Beyond the challenges to slowing the progression of Covid-19 and the heroic battle being fought by our medical professionals, the economic uncertainty caused by extreme distancing measures have made society impatient for a resolution.

Business owners, out-of-work hair stylists, waitresses, Uber drivers (and politicians) are anxious for the crisis to pass, but there is already enough economic damage to say that earnings forecasts are of little value. This sort of uncertainty has led to a sell off over 30% below recent market highs. Despite a promising bounce into early April, history suggests that typical bear markets see a decline closer to 50% before the worst is over. Here’s what the first quarter looked like:

| First Quarter 2020 Scorecard | ||

| Quarter | 12 Months | |

| S&P 500 | -20.0% | -9.9% |

| Dow | -23.2% | -15.5% |

| NASDAQ | -14.2% | -0.4% |

| Stoxx Europe | -23.0% | -17.7% |

| Nikkei Japan | -20.0% | -13.1% |

| Hang Seng | -16.3% | -20.2% |

| Oil | -66.8% | -65.9% |

| Gold | 4.5% | 23.1% |

As a result of the rapid spread of Covid-19, an historic U.S. equities bull market for stocks that ran for 11 years has ended. Emotionally, it is difficult to watch a portfolio drop from (in many cases)a record high value back to or even below where it was a year ago, but the longer term perspective helps keep our eyes on the prize: patient long term investors have built a good deal of wealth over time. Virtually all clients have positive returns at respectable average annual rates for the past five years and the past ten years even after the recent sell off.

Recent stock market behavior is being compared with the big meltdown of 2008 and even the panic of 1987. Having actively represented investors during both of those frightening events (and the Tech Wreck of 2000-2002), I can assure you that this too will pass. Surely, an economic valley is ahead of us (AKA “recession”), with pressure on equity values. We tend to forget how desperately frightening past bear markets were, until we are suddenly in the midst of a new one. Yet somehow, after panics, markets always seem to recover and then go on to greater profits.

Take a look at this chart showing the well-known Dow Jones Industrial average going back to 1980:

The October 1987 crash was likened to the “Crash of ‘29”, I considered a career change at that time! Can you spot the price decline on the chart above? How about the “Tech Wreck” that caused so many do-it-yourself traders to postpone their planned early retirement? The decline that really stands out for me on the chart is that which accompanied the Great Recession of 2008-2009. At first slowly, then with a panic over the possibility that our financial system would collapse, it was certainly the worst experience of a lifetime for most investors. So far, this sudden panic, coming as it does in the midst of good times, is more reminiscent of the 1987 sell off. Does it mean we will see as quick a recovery?

At times like these, I like to retrace some of the steps from my financial education. Not too many clients know this, but my major in college was psychology. After leaving to start a small business, with some seed capital from my parents, I found myself fully engaged in creating and running a business. That is where the real education began. After selling that operation, I dabbled in real estate, then developed a fascination with the world of finance. At first, I was an autodidact, learning while on the job. More formal schooling followed. For younger people with an interest in finance, I highly recommend the path of “jumping in” because you’ll either love the water and learn to swim or you’ll dog paddle to shore wet, but wiser. Even for those who step into the world of finance armed with a Master’s in Business or a Chartered Financial Analyst designation, the real education to be had is in navigating the ever- churning, turbulence of actual investment markets, working with actual clients.

Two of the guiding lights of finance today are Warren Buffet, age 89 and his lesser known associate Charles Munger, age 96. These two have been managing the affairs of Berkshire Hathaway for over 60 years, years that included some vicious bear markets. They have built a celebrated track record and have proven beyond the shadow of doubt that intelligence applied to investment selection, over time, will provide handsome rewards.

I listened with interest to a video recording from early February of this year in which Munger expounds upon his views and his experience. While there were many nuggets that deserve more attention than time permits here[1], I was particularly intrigued when he spoke of an investment book that had escaped my attention: Common Stocks as Long Term Investments, a tome published in 1923 by Edgar Lawrence Smith. Smith was a Harvard educated investment advisor who lived from 1883 until 1971. As an investment advisor, he challenged conventional wisdom, that bonds provided better returns than a basket of stocks. He conducted a series of ten studies that compared the two asset classes over a range of time periods between 1866 to 1921. He initially held what was the widely accepted belief that bonds were the way to go and stocks were a speculation that might reward only a few knowing or lucky investors. But his studies confounded him and the investment community. After testing the performance of different baskets of stocks and in a manner that did not cherry pick stocks using hindsight, he published his book revealing a then startling conclusion: While stocks did not beat bonds every year, over any span of twenty or more years they provided superior, usually much superior returns as compared to bonds .

His conclusions have become gospel, especially since his work was confirmed by the studies conducted by Rex Sinquefeld and Roger Ibbotsen of Yale, whose “Stocks, Bonds, Bills and Inflation”, used 50-years of market data from 1926 to 1976. “Stocks Bonds…” has been updated annually and now, with over 90 years of data, the message remains the same: with the advantage of time, a diversified portfolio of common stocks will provide greater wealth enhancement than bonds. Other studies have suggested that common stocks also perform better than real estate, precious metals and a basket of commodities as well.

To be sure, these studies also confirm the fact that over shorter time periods equities are more volatile than bonds. Their periodic swoons hold the risk of wiping out those who use leverage (margin) or those whose emotional make up cannot deal with volatility. To tame the volatility beast, portfolio managers favor a “balanced” approach, blending equities and fixed income securities, along with cash in a never-ending attempt to get the blend just right. The holy grail is to capture most of the stock market’s secular upward trend while avoiding the worst of its periodic swoons.

Today, with interest rates on government bonds in the low single digits, those who have been frightened by recent stock market behavior and who may be tempted to park funds in bonds would be wise to reconsider. Inflation will steadily eat away at the little income these low yielding instruments generate. To be sure, I’ve advised a temporary retreat to the safety of U.S. Treasury bills. While offering than a 1% yield, they are highly unlikely to fall in value. They make an appropriate parking place for working investment capital that can be readily re-deployed into bargains when it appears safer to return to more permanent investments.

At times like these, some investors ask, “why not just get out of stocks and wait for the recovery to get back in?” To exit stocks entirely with the notion of buying back in “once things settle out” is naive. Over my 45 plus year career I’ve never known anyone able to time their exit and entry points with any consistent success and that includes myself. Many folks who exited stocks during the Great Recession sat, paralyzed, as the market rebounded. Some refused to buy stocks for years, thereby missing a portion of the longest bull market in history

At any given time, the choice to buy should be based on information that suggests a company can produce superior free cash flow on a consistent basis, enough to service any debt and to pay dividends or to fund share buybacks. There will, of course, be other considerations- a unique product (Apple iPhone in 2010), dominant market share (American Tower or Mastercard), a reinvention of how business is done (Amazon, Uber) geographic dominance (Dominion Resources, Enterprise Product Partners) or perhaps recurring, stable income (Equinix, Adobe). Naturally, we will be more attracted to companies likely to increase income and dividends over the years so as to overcome the effects of inflation on our buying power.

Likewise, the choice to sell shares may be prompted by product obsolescence, strong newly emerging competition, unfavorable management changes, poor financial management (overpaying for acquisitions), falling profit margins (retail stores) or sagging returns on equity.

It is useful to remember that this sell off is not the result of a fundamental weakness in the American or even in the world economy. Surely, after an eleven-year expansion, things were slowing. However, sudden economic contraction does not appear to be due to the usual source – too much lending to marginal consumers or businesses. Rather, it appears fundamentally the result of mandated behavioral changes on people worldwide. Let’s consider some key indicators for the US economy just prior to the pandemic shut down:

- Employment was at its highest level in generations when the pandemic struck

- Household debt, especially mortgage debt is much lower than it was in 2007, relative to Household assets. This suggests fewer people are living “on the edge” and will weather this storm

- Household net worth is up from $70.6TT in the 4th quarter of 2007 (just prior to the previous recession) to $118TT in the fourth quarter of 2019.[2]

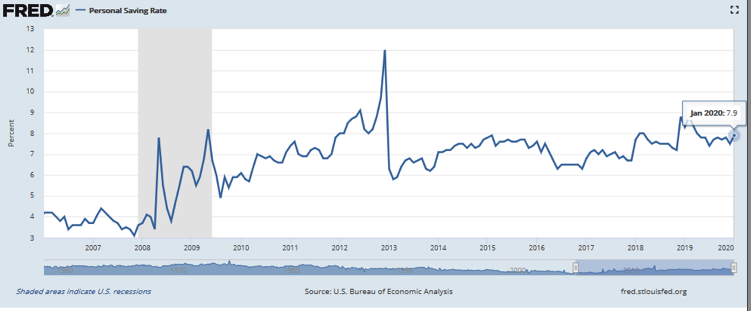

- The personal savings rate was nearly twice that of the years prior to the Great Recession:

Financial planners advocate for having a “rainy day fund.” Most of my clients are respectful of this dictum and should be able to live comfortably for a year or more on available, liquid savings, without the need to sell securities at distressed prices. And, let us not forget the hopeful signs of innovation emerging from this crisis: Consider the enormous effort being made across the planet to find a vaccine and to test existing medicines that can reduce symptoms. Consider ingenious and creative people who are using 3D printing to manufacture parts for respirators, safety goggles and even a “no touch” door handle attachment. Consider how distillers have turned some of their alcohol production into facilities to create something more valuable: a greater volume of hand sanitizers. Notice how many families, business people, educators and yoga teachers are today using “Zoom” to connect and keep businesses running, when they may not have even heard of this website two weeks ago? Mark Cuban, the billionaire TV personality has extolled the virtues of entrepreneurial capitalism in which the United States excels. He believes exciting new technologies and a raft of productive businesses will emerge in response to the current societal challenge. The world may seem to be on hold, but beneath the surface human energy and ingenuity is stirring!

I advise clients to continue to hold top notch names, those who in my judgement are certain to survive and may ultimately prosper from the present situation, the going is likely to continue to be rough for an unpredictable period of time. As clients know, we diversify their portfolios using the traditional asset classes of Equities, Fixed income, cash. Beginning last year, we added gold, the only asset that is up this quarter and over the past 12 months.

We continue to keep an eye peeled for superior businesses with the characteristics outlined above. There will be exciting opportunities to build wealth coming out of this fight. I enjoy the challenge of finding opportunities, especially among wreckage in a bear market. My heart is racing and in a good way!

Gary Miller CFP

[1] Munger quoted Warren Buffet as saying, “I try to take the high road-it’s less crowded”.

[2] Source: Board of Governors of the Federal Reserve (https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/chart/)