Market Update August 20, 2021

Despite a wave of bad news, especially headline risk for leading Technology giants like Google, Facebook and Amazon, the broader indexes have managed to advance to record highs. Let’s summarize a few of the worries:

- Reduced stimulus by the Fed: Recalling the bond market swoon in 2013 (AKA “Taper Tantrum”), when Ben Bernanke’s Fed sought to reduce bond purchases, market commentators have warned of a repeat. I’m not too worried that once the Fed scales back from buying $120BB of T-bonds per month, markets will freak out and collapse. Yet, demand from an aging global population of investors seeking safety suggests that the private sector can readily replace the Fed as it tapers down its buying of T-bonds, thus preventing a sharp rise of interest rates. Even a rise of T-bond yields to 2% or even 3% is unlikely to cause a recession.

- Another Covid Crash? A “Delta” variation of Covid 19 is on the loose! Are we about to lock down the economy again? To paraphrase David Kelly of JPMorgan: “as the virus develops variants, the world of commerce develops variants as well, and rapidly, to cope with the challenges.” It is doubtful we will see a repeat of heavy lock down mandates.

- Everyone hates Big Tech. They steal our personal information and sell it, they follow us everywhere, they censor our posts, and misspell our text messages!…OMG where’s my iPhone?…I CAN’T FIND MY IPHONE!!!!! Love ‘em or hate ‘em, our entire way of life is now heavily reliant on these big technology platforms. It is possible that overzealous regulators and those who want to penalize success will enact some damaging new laws, but so far, these stocks seem unconcerned.

- The Afghanistan Debacle weakens America’s prestige, thus investors may retreat from owning U.S. firms and the stocks and bonds they issue. Nonsense. The USA still offers respect for private property rights and the rule of law with relatively non-corrupt courts. We have the most liquid and diverse equity and bond markets in the world. There is little risk of anyone attempting to go to war with us. Alternative global markets have become a treacherous neighborhood for investors. Witness the Cult of Personality that has grown around China’s ruler Xi Jinping, who arbitrarily attacks China’s most successful Tech Giants, tanking their stock prices. If anything, this nearsighted despotism is driving money out of China and back into U.S. based investments.

As a result, in the current quarter we’ve seen all time price highs achieved for some key client holdings: Apple, Adobe, American Tower, ASML, Nvidia, Johnson&Johnson, Microsoft, Paychex, Google, Public Storage.[1] Not bad, given how worrisome things seem to be, at least in the eyes of the media.

Here is something to be Concerned about:

The rise of inflation in the United States has dominated the conversation for much of the past six months. Younger folks might be puzzled by recent focus on this topic, but for those of us who lived through the startling inflation of the 1970’s, this corrosive force is to be reckoned with. It is potentially the greatest threat to comfort and prosperity in the later years.

Upon arriving in California in 1977, I rented a small home in Mission Viejo.

At the time, I was stunned to learn this modest dwelling was valued at the astounding level of…$80,000. I recall thinking that it would be impossible to ever own a home in overpriced Orange County, California!

That home today is pretty much the same as it was 44 years ago, yet the price is approaching $1,000,000. The dollar is an ever- shrinking unit of measure. Forty-four years from now, that 1600 square foot Mission Viejo home could be priced at $10,000,000![2]

The Retiree Challenge is to find a way to increase earnings or dividends, even when the working years are done. A retiree who lives pretty much on a fixed income, who is not sophisticated in the art of spotting inflation-proofing strategies, could suffer down the road, especially in the very late years when doctor’s visits become frequent or when one’s ability to deal with financial problems diminishes.

I’ve worked primarily with retirees now for about 35 years. For most of those years, inflation has been relatively tame. Still, as we all know, the cost of everything sneaks higher, and it is most obvious right now in the price of residential real estate or when going out to eat. Inflation is a subtle thief that steals your buying power in small but relentless increments.

There are many causes for inflation, but the underlying cause is that the dollar is not tied to anything of real value, as it once was, before the gold standard was abandoned in 1972. The dollar, as with all paper currencies, is only as strong as people believe it to be. When too many dollars are in circulation and the sum total of goods and services available is finite, then the cost, in dollars, of those goods and services is driven higher. It is true that the availability of goods and services has expanded thanks to rising global trade and to technology-driven productivity and efficiency. Clothing imported from Asia remains a bargain. Your tax preparer can crank out your annual return using his/her computer in much less time than she would have in, say 1975. Alternatively, you can prepare your own taxes using Turbo-Tax (Intuit product) for far less than a tax preparer might charge. The amount of technology a typical automobile is far greater today than it was forty years ago, gasoline mileage is better, but the price of a car has not gone up as fast as general inflation. Farmers produce considerably more food with less labor, time or weather damage due to technology-supported farming efficiencies.

Outpacing productivity gains is money creation. Our government has, irresponsibly, borrowed and “created” money at a faster clip than the production of goods and services. As a result: a dollar purchases a shrinking bag of groceries every year .

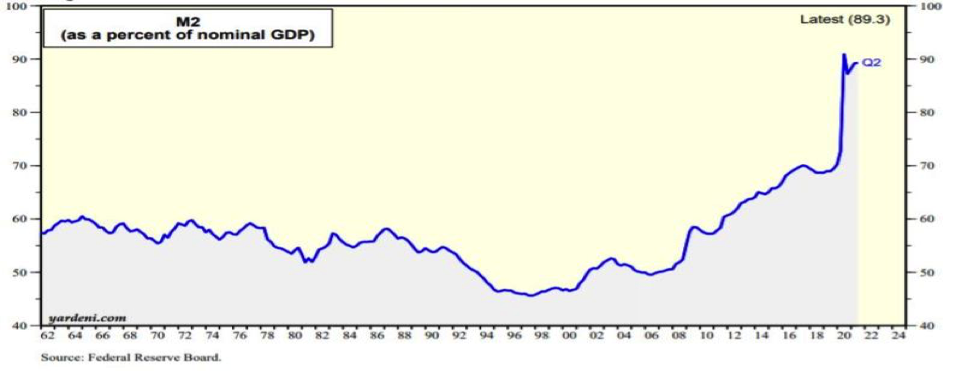

Want to see what money creation looks like? Here is a graph of what is known as the “M2” Money supply, relative to gross domestic product going back to 1962. Notice what has happened beginning with the Great Recession, 2008.

Hand-in hand with money creation has been ballooning of the national debt. This began to get out of hand during the Great Financial Crisis. In rescuing banks, insurance companies, auto companies and others, the Federal government has become a dominant force in our economy. Success in avoiding a Great Depression thirteen years ago, led policy makers to belief that this approach was without negative side effects. Today, there are few voices of responsibility in either political party. When the Covid 19 pandemic arrived, legislators and the Fed turned to their new playbook in a big way. Congress has handed out money to failing businesses, to support people who are not working, to renters who are not paying and a to pay for wars we are not winning…. with no apparent plan to ever repay its borrowing or reduce spending.

History suggests that chronic debtor nations become weak and eventually disintegrate. This process can take decades, even centuries, but in my opinion, we are on that slippery slope. Inflation is a symptom of this worrisome trend. My purpose here is not to pontificate about secular trends we, as individuals cannot likely control. What we need, here and now, is an approach that will protect us from the depredations of inflation.

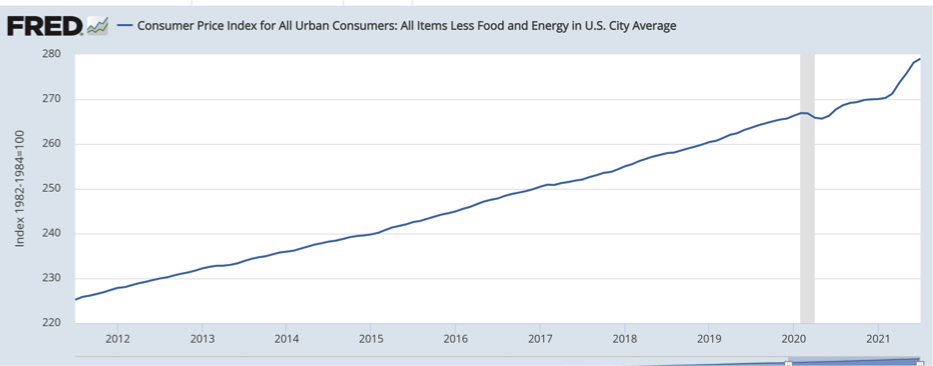

Recently, the pace of inflation has accelerated. Some argue this is a temporary thing. This observer is not convinced. In response, I’ve become more interested in placing clients into investments that have “pricing power.” By owning equity (shares) in companies that can get away with raising prices, free cash flow should follow and dividend income or share price appreciation should keep pace with or even overcome general cost of living increases.

Jim Cramer, that fast talking stock picker on CNBC TV had a wonderful summary of this opportunity on his August 18, 2021, show. You can view it here:

I found myself nodding my head in agreement with most of what he said on that show. Where he advocated owning certain firms, as a way to stay ahead of inflation. Most of my clients already own the stocks he discussed. The bottom line is this: OWN COMPANIES THAT HAVE THE ABILITY TO RAISE PRICES.

One wants to look for companies with dominant market share, dare I say monopoly pricing power? Names include Microsoft, Apple, Amazon, Costco, Adobe, Intuit to name a few. We also want to own companies who operate similar to toll roads. With a toll road, to get from A to B, you must pay a small but regular fee. Costco, which is not a tech company, pioneered this “membership” concept. Most of Costco’s bottom line earnings come not from product sales but membership fees! Amazon followed with “Prime”. We purchased Microsoft for most client accounts in early 2016 after I became aware the company was converting to an annual subscription requirement for Windows and Office Suite updates. Adobe has adopted a similar approach. Toll road pricing power is the key to retaining buying power in the face of inflation.

Alternatively, rental real estate can be an avenue to pricing power. I have a number of clients who, besides investing with me, own residential or commercial buildings. Over time these can be an excellent inflation hedge, as rents are raised. However, for those who do not want the operational responsibility of maintaining a property, dealing with renters, making property improvements as city building codes change, etc., we own a couple of REITS like Public Storage (PSA), and Prologis (PLD) (logistics warehouses). REITS (real estate investment trusts) are professionally managed pools of properties. As a bonus, they do not pay income tax and so pass through a higher dividend yield to investors.

If you are already a client, please know that this advisor has lived through the era of high inflation and has tested solutions to the inflation conundrum. I’m committed to helping you overcome inflation so you can continue to afford to travel, go to fancy restaurants or buy good theater seats, and to help your grandkids financially even as the price of everything soars.

Gary Miller

[1] If you do not hold some of these gems in your portfolio, you soon will, when I am again able to manage your accounts!

[2] If that figure sounds crazy to you, consider how the referenced home has risen over ten fold since 1977. Inflation has been relatively tame for most of this time. If inflation continues on that path, the current price will again rise ten-fold taking it to about $10,000,000!