|

|

Quarter End Report - March 31, 2013

|

The Stats:

Most of our balanced/value clients enjoyed an appreciation of between 5% and 6%. Most portfolios' ten year return hovers just below 9% per year on average, but of course there was one heck of a bear market on the way to this track record, reminding us to be wary of "average returns." This is like saying the average daytime temperature in Minneapolis is 45 degrees Fahrenheit. Crucially, Balanced/Value style portfolios were more insulated than were stock mutual funds during the infamous bear market of 2007 - 2009. This is indicated by our clients' typical "Standard deviation of return," 7 which compares with a stock market with twice this level of ups and downs. In short, we've beaten the stock market with half the volatility, a goal set publicly (see our 2002 newsletters at our web site www.trustedfinancial.com) when I opened shop as an independent, fee only investment advisor in mid-2002 .

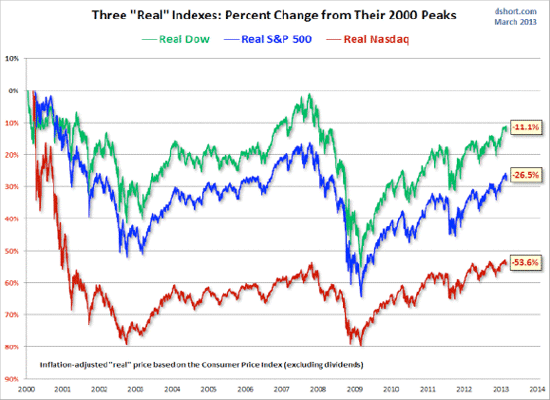

Nominally, new highs were achieved for major equity indexes during recent days, but adjusted for inflation; the markets remain below their all-time highs, achieved during the Technology Bubble in 2000.

In contrast to the pattern of the past 12-13 years, it was stocks that allowed our clients to enjoy a rewarding appreciation on their assets during the recent quarter, led by Rayonier, T.Rowe Price's health care mutual fund and our pipeline utility holdings. Since this is a quarterly report, I've focused on recent performance, but celebrated investors Warren Buffet and Charles Munger preach: "invest for the long term." An oft-repeated Buffet admonition is to invest with a plan to hold each new investment for the rest of your life! This approach certainly focuses one's thinking. If an investor were to commit money to each investment for the rest of his or her lifetime, the selection process would be rigorous. It's an approach I have embraced with increasing devotion as the years unfold. Currently, our longest held position is in one or more of the Kinder Morgan entities. I became interested in the company in early 2003 after the Morningstar advisory service recommended it. I still have a fat file of research conducted as I tried to trace out the interrelationships between the parent corporation and the affiliated Limited partnership and Limited Liability Corporation. The confusing structure was a turn off, but also an opportunity. It appeared that many potential investors were taking a pass, allowing Kinder's price to wallow at "value" levels. Fast forward and the 10th anniversary of our initiating a position in Kinder Morgan will arrive next month, a period in which the stock has returned over 100%. Moreover, our clients have a growing list of other holdings with a longevity exceeding five years. While these positions are closely monitored, we do not believe trading in and out of things should be taken to indicate a money manager's attentiveness to his clients. Knowing when to hold 'em, and hold'em and hold 'em has been part of our contribution to client welfare.

This in not to say we "fall in love" with any one holding or industry. We dumped our holding of energy pipeline MLP Enbridge (EEP) in the recent quarter after it became clearer that they are going to be diluting shareholders for some years to come in order to pay for expansion. While this Canadian giant will likely be a great company and a cash cow sometime in the future, I think we may see another, better place to re-enter our position. We also took profits on PPG Industries, a cyclical stock that manufactures specialty coatings, purchased in early 2012. This one year holding generated a profit of over 40%, and we continue to hold a smaller position for most clients.

Looking Ahead:

I'm in the camp that believes the US economy is on a sustainable path of growth. No boom ahead, but no recession either, for the next couple of years. Despite volumes of worrisome news (Fiscal Cliff, Sequester, higher payroll taxes, Obamacare taxes, Cyprus, North Korea) stock prices ploughed ahead in the recent quarter. This was driven in part by a small shift of investor sentiment toward stocks, but there has not been a massive shift out of bonds, an event that could, during this cycle, drive stock prices skyward to truly new high levels, even adjusting for inflation.

Sure, the economy has been propped up by five years of massive intervention by our Federal Reserve, in the hope that by blowing on embers they can light a fire under the natural economy. I believe they will be judged by history as having succeeded. I know this is sacrilege to those of us who believe in balanced budgets and fiscal restraint, who believe in a conservative monetary authority. Yet there is plenty of evidence that growth is now on a self-sustaining path: home sales and prices rising, consumer confidence growing, albeit slowly, durable goods orders trending upward. Beyond these obvious measures, the United States is likely to enjoy strong undergirding from its booming energy sector. We appear to be in the early days of a new era of energy independence that has positive implications for our economy, our balance of payments and our foreign policy. The Fed can take little credit for this phenomenon: a virtuous combination of high energy prices meeting new technology has unlocked a sustainable source of economic growth that may allow for a surprising moderation of the Federal government's debt dilemma.

There are two things that make me cautious right now: the rapidity of the stock market's rise and the inevitability that the Federal Reserve will allow interest rates to rise. The first is of more immediate concern. My over 30 years of experience working in the markets suggest to me that we are at some sort of a plateau. Many equities that I follow appear to be stretched in price. I suspect it will take another two or more quarters of good earnings to justify their current price level. Further, in recent years there has been a strong confirmation of the old Wall Street warning "sell in May and go away." For the past three years in a row, following a strong first quarter, a serious correction has begun in spring (actually in April) and carried well into the summer before being erased by a late year rally. While we are long-term equity investors, as emphasized above, I am disinclined to make additional commitments to the equity side of the market over the next few months due to these two factors. Virtually all of our balanced/value clients enjoy portfolios that are chock-full of stocks paying healthy dividends and bonds paying highly competitive rates of interest. We've been resting for a while, allowing client cash positions to build in anticipation of bargains that may arise later in the year.

Reminder:

The deadline for funding your IRA is April 15, no exceptions. If you have or wish to create a SEP-IRA, you can delay funding until your tax filing date, including extensions.

|

I hope this report has been helpful. If you have any questions, please do not hesitate to give me a call:

949-254-0656.

Sincerely,

Gary Miller

|

About Us

WHO WE ARE

Certified Financial Planner™ with 35 years direct experience advising investors.

WHAT WE OFFER

Complete review of your budget, your tax situation, and your ability to build wealth. We can also review your safety net: Sufficient emergency fund?

Properly insured?

WHY YOU CAN TRUST US

We are retained as direct consultants to you. Since we act as fiduciaries, we do not offer any products, insurance, or investments for sale. We are your trusted advisor.

HOW WE ARE COMPENSATED

We are paid by you for rendering advice for your benefit. We may make a one time review or provide ongoing financial and investment advice. Our fees are very competitive and fully disclosed.

|

Gary Miller is in his 38th year of providing financial guidance to indivi-

duals and pension plans. He is a Registered Investment Advisor and a

Certified Financial Planner ™ Practitioner. Gary holds a Certificate in

Personal Financial Planning from the University of California, Irvine and has served as a Board Member of the Financial Planning Association,

Orange County Chapter.

|

|

|

|

|

|

Copyright ©Trusted Financial Advisors 2013.

All Rights Reserved.

|

|

|

|