of a flame up of commodity demand from that quarter of the globe. Meanwhile, the Mother of all commodities, oil remains sharply down from last year’s levels due to an oil price war initiated by Saudi Arabia in response to soaring North American production. In sum, I don’t anticipate inflation ramping up in a way that could push monetary authorities to raise interest rates as a counter measure.

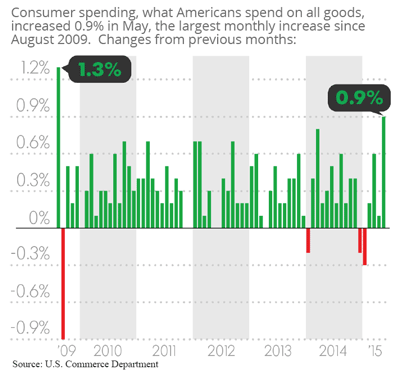

Doldrums around the world, and the effect of a very strong U.S. dollar are hurting American export oriented industries. The first quarter actually saw our GDP fall, a result of the west coast port strike and severe winter weather, as well as the aforementioned strong dollar. The Consumer, backbone of the U.S. economy (70% of spending) is still a key to where the world economy is heading , since we buy so much from the rest of the planet. A year ago, I believed there were convincing signs that employment levels would continue rising, leading to a rise in consumer confidence and consumer spending. I was right about the employment trend but wrong on consumer spending. Despite an unexpected “tax break” from substantially lower gas prices, Americans have shown a hesitancy to open their wallets. After all, memories of a deep recession are fresh, long time unemployed are just getting a chance to repair their balance sheets and lenders are not throwing money at consumers like they once did. The month of May was the best month to month increase in consumer spending since April, 2009. Are we about to see consumers rushing into stores (or buying online)? The graph below demonstrates that there is no clear trend of improvement. Further, as discussed below, a shopping mall REIT that we owned has seen its earnings sputtering, perhaps because of tepid customer traffic.

Housing, another major driver of the U.S. economy is clearly in recovery mode but the pace is slowed by ultra-cautious lenders, a legacy of the excesses of the early 2000’s. I believe we are in the early stages of a decade of growth in single family housing demand and construction, based upon the power of 80MM Millenials, those born between about 1980 and 1995 who are and will be raising families and transitioning from their urban lives as renters to a more traditional setting.

The quarter just past was in line with the year to date: slight upward movement for U.S. stocks, with the Standard & Poor’s 500 clocking in with a return of 1.96%, including dividends. Since dividends average close to 2% there clearly was little forward price movement in the quarter just passed. While compared to a Certificate of Deposit, 2% is great return in fact the market has been stuck in fly paper, as compared to the way it buzzed around for most of the past 6 years. Trusted Financial’s Balanced/Value accounts have actually underperformed a bit, with some clients even going backwards a percent or two. This is likely the result of our relatively heavy allocation to high dividend paying income stocks and a still healthy allocation to bonds whose secondary market quotations are down for the year due to rising long term interest rates.

By most measures equities are fully valued, and perhaps a bit over valued. If you look at my blog/newsletter from June 30 a year ago, you’ll see I was pointing out that the U.S. stock market, as adjusted for inflation, had for the first time achieved true all-time highs, dating back 14 years. This type of technical milestone usually signals a new, bullish era is at hand. Historically, it signals the beginning of a bullish “blow off” phase. Not so far. While we continue to be in a long term bull market, in my opinion, one that has years to run, significant corrections within this major expansionary trend are the norm. So most client portfolios hold more than the usual 3%-5% in cash as a result. Cash may not grow, but it won’t get hurt in a big sell off, and allows up the flexibility to buy companies at a discount should the market swoon.

I’ve made some relatively small new allocation investments that can grow in an environment of mildly rising interest rates. Homebuilding stocks, appear to be entering a secular bull market, riding the wave of new household formation by Millenials. Since there is no evidence that the Fed will need to push interest rates so high as to squeeze home affordability, we took on our first homebuilding investment: SPDR’s Homebuilders exchange traded fund (XHB). Clients also saw increased exposure to banking stocks. New York Community Bank (NYB), with its 6% dividend was purchased for many accounts: they focus on lending to owners of rent controlled apartment buildings, a stable source of cash flow. Many client portfolios also saw re-entry into two previous common stock holdings, Goldman Sachs (GS) and US Bancorp (USB). Goldman’s first quarter was an eye opener, with the company, known for its brain trust, performing very strongly in all divisions, back despite a more restrictive banking environment. Mergers and Acquisition advisory is a specialty and activity in this area is booming. Minneapolis based US Bancorp (who acquired California’s Downey Savings and Loan during the financial crisis) is one of the soundest bank holding companies in the country. Both Goldman and USB stand to benefit from short term interest rate increases by the Federal Reserve and the growing improvement of borrower credit quality.

We also took a relatively small position in Rollins (ROL), the pest control company (Orkin) as their recent earnings call indicated people are again buying service contracts (a source of predictable, recurring revenue) and that collections are improving. All the metrics are good and the company enjoys high operating margins and is buying in stock. Rollins has the prospect of growing by acquisitions in a fragmented industry, and have proved adept at integrating new partners. The company appears dedicated to relentless investments in efficiency as well. I also suspect they could themselves become a buyout target for a company like Berkshire Hathaway.

For Apple owners, the meteoric rise in the stock’s price left them with a high allocation, well beyond our normal weighting. When the shares failed to follow through on a new high quotation after a terrific first quarter earnings report some profits were taken. Apple remains a significant holding but the company is very well loved, which is not comfortable place for a value investor. The company appears to no longer be under valued, but that view depends on an understanding of the potential impact of current and coming products. The next catalyst for the stock is not clear to me: Apple Pay? Apple Watch? Streaming music? Morgan Stanley recently reported that demand for the iPhone six, the larger format generation, continues to be very strong both here and in China. However, given the company’s market capitalization, now the highest of any company in the world, it logically becomes more difficult for any one product to have as dramatic an impact on earnings and share price as have earlier new product launches. Admittedly, I am not tech savvy enough to grasp all the possibilities but I find Apple’s appeal to be primarily as a maturing, “cash cow” company that we can own for a rising dividend payout.

More Exits

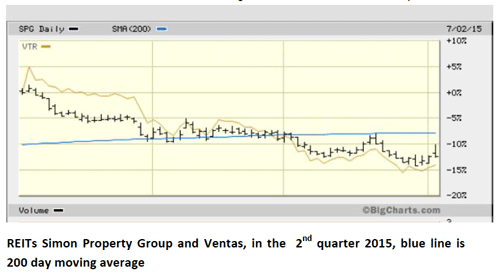

REIT’s got beat up in the quarter on rising interest rate fears. We cashed out of Simon Property Group (SPG) after a long holding period and with most clients booking a healthy profit. The stock has likely been hurt due to its failed bid to take over rapid growth competitor Macerich (MAC). Further, I have harbored a suspicion that the weight of online shopping has got to lead to sub-par performance for shopping malls, so this stock has been on probation for some time. That being said, I’ve underestimated Simon’s management team before!

In the sell-off for REIT’s, Ventas (VTR), an operator of medical buildings, sagged. I admit this sale came for loss protection reasons. The company’ story is compelling. However, not as compelling as another REIT, American Tower, that continues as a holding in client portfolios.

My fundamental, value investor side likes the Ventas story as it fits in well with the “aging of America” narrative. But as someone who respects price chart activity ( often signaling news that is not yet published or apparent), I was surprised and distressed to watch the stock fall below its 200 day (essentially one year) price moving average and chose to take this as a meaningful warning.

Finally, one of my favorites, Canadian National Railway (CNI) began losing altitude the back of sagging shipments of commodity exports (see China mention above), falling coal loads (down 18% year to date!). Overall, CNI has seen carload volumes fall 3.5% year to date as compared to 2014’s first half, pretty much in line with the industry. A slowdown in the North American shale development as well as export head winds due to a strong U.S. dollar appears likely to keep the rails under pressure for some months to come. The good news: virtually every client booked a profit on this sale. Rail carriers are an oligopoly in North America so I’ll be looking for a re-entry point.

De-emphasizing Bonds

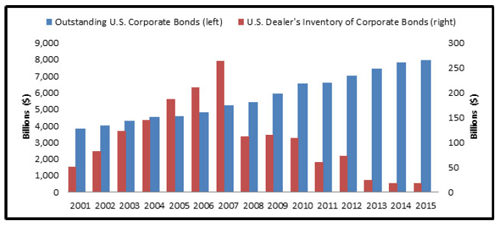

The fixed income markets have become a potentially treacherous place according to a recent study by Schwab research3. This is not just from the risk of rising interest rates. Post 2008 crash regulatory actions have largely killed off investment banking activities, thus hurting market liquidity. This comes at a time of rising bond issuance:

We appear to have a new landscape, one that could cause a problem if interest rates were to rise sharply and bond holders headed to the exits en masse4. At present, it’s a good thing that we have been running off client bond positions for the past three years. I have not been motivated to replace redeemed or matured bonds (many with yields in the 8% range or higher) with today’s low yielding offerings, except for a few small secondary market opportunities that have appeared recently. Instead, preferred stocks have been a replacement for bonds, offering yields around 6%-7%. Problematically, however, preferred stocks trade in relatively low volumes, therefore I try not to own too many of any one issue, lest we need to exit quickly. Let me again remind clients that we try to fill your portfolio with instruments that pay “rent” so you can relax when the markets go down for cyclical reasons.

Right now it is difficult to be as bullish as a year ago and some very smart people feel the market is overvalued. But I vigorously disagree with Bears, one of whom ran for President, prominently proclaiming we are on the verge of a financial meltdown. Harry Browne’s “How to Profit from the Monetary Crisis”, making a similar gloom and doom prediction. The year was 1974. If I’d followed that belief system, I’d have been out of a career almost before it began!!!

1 While share prices were little moved, both stocks generated income in the form of dividends

2 Talk is of a 7% expansion in GDP in 2015, which compares with growth averaging over 10% for most of the past ten years

3 Schwab "Rate Hike Could Cause Market Liquidity Problem for Bonds"

4 By the way, if you scratched your head, noticing in the above graph that pre-2008 dealer bond inventories exceeded corporate bonds outstanding, this was because dealers used borrowed money and leverage as well as derivatives to leverage their holdings.