Based in Richmond, Virginia, Dominion Energy is an integrated energy company, third largest in the United States, with approximately 27,000 megawatts of electric generation capacity; 15,000 miles of natural gas transmission, storage, distribution and gathering pipelines; and more than 63,000 miles of electric transmission and distribution lines. Dominion operates one of the nation’s largest natural gas storage systems, recently completed the only LNG export facility on the east coast, and is 48% owner of the proposed Atlantic Coast Pipeline, scheduled for operation in about 18 months.

Based in Richmond, Virginia, Dominion Energy is an integrated energy company, third largest in the United States, with approximately 27,000 megawatts of electric generation capacity; 15,000 miles of natural gas transmission, storage, distribution and gathering pipelines; and more than 63,000 miles of electric transmission and distribution lines. Dominion operates one of the nation’s largest natural gas storage systems, recently completed the only LNG export facility on the east coast, and is 48% owner of the proposed Atlantic Coast Pipeline, scheduled for operation in about 18 months.

About half of Dominion’s profits derive from regulated energy transportation and storage, and most of its operations enjoy favorable regulatory jurisdictions and reliable cash flow.

Financial metrics for this company suggest that it stands on a sound financial footing. While its profit margin is the highest in 6 years, its price to earnings ratio is the lowest in six years. Further, the company is currently offering a dividend yield of 5.7%, a dividend that appears safe. True, the company has more leverage (borrowed money) than normal, due to the cost of building their Cove Point liquified natural gas (LNG) export facility and the Atlantic Coast natural gas pipeline project but it appears this matter has already been discounted in the stock price; that is, we do not believe there is much downside risk from here.

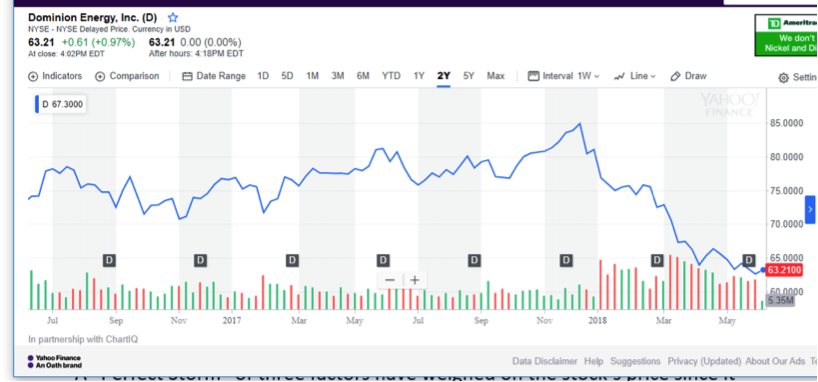

So then, why has the stock fallen nearly 25% from its December 2017 high?

A “Perfect Storm” of three factors have weighed on the stock’s price since it reached its all- time high in late December 2017.

- Just prior to year-end, the company announced plans to purchase SCANA, a regulated electric utility operating largely in the state of South Carolina. SCANA is teetering financially due to debt incurred to build a nuclear power generating station that went belly up. Regulatory authorities in the state had approved a significant rate increase to consumers to fund the project. With the project a bust, South Carolina rate payers, who are also voters are not pleased, so there is pressure to reduce electricity rates. While Dominion’s bid to take over SCANA includes a proposed $1,000 average fee refund per home served by the system, this does not appear sufficient to satisfy some vocal critics. Legislation requiring a larger, permanent rate reduction is working its way through the South Carolina legislature and this threatens the economics of Dominion’s proposed purchase. Fortunately, there is an escape clause in the merger agreement, that postulates that if the state imposes a rate reduction above and beyond the rate relief Dominion has already promised, Dominion can back out of the deal and with no break up fee. Still, it appears that nervous investors do not appreciate the lack of clarity around this matter and worry that Dominion’s management may not walk away even if terms become less favorable. Given the anger in South Carolina over the situation, there may remain a risk that once a merger is completed the company may be forced to reduce electricity rates. At the moment, the situation is fluid.

- Dominion has cash needs for its two major expansion projects, which were financed largely through borrowing. Dominion recently completed a multi-year project (on time and at budget) for the only liquified natural gas (LNG) export facility on the east coast, called “Cove Point.” Its capacity is committed to two Asian utilities and the first shipment was recently received in Japan.

Cove Point LNG enters commercial service

While expected to be a wide moat cash flow generator, the company would like to recover much of the capital investment while maintaining its investment grade credit rating, which means it is limited in its ability to sell bonds and must sell off some assets and issue additional common stock. The plan was to sell much of the project to a related entity, Dominion Midstream Partners (DM). [1] Due to its structure as a master limited partnership, DM enjoys lower taxes and relatively higher share valuation. As a form of financial engineering used by many energy companies in the past, “drop downs” such as this have generally worked well. Conceptually, the related partnership issues additional shares and/or applies some of its ample free cash flow to pay for the “drop down” (purchase) of the Cove Point project. This in turn relieves the general partner, in this case Dominion Resources, from debt. Enter the next wave of the perfect storm: in March, the Federal Energy

While expected to be a wide moat cash flow generator, the company would like to recover much of the capital investment while maintaining its investment grade credit rating, which means it is limited in its ability to sell bonds and must sell off some assets and issue additional common stock. The plan was to sell much of the project to a related entity, Dominion Midstream Partners (DM). [1] Due to its structure as a master limited partnership, DM enjoys lower taxes and relatively higher share valuation. As a form of financial engineering used by many energy companies in the past, “drop downs” such as this have generally worked well. Conceptually, the related partnership issues additional shares and/or applies some of its ample free cash flow to pay for the “drop down” (purchase) of the Cove Point project. This in turn relieves the general partner, in this case Dominion Resources, from debt. Enter the next wave of the perfect storm: in March, the Federal Energy Regulatory Commission (FERC) which controls fees charged by interstate carriers like DM, issued a surprise rule reducing a tax adjustment built into pricing. Unfortunately, Cove Point was negatively affected by this unexpected ruling, tanking its share price and making a drop down of the Cove Point project financially unattractive. Therefore, Dominion is expected to sell off some resources and issue stock valued at about $1.5BB over the next two years. This represents an additional 4% above current shares outstanding of 653,000,000. Stock issuance results in diluted value for existing stock holders. This alone does not explain a 25% decline in the stock price. As a correlated worry, with Dominion shares down by some 25%, additional stock sales may become necessary, also known as ” a liquidity trap.” The market does not like dilution, nor does it like uncertainty. Additionally, Dominion is involved in construction of the Atlantic Coast Pipeline, a $5BB venture in which it holds a 48% interest. The pipeline is needed in the rapidly growing states of Virginia and North Carolina and brings low priced shale gas production from the Marcellus formation to those states. The pipeline, which is slated to be in operation in 2020, is likely to be a nice steady, positive cash flow generator for Dominion. However, two worries remain: environmentalists are trying to slow or suspend the project, which is expected to be a small setback. More worrisome: if the share price of the associated Master Limited Partnership, DM remains depressed, it may further delay the ability of Dominion to offset the pipeline’s debt through a drop down, possibly requiring issuance of still more shares.

Regulatory Commission (FERC) which controls fees charged by interstate carriers like DM, issued a surprise rule reducing a tax adjustment built into pricing. Unfortunately, Cove Point was negatively affected by this unexpected ruling, tanking its share price and making a drop down of the Cove Point project financially unattractive. Therefore, Dominion is expected to sell off some resources and issue stock valued at about $1.5BB over the next two years. This represents an additional 4% above current shares outstanding of 653,000,000. Stock issuance results in diluted value for existing stock holders. This alone does not explain a 25% decline in the stock price. As a correlated worry, with Dominion shares down by some 25%, additional stock sales may become necessary, also known as ” a liquidity trap.” The market does not like dilution, nor does it like uncertainty. Additionally, Dominion is involved in construction of the Atlantic Coast Pipeline, a $5BB venture in which it holds a 48% interest. The pipeline is needed in the rapidly growing states of Virginia and North Carolina and brings low priced shale gas production from the Marcellus formation to those states. The pipeline, which is slated to be in operation in 2020, is likely to be a nice steady, positive cash flow generator for Dominion. However, two worries remain: environmentalists are trying to slow or suspend the project, which is expected to be a small setback. More worrisome: if the share price of the associated Master Limited Partnership, DM remains depressed, it may further delay the ability of Dominion to offset the pipeline’s debt through a drop down, possibly requiring issuance of still more shares.

- The above drama is playing out against a backdrop of weakness for income equities, such as utility stocks. These have been under pressure since it became clear that the Federal Reserve is determined to allow ambient interest rates to return toward more normal, higher levels. With the end of Quantitative Easing, and recent tax and spending legislation that will vastly increase Federal borrowing investors are concerned that interest rates could rise sharply, providing competition for dividend paying utility stocks such as Dominion.

We believe this last worry to be over blown, but combined with the previous two events, conditions for a price sell off have piled upon one another, resulting we believe, in a stock trading at a bargain level. Why? Dominion provides a solid foundation and a reliable dividend that makes waiting for a turn around worthwhile. As the situation improves, this would be a candidate for further purchase.

Keep in mind that most of Dominion’s income is derived from regulated utility functions such as electricity generation and transmission and natural gas storage and transmission. The company is conservatively managed and operates in states where they are allowed to earn an above average return on equity, about 10.5%. Its underlying operations make it is a cash cow with great degree of diversification in functions and location.

One last consideration:

MORNINGSTAR NOW HAS A RARE 5 STAR BUY RATING FOR THE COMPANY

For a very detailed and supportive analysis of the company see:

https://seekingalpha.com/article/4171766-dominion-energy-turned-soap-opera-investors-need-know

[1] Due to its structure as a master limited partnership, DMP enjoyed lower taxes and relatively higher share valuation. Basically, the idea is a form of financial engineering used by many energy companies in the past. Conceptually, the related partnership applies some of its ample free cash flow plus proceeds from issuance of additional partnership units to pay for the “drop down” of the Cove Point project.