Quarter End Market Review March 31, 2017

“March comes in like a lion,” says the Old Farmers Almanac. As for the rest of the adage, something about exiting like a lamb, this year was an exception. Despite unprecedented drama coming out of Washington and with the new administration bungling its signature promise of repealing and replacing the Affordable Care Act (Obamacare), upside stock price momentum has barely paused, rather a surprise.

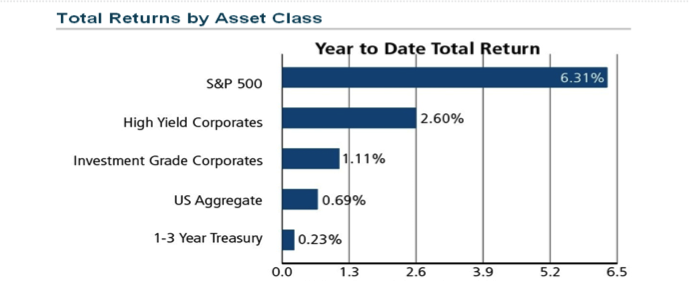

Here’s a graphic summary of performance in the first quarter:

We knew that stocks have had one of their best quarters in years, but given an increase in the Fed Funds rate, along with clear telegraphing by the Fed that there will likely be more rate increases to come, gains for bond holders are a surprise. This demonstrates something I’ve suspected for some time. Short term interest rates, strongly affected by central bank manipulation, do not necessarily affect long term bond performance. There is a secular and insatiable demand for bonds from aging investors in all major western economies: security is King, and this demand so far is outstripping the potentially negative consequences of rising interest rates.

Stock Market in Jeopardy?

The predictive ability of the US stock market is uncanny. The Dow Jones Industrial Average and Standard & Poor’s 500 index have an uncanny ability to foresee major financial trends looking out about 6 months. Right now, the market continues to find a lot to like.

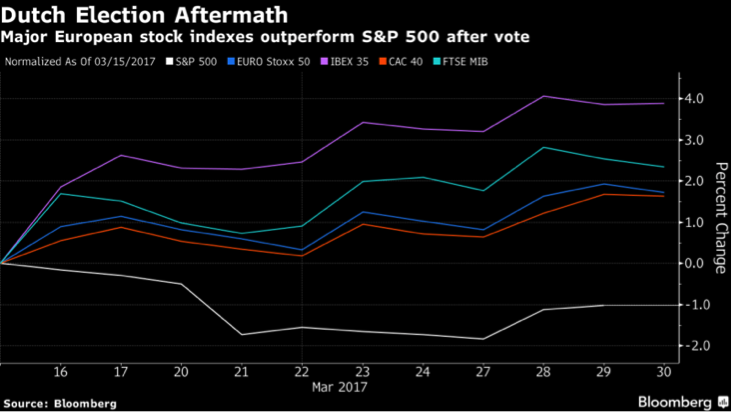

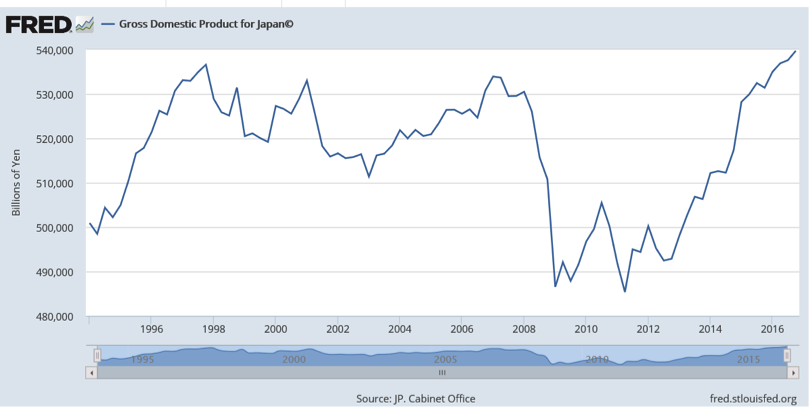

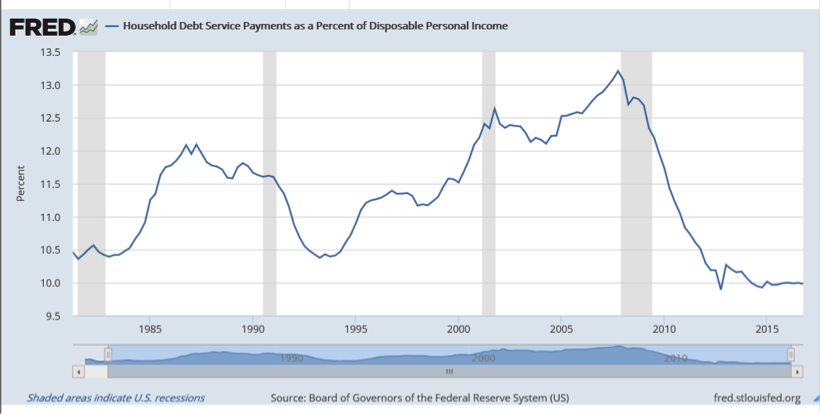

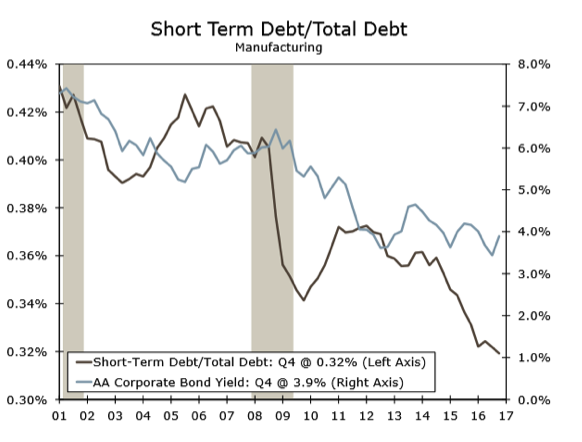

Doubters cite apparent disarray among business friendly Republicans in D.C. These include Simon Johnson, MIT professor and former chief economist at the International Monetary Fund, who thinks the president’s “next major policy push – on taxes – is in big trouble” after the failure of healthcare. “The Freedom Caucus and Speaker of the House Paul Ryan primarily want to cut rates for the rich,” …Trump wants a broader tax cut, but one that will increase the deficit dramatically – which the Freedom Caucus will have a hard time swallowing, in part because doing so would expose them to primary challenges.” Despite the Trump tweet storm and the Administration’s setbacks, those who believe we are experiencing a supportive Washington environment remain patient: major indexes remain above the crucial 200 day moving average and the “VIX” volatility index has settled down after a spike in March. The NASDAQ index, replete with technology and biotech companies achieved a record high today. Still, the torrid upside momentum following November’s election has slowed, and so we are glad to have increased equity exposure in the fall, especially in the immediate aftermath of the November election. As a result most client accounts saw healthy appreciation this quarter. As a general rule, stock prices did well while preferred stocks and bonds were backing and filling but continued to pay their dividends. We selectively added to stock and bond positions. Bonds are now emplaced primarily through mutual funds whose managers sport impressive and creative track records. How’s the Economic Outlook? Inflation worries, largely driven by energy prices, have dissipated somewhat: OPEC appears to have successfully put some sort of floor under oil prices in the $50 area. But with breathtaking rapidity, shale oil producers have raised production here in the United States to replace OPEC’s throttled production and as a result energy prices have already softened, suggesting we may have seen a peak to this inflation driver. This reduces the risk that Federal Reserve Board hawks will convince their peers to raise rates beyond current expectations of two more quarter point increases. It also means the consumer will continue to have more disposable income in her wallet. Speaking of the consumer, as cited in past reports, we appear to be living with a post-depression mentality. People are reluctant to take on debt, having seen the consequences of excessive borrowing a decade ago, leading to the Great Recession. Personal consumption expenditures have not exceeded growth of disposable personal income over the past year, so while consumption is healthy, people remain reluctant to borrow and spend beyond their means (unlike the government!). A longer term perspective and a related statistic, the cost to pay interest on debt tells a similar story: Likewise, there are positive indications in the U.S. manufacturing sector- debt has fallen and has largely been rolled into longer term maturities at recent, historically low interest rates. This is good news in that one can conclude that manufacturing company balance sheets are healthier. Then again this could mean that businesses are afraid to invest in plant and equipment, and that seems to be the case: while consumers are sustaining the economy, demand for plant and equipment have lagged past recoveries. It is hoped that lower corporate taxes, the outlook for repatriation of offshored corporate cash and greater optimism now heard from the business community will soon spark a recovery in this sector. For legacy Trusted Financial Advisors clients, this was the best performing quarter since the second quarter of 2009. It is unlikely this will be repeated soon. Economic figures could surprise to the upside in the coming quarter and there is a strong psychological component to stock prices. Despite a fully valued market, sentiment remains positive thanks to high employment and low debt levels. With single family home prices in a solid uptrend, the “Wealth Effect” also lends emotional tone to consumer decision making. Will this translate into still higher stock prices? Is it possible there will be a buying panic? I doubt it, but if this were to occur the market could easily rise another 20% before topping out, perhaps in 2018. International indicators are also positive With US equities fully valued, we have been looking abroad to consider possible positioning with international holdings. There are two important elections in Europe coming up that will have a bearing on investor sentiment. Investors are said to be frightened that an anti-Eurozone populist party could take control of the French government, a reflection of anti – immigrant sentiment that drove the “Brexit” vote last June. If France were to follow Great Britain with “Frexit”, it is highly possible that the euro zone will dissolve. Trade and transport barriers could be re-erected along with a return to inefficient currency exchanging between multiple nations. This prospect might actually cheer some investors who feel that European regulations are too inflexible, socialistic and bureaucratic. Yet, indications are that investors prefer status quo: Dutch populists were defeated in a March election and Euro stocks gained fans as a result: But with upcoming elections in France and Germany, the European political and business climate could look very different by the third quarter. So far markets appear to be betting that status quo will win. Japan, third largest economy in the world, may have reached escape velocity under the low interest rate pro-growth policies begun there about four years ago. Japan has been in an economic funk for nearly three decades, but as the chart below suggests, better times appear to have arrived: China has avoided the recession that I suspected last year, but that economy is maturing and torrid growth rates near 10%, seen in the earlier part of the century are a thing of the past. This subdued level of Chinese demand for raw materials and oil should keep commodities prices subdued, which is why we have little exposure to commodity related holdings. Currently we have nothing that benefits from agriculture product demand, minerals, iron ore and just one holding in the energy space. Slower growth in commodity consumption means inflation will remain low. Low inflation and low cost money offer a virtuous under pinning for non-commodity businesses throughout the planet. While investors and many on Main Street are gearing up for great things, in the wake of the November elections, I continue to believe growth will remain on roughly the same path it has trodden for the past three or four years: uninspiring, but unlikely to devolve into a major correction or recession. This might change if the Trump administration is successful in cajoling its fiscally conservative allies in Congress into massive government spending on military, infrastructure and yes, healthcare. Given the embarrassing bungling of Republicans’ signature Obamacare repeal and given emboldened Democrats, we can expect a slower road to economic reforms that would generally be good for common stocks. At this instant, the most likely area for bipartisan agreement may be reduction in corporate tax rates but that is a factor seemingly baked into current prices. With common stocks having risen some 30% since their correction in in the first quarter of 2016, it is likely that the easy money has been made with a broad indexing approach. Going forward, sector and company selection will be a more important driver of superior returns. Gary E. Miller [1] www.businessinsider.com March 31, 2017 : There’s a simple reason why the Fed should stop raising interest rates

Source: Wells Fargo Securities March 29, 2017: Interest Rate Weekly