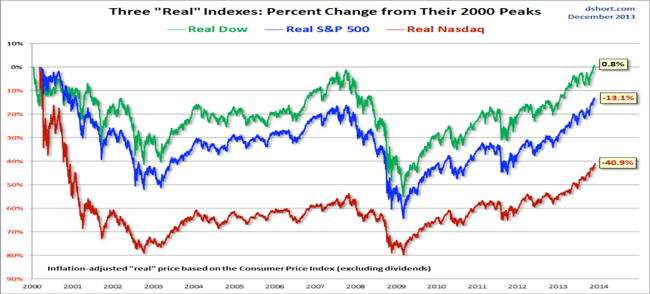

Finally, after thirteen years, the broad U.S. stock indices achieved inflation-adjusted records in 2013. Responsible investors with a functioning memory were unlikely to have participated in the 30% rise of U.S. Equities, because no one in their right mind committed their entire liquid net worth to such a volatile vehicle. For those of us who had a substantial amount in stocks, along with other vehicles, the overall results have been decent, pretty much in line with Trusted Financial’s long-term rate of return.

The truth about stock ownership is that it has been only a marginally productive endeavor over the past 13 years, once performance is adjusted down for the effects of lost buying power (aka “inflation.”)

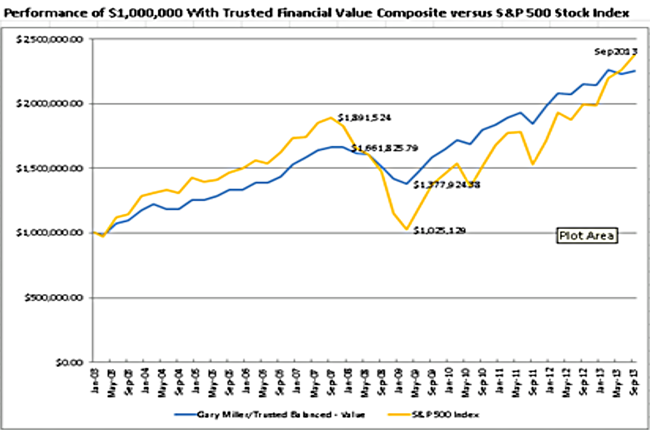

Graph is current through November 30, 2013

Graph is current through November 30, 2013

We know the devastation wrought upon those who were poorly advised or chose to remain too committed to equities in the past thirteen years. While virtually no investor went unscathed during the two major bear markets of the period, the post – Great Recession meltdown offers a graphic example of the value in maintaining investment balance and in paying close attention to rapidly changing events: portfolios fully committed to U.S. stocks had to wait five years to recover their investment capital (October 2007 to October 2012).* Trusted Financial, balanced stock holdings with bonds, cash and alternative investments, were whole after only two years. By now, you’ve figured out where this blog is going. Yes, this is a defense of balanced investing, something that may need repeating if stocks continue to outperform for a while, their normal 9% year-long term trend, and as the ranks of doubters are thinned. While I suspect this stock market could continue considerably higher for a matter of years, my 40 years of hands on experience has taught me to stay patient, stay balanced and stay calm. There will be some brutal shake-outs ahead and those who are holding a blend of investments structured to reduce volatility will be able to hang on during the coming earthquakes and quickly rebuild wealth.

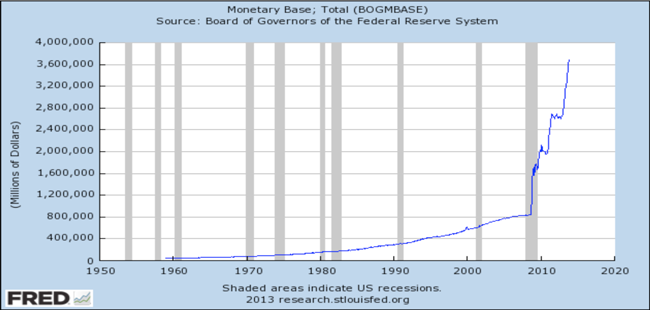

The recovering economy has been met with skepticism every inch of the way: Monetarists have denounced Fed policy of extreme money creation as ruinous to the U.S. dollar. Conservatives fought the bail out of banks, insurance companies, and the auto industry. Liberal economists, like Robert Reich and Paul Krugman, railed that fiscal programs like infrastructure spending, extended unemployment and expanded food stamps were inadequate to prevent another plunge into recession. While there were fiscal cures attempted during the Bush Administration and in the first two years of Mr. Obama’s reign, Congress has since left the heavy lifting to our Federal Reserve Bank. When it became clear that a Republican Congress would not agree to further fiscal stimulation, and in the face of a very sluggish recovery, the Fed initiated “Quantitative Easing” in 2011, a process that continues today. The following chart illustrates that credit creation has been unprecedented since the financial meltdown that began in 2008:

Such expansion, which echoes Germany’s infamous currency debasement in the 1930’s, should, it would seem, lead to runaway inflation and a collapse of the U.S. dollar.

What has instead happened, so far, are record low interest rates, leading to a renaissance in real estate values and construction, retail sales and repair of household debt and corporate debt. It also led to soaring bond values, until this year, and a generally rising stock market since early 2009. Yet inflation remains tame, at around 2%, at least as officially reported.

Throughout the current period of economic recovery, there have been complaints that it is too slow, around 2% GDP growth vs, for example, Chinese growth of 8-10%. Some economists and many on “Main Street” complain that the recovery is also too narrow (unemployment and underemployment too high while the “Investor class” is building net worth.) Yet, from anecdotal conversations with friends in a variety of trades and professions it appears that we are experiencing a steady economic recovery. How solid is the footing for this recovery? Well, it seems our Federal Reserve does not think it all that solid, as they continue to lend $billions against non traditional collateral, holding interest rates down and building up the money supply, as they have done without pause since 2008.

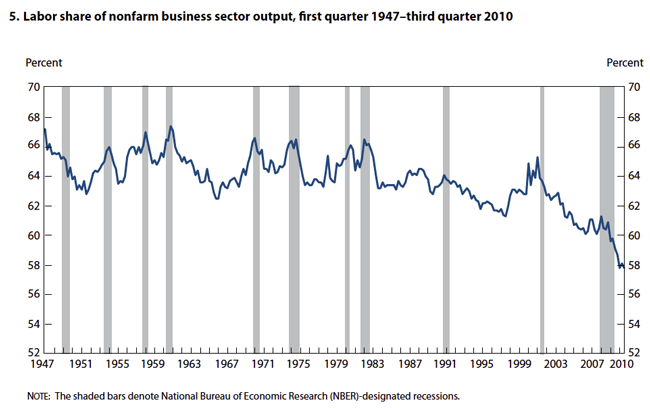

Why have we not had runaway inflation and a demand-fueled boom? There is, at present, no clear answer – we are in new and uncharted waters. But, if you lay all the economists in the world end-to-end they would not arrive at a conclusion, so I guess my thoughts are as good as any! U.S. inflation appears under control due to a virtuous Perfect Storm of good news: off-shoring has provided cheap consumer goods and competition to costly labor and associated benefits in the developed world. Energy prices are not only under control, but the cost of fuel is falling when adjusted for inflation. The prospects for continued cheap fuel are bountiful due to the Shale Revolution. Then there is the lingering effect of the Great Recession, which, I believe re-molded the thinking of the current generation of mature adults. The punishing hardship suffered so recently by so many has altered their consuming nature. This is especially true of the massive Baby Boom generation, vulnerable to the uncertainties of approaching old age. Twice in the past twelve years these folks have seen their savings melt down in the fire of stock market crashes. The value of their homes fell in a manner unknown since the Great Depression. The hollowing out of the Middle Class has left many 50-somethings underemployed or performing tasks below their competence level for low pay and few benefits. Most private sector people today have much smaller pensions than their parents or no pension income at all. Millions must rely on their own skills to husband their savings through future decades of retirement. In response, many have decided to continue working, at least part time, past age 65. They have become savers, not spenders and this keeps demand for goods, and thus inflation, in check. There are social repercussions for this decision, not the least of which is the failure of good jobs to open up for young people. On top of this, the relentless forces of technology are eliminating jobs, often entry-level tasks. So the current generation of young adults is finding the ladder of success to be a slippery climb and thus many are delaying household formation. This has deflationary effects on the price of housing, furniture and accessories. Adding to the woes of the young, the labor force in the US may grow with possible downsizing of the U.S. military. While much of this situation is unfortunate, from the perspective of corporations and investors, this is good news: there is little inflation from a major input to the Gross National Product, labor.

Further pressuring prices is technology, something I’ve talked about in previous reports. We are in about year 25 of a sustained period of rising productivity that began with widespread adoption of the personal computer.

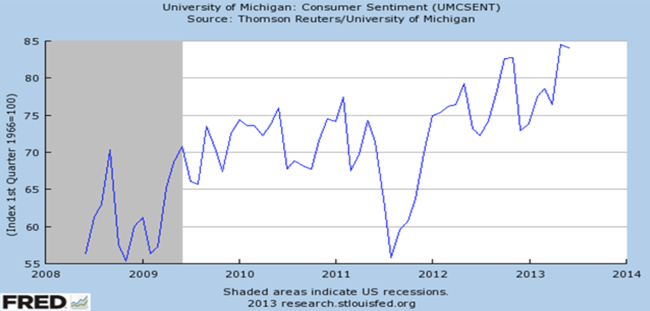

Example: Canadian National Railway (CNI), that most clients own, has increased its profit margins by better managing its fleet of rail cars and locomotives and by carrying more goods per dollar spent on labor, fuel, and maintenance, all as the result of technological tools that have been employed by the railroad over the past decade. Technology helps the bargaining power of consumers. Consumer sentiment has been trending upward but this does not necessarily translate into a boom in retail spending. Why? One reason, I believe, is that today’s consumer is a much savvier shopper, and given recent history, tends to be more careful about taking on debt in order to consume. Example: my wife was in a medical supply store just today shopping for a combination walker/wheelchair to help her dad who is exhibiting signs of age. The price was $240. She used her smart phone to communicate with her sister who was able to locate the same item, slightly used at a competing shop for $120.

These are a few factors that explain why, so far, massive monetary stimulus has allowed a narrow economic recovery without high inflation. Yet, traditional monetarist beliefs may over time prove prescient: we may only be in the early stages of what will become a ruinous inflationary boom-and-bust. That is why people entrusted with managing the life savings of others, like myself, must approach the current stock market with caution.

2013 began on a very hesitant note. Do you recall the brutal battle over the expiring Bush tax cuts that threatened to send the tax on investment gains and estates through the roof? Do you recall the automatic “Sequester” that mandated across-the-board Federal spending cuts of $85BB, threatening to close some airports and gutting spending on infrastructure, and military contracting? Do you recall that Federal Reserve meetings exhibited concern with the tepid pace of economic recovery?

In December 2012, A. Gary Shilling, an economist with an impressive record** predicted 2013 would see a major stock market correction and a 20% decline in home prices. This was the backdrop as investors entered 2013…Surprise! The Standard & Poor’s stock index has risen over 30%, one of the best performances in market history, and its best performance in 18 years. The housing recession clearly ended with a healthy recovery in sales and values. Unemployment declined substantially.

There is now enough evidence, in my opinion, to suggest that the current economic recovery, as measured by corporate profits, is gaining and not losing momentum. This will not please those who point to a high level of unemployment and underemployment, as evidence we have not emerged from recession. Virtually all indicators of expanding economic activity suggest the Recession ended in 2010. Recent reports on unemployment and GDP growth suggest the recovery is gaining momentum. Stocks anticipate the future with uncanny accuracy. This explains the healthy run-up especially in the fall quarter. Since the expansion appears likely to continue, shouldn’t we be loading up on cyclical, economically sensitive companies, like airlines, autos and retail stores? Perhaps, but barring a real acceleration in future growth, stocks are fully valued in the USA.

As consumers and investors gain jobs, regain the value of their homes and as confidence in stocks improves, a good deal of additional money, now locked up in sub par money market funds will find its way into the stock market, in my opinion. The market could become seriously overvalued before a meaningful correction (15% or more) takes hold. The challenge for a value oriented equity investor, such as myself is to maintain rationality and avoid getting caught up in the herd mentality. The job is to find situations where future growth will justify today’s pricing and to be willing to hold cash, waiting for a bargain to be found. The endless search for opportunities continues, even during this holiday season!

Putting “market” musings aside, my focus is on “bottom up” investment selection, trying to drill down into the particulars of individual companies, allowing the fundamentals to guide what we own and how long we own it. While my record is far from perfect, I’m proud that you, our clients, avoided the worst of the Technology Wreck (2000-2002) and the financial melt down (2007-2009). When I left the brokerage world to serve as a fee-only advisor thirteen years ago, clients were told that our goal was to capture about 80% of the stock market’s upside but with only 50% of its risk, with risk defined as quarter-to quarter volatility. This goal has been very much achieved, and is reflected in our composite, size weighted performance history, available upon request, to anyone who cares to see it.

Above is a ten & ¾ year graph (Jan 2003 to Sept 2013) comparing our composite performance to the S+P 500 stock index. Trusted Financial is the blue line. Recall that your account is managed individually so your results may have been better or not as good, depending upon your particular needs and the timing of funds added or taken from your accounts.

I must admit to worrying that some of our clients will choose to leave us and run to catch the speeding train that is the current stock market, but this is something beyond my control. After almost 40 years of hands on investing on behalf of others, I know what works. Your portfolio will continue to be invested with quality holdings with wide moats, committed management, high ROE and high free cash flow. Importantly, balance will remain important. Your portfolio will not be over-weighted to any one asset class. There is a reason why tortoises have longer life spans than rabbits!

Best wishes for a healthy New Year!!!

Gary Miller